September 1, 2023 | Crude Oil Demand Will Suffer as Transport Goes Electric

While the world’s crude oil consumption will soon start to decline, many investors expect there will be robust demand for crude oil for decades to come.

But it is not too early to analyze the impact of declining demand for crude oil when choosing long-term investments.

Most investors based in Canada, and especially Alberta, believe that oil and gas demand will be around for decades to come. That belief is strongly held, as I have learned after getting into some heated arguments about the likelihood of a decline in demand for oil.

But it is one thing to say that crude oil will still be used for decades to come, a high probability event, but not the same to believe that demand for crude will remain steady, which is extremely unlikely because of the increasing use of electric power in road transport vehicles.

Change is difficult. But it is important to consider its effect when deciding where to invest during this transition period. Even if the transition takes more than 20 years, investment decisions today need to recognize the fact that the world’s demand for crude will soon be in decline.

And serious long-term investors would like to know how quickly the demand for crude oil will decline.

A major oil company, BP, publishes an annual report.

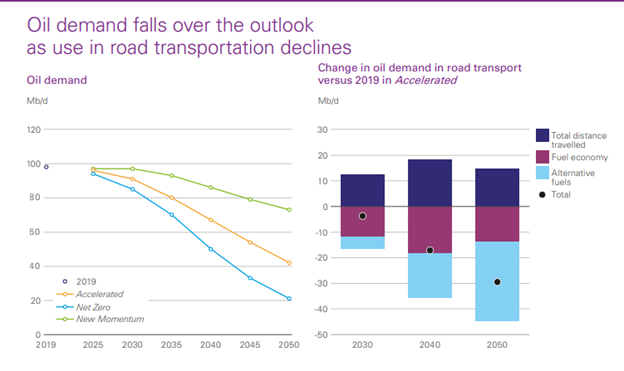

BP agrees with the consensus view among most analysts:

“Oil demand declines over the outlook, driven by falling use in road transport as the efficiency of the vehicle fleet improves and the electrification of road vehicles accelerates. Even so, oil continues to play a major role in the global energy system for the next 15-20 years.”

BP Energy Outlook 2023.

BP gives a wide range of forecasts for the decline, with the “net-zero” scenario indicating 50 percent by 2040 and 80 percent by 2050.

Source: BP

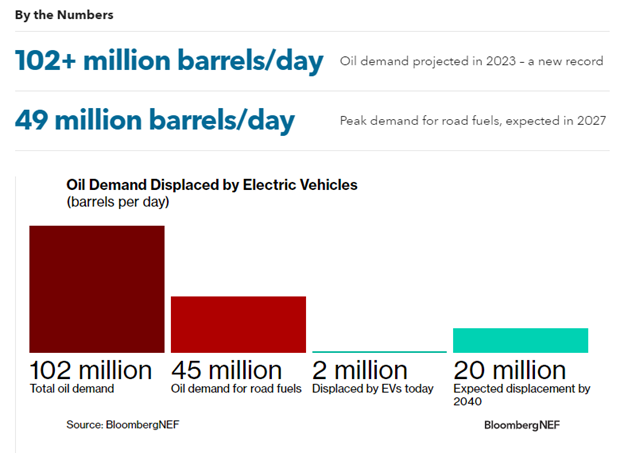

According to Bloomberg New Energy Finance in 2027 the demand for road fuels will peak at about ½ of crude consumption:

By 2027, the transition to battery-electric power for road transport will start to eat into crude oil usage, affecting almost half of total demand. By 2040 nearly ½ of crude oil used in road transport will not be needed reducing total demand by 20 percent.

Stock market valuations for electric vehicle producers like Tesla have soared, supporting the view that the future of transport is electric.

The U.S. consumes 20 million bbls/day, which includes about 9 mbbls/day for autos and light trucks.

In the U.S. rapid growth in light crude oil from the Permian Basin in Texas pushed production to 14.8 mbbls/day (the largest production in the world) so the shortfall is about 5 mbbls/day. Canada exports about 4.3 mbbls/day to the U.S. The U.S. exports about 3.6 mbbls/day of crude.

As the U.S. uses less oil for road transport the shortfall of demand for crude imports could shrink to zero. Crude producers who export to the U.S. — Canada is the largest — will see major disruption from this transition to electric.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth September 1st, 2023

Posted In: Hilliard's Weekend Notebook