October 14, 2022 | Canadian Real Estate Speculators Feel The Heat From Higher Rates

Homeowners and real estate speculators in Canada are already feeling the heat from interest rate increases that have had the effect of tripling mortgage interest for some people.

A petition was started in protest against higher rates, and by Thursday October 13, 2022, had gathered over 15,800 signers. This makes the petition one of the most popular on Change.org. Here’s the link in case you want to sign or read the justification.

When I first saw the petition, I tweeted this:

Source: Twitter

From the petition:

“The Bank of Canada continues to raise interest rates at a staggering pace and not allowing Home Owners to adjust accordingly.”

The problem is that speculators are helped by abnormally low rates. Starting in 2010 when rates were kept artificially low central bankers created bubbles in real estate, bond and stock markets. These bubbles are now bursting with pain being felt from Wall Street to Bay Street to speculators to pension plans and many more who are silently suffering as rates are pushed back into the “normal” range. And the impact is just starting as monetary policy by central banks tends to work with a long lag, as many loans do not mature right away.

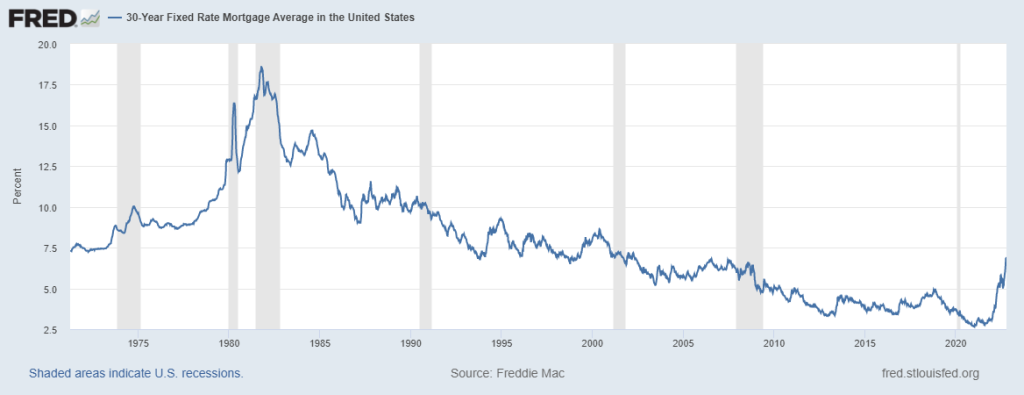

This protest has erupted long before interest rates have reached penal levels. Here is the history of mortgage rates, using US data:

Rates have a long way to go higher to reach the levels, 15 percent and higher, in 1982 when inflation was previously at current levels.

Obviously, there are many people signing this petition who are not speculators but just regular folks who cannot afford their mortgage payments now or are worried about their next renewal. There are also many thousands of families and young couples who wish to purchase a home but cannot qualify now with the higher rates. The rental market is difficult also, with rents rising rapidly.

The petition calls for the government to stop the Bank of Canada from forcing interest rates ever higher and hurting homeowners. The central banks, including the Bank of Canada, have made it clear that they are serious about combatting inflation and they will use the main tool they have, which is higher rates. They are willing to live with the collateral damage.

The way that higher rates dampen inflation is to reduce demand for the purchase of things with borrowed money. Housing is an asset that will be hit, but house prices are not counted when calculating inflation. Stock and bond prices are also not part of CPI. But inflation must be contained.

Of course, eventually the higher rates will have the effect of pushing inflation lower but that will take time and probably trigger a deep recession.

Based on the popularity of this petition, the public is already upset with higher rates, especially those who have borrowed money. The older Canadians who do not have a mortgage and are investing in GICs and savings accounts will be happy with higher rates.

Things are getting very interesting.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth October 14th, 2022

Posted In: Hilliard's Weekend Notebook

Next: Canadians Beware »

Good article Hilliard. It is time Canadian renters start a petition against the Canadian government’s insanely excessive immigration policy which has directly contributed to extremely overpriced rents and house prices all across Canada. Want to see a guaranteed and immediate -50% plunge in rents and home prices across Canada? Have the Canadian government announce there will be ZERO immigration allowed into Canada for the next 5 years.