June 6, 2022 | How $10 Gas Will Wreck the Fed’s Stupid Game

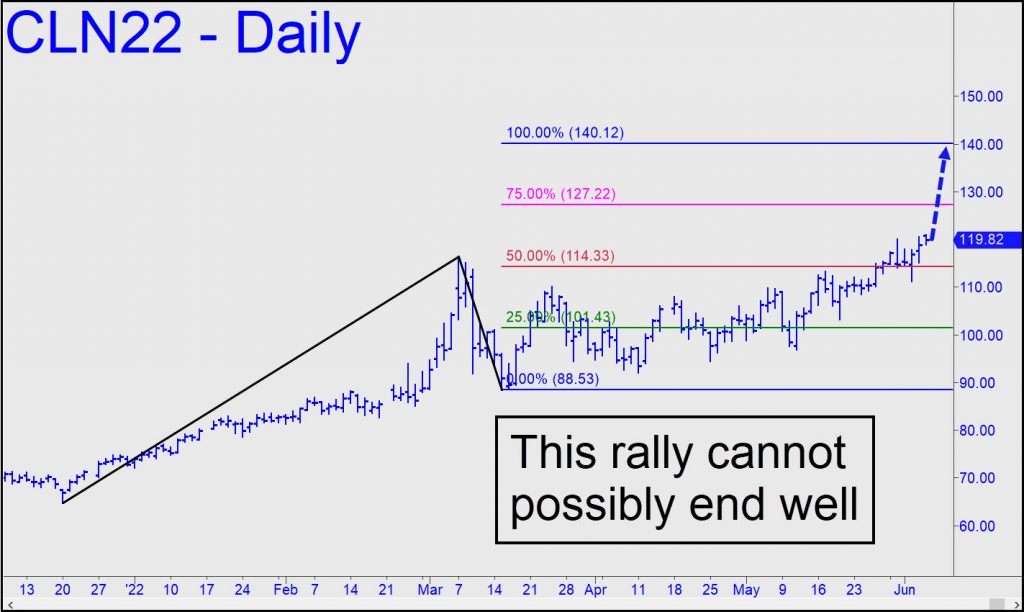

There’s no relief in sight for gas prices that seem headed to at least $10 gallon. The chart above suggests July crude will likely hit $128 this week or early next, a whopping 7.5% gain over last week’s high. But watch out if the futures shred their way past this Hidden Pivot resistance, since that would portend a continuation of the trend to $140, a target first drum-rolled here several weeks ago. It’s a safe bet that Californians will be paying $10 or more for gasoline by then, even if far fewer of them are driving. Realize that it is not consumer demand that has been pushing up prices, or even conspiratorial constraints on supply, but rather a flood of speculative money into energy resources as a hedge against inflation.

The irony is that the coming price collapse in crude will be part of a deflationary tsunami that wrecks the banksters’ moronic shell game. It will occur simultaneously with a real estate collapse that has already begun. Indeed, bidding wars for homes appear to have ceased due to the steep rise in mortgage rates, record-high prices for homes and a dearth of inventory.

No Escape

Inflation in these two key sectors is similar in that neither contains an escape hatch for investors. Because energy prices cannot continue to rise without eventually throttling the economy, the rally is doomed. But when prices finally plunge, as they must, that will suck the air from a $2 quadrillion derivatives market that was largely built using energy resources as collateral. The collapse in mortgage-backed securities did the same thing to the banking system in 2007-08. This time, although tens of millions of homeowners are sitting on huge paper gains from real estate inflation, none of them can cash out because there are no reasonably priced homes for them to move into.

A well-known quote from the late economist Herb Stein encapsulates the endgame: If something cannot go on forever, it will stop. Inflation is close to that point. When it finally arrives, the economy will not simply level off and enter a glide path to renewed prosperity, stability and economic health. On the contrary, it will experience a wrenching dislocation with no remedy save the kind of brutal price discovery that we have not seen since the Great Depression.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman June 6th, 2022

Posted In: Rick's Picks

Next: Not ‘There’ Yet »