August 18, 2022 | Rapid Rate Change Just Starting To Be Felt

A key point regularly missed is that monetary policy moves at a multi-quarter lag through the economy. That means that the rapid rate hikes year to date have just started to be felt and will continue to slow spending and growth through 2023. This will be the case even if central banks stop hiking and ease again in the months ahead. The segment below elucidates further.

Stephanie Pomboy reacts to today’s latest data on retail sales, Fed rate hike outlook, jobs, credit conditions & inflation. In her words, it’s difficult to see anything other than stagflation reigning for the rest of the year. Here is a direct video link.

Consumer stress (measured as the increase in food, gas and mortgage rates) graphed below since 1972 (courtesy of The Daily Shot) has already seen a larger, faster increase than preceded the 2001 and 2008 recessions/market meltdowns.

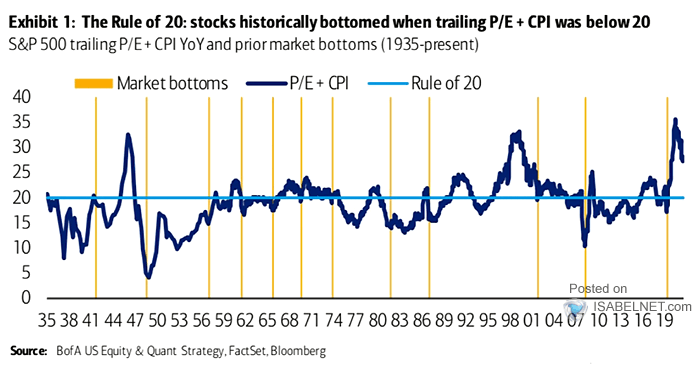

While the stock market has begun the repricing process, as shown below since 1935 (courtesy of ISABELNET.com), it has historically not bottomed (yellow bands below) until the S&P 500’s trailing price to earnings valuation (PE) plus CPI inflation sum below 20.

As of August 12, the S&P 12-month trailing PE was 22.75 (from 31.31 a year ago), with the latest CPI reading at 8.5% in July; the sum of the two remained above 30. This reading (based on trailing earnings) is doubtless understated because it assumes that record corporate earnings of the past year will continue despite higher input costs and a contracting economy–whistling past the graveyard indeed. S&P 500 earnings dropped an average of 30% during the past five profit recessions since 1989. As earnings mean revert, history assures that stock prices and valuations will eventually follow lower.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park August 18th, 2022

Posted In: Juggling Dynamite

Next: The Short Position in SLV »