August 15, 2022 | Commodities Slump with Global Growth Outlook

Overnight, China’s National Bureau of Statistics reported that retail sales grew by 2.7% in July-nearly half as much as the consensus forecast of 5%. Industrial production also missed the 4.6% estimate with an increase of 3.8% as the Chinese economy joined the US in shrinking during the second quarter. China’s GDP grew by just 2.5% in the first half of the year, running well below the full-year target of around 5.5% set in March. Analysts will have to reduce their global growth outlook further on this news.

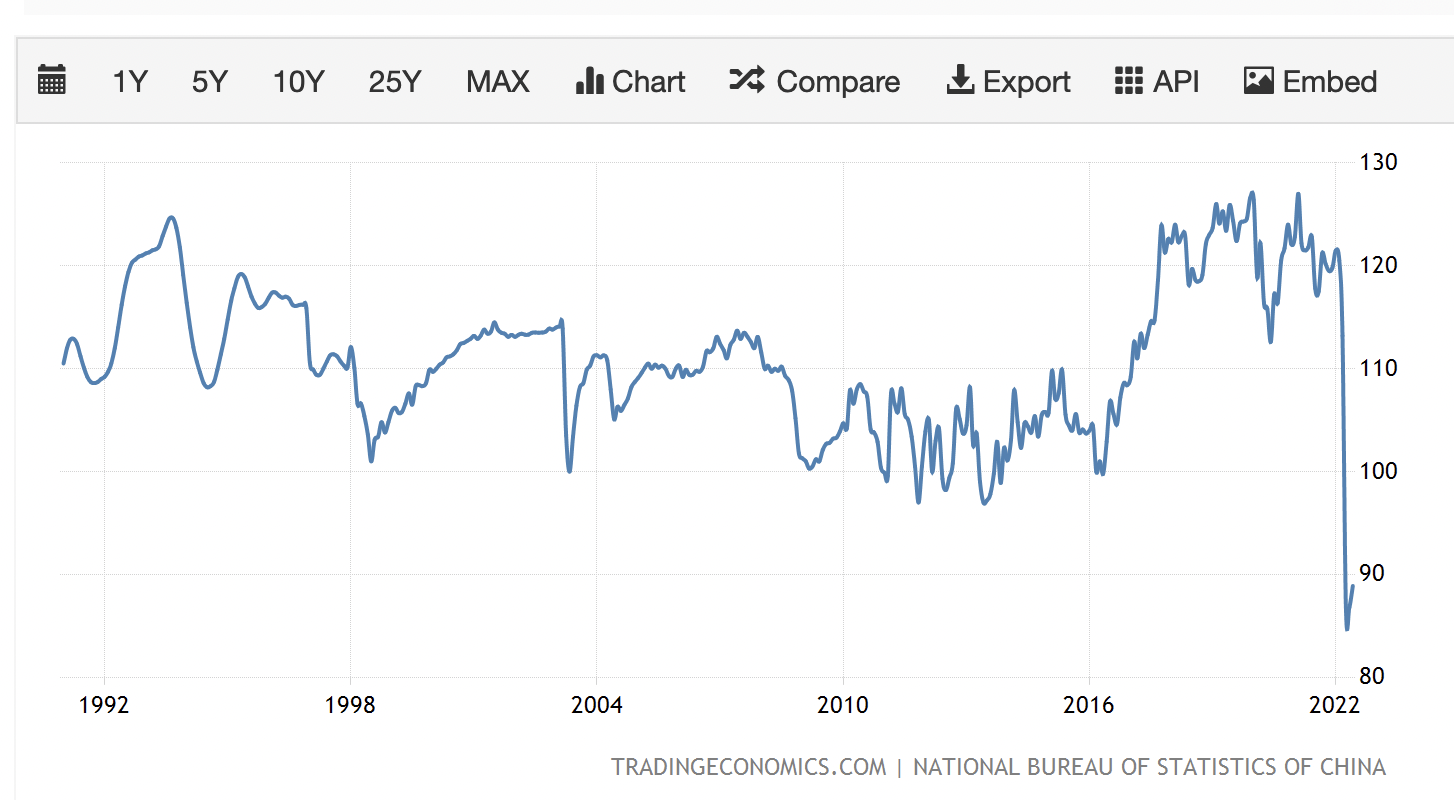

With China’s housing market in distress, consumer confidence remains near the lows ever recorded since 1991 (shown below).

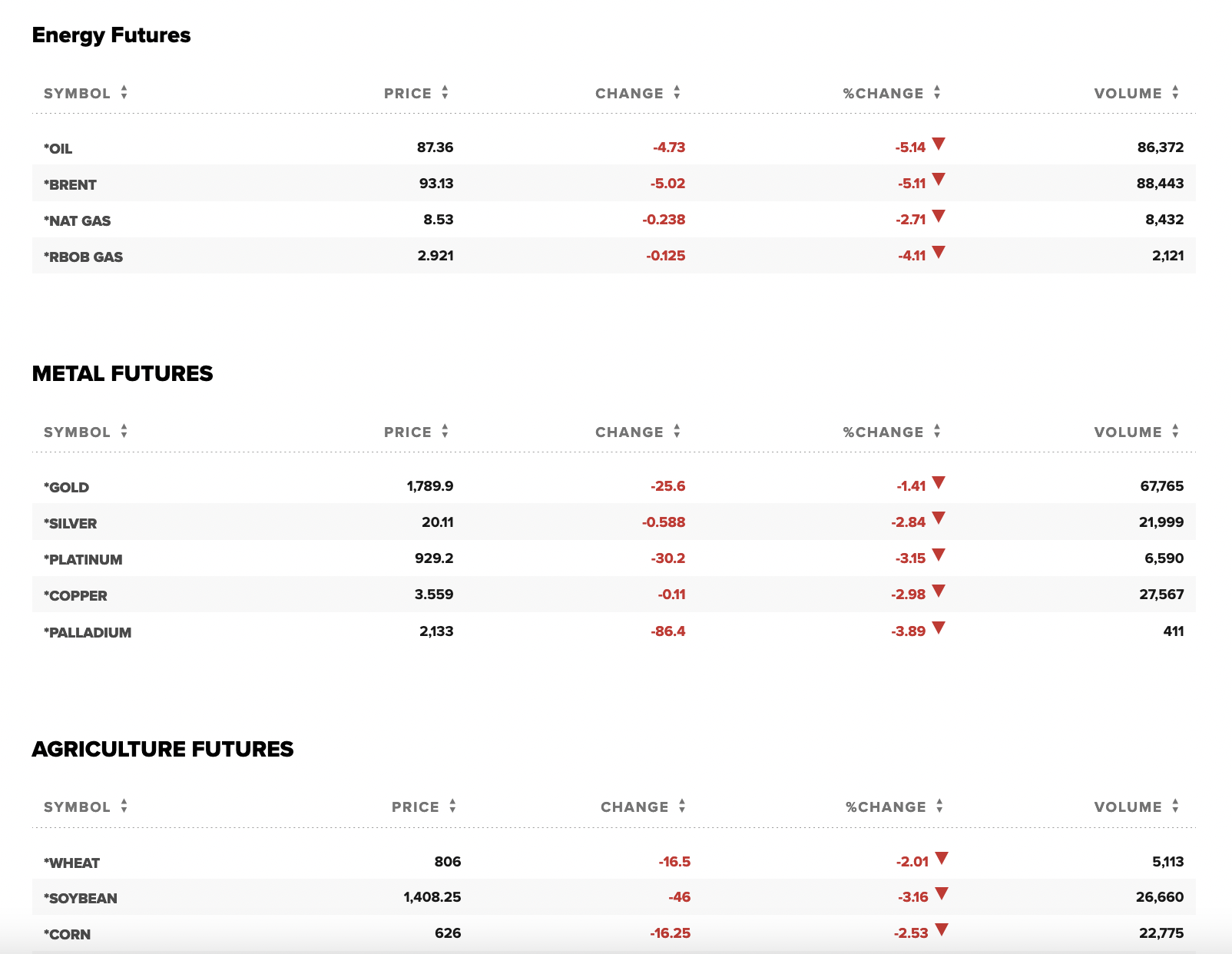

China’s central bank (PBOC) responded with a .10 cut to its one and seven-year lending rates today. Rather than rejoice in easier credit conditions, commodities are slumping hard on evidence of a worsening global downturn.

Resource-linked currencies like the Canadian and Australian dollars are tumbling along for the ride, off more than 1% this morning, while government bond prices are rising on the disinflationary news.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park August 15th, 2022

Posted In: Juggling Dynamite