Most financial advisers and managers talk of ‘defensive sectors’ as a place to take shelter in bear markets (because their business model doesn’t want or mandate them to ever leave equities). Defensive equities and funds work better in theory than in reality because risk assets of all types tend to fall in bear markets.

Case in point, from recent highs, so far the Dow Jones Index is off 13% compared with the S&P 500 -18%, Canadian preferred shares (CPD index) -13%, REITs -16%, Canadian Financials (XFN) -13%, US banks -28%, dividend-paying large-cap companies (XDV) -11%, gold miners (XGD) -25%, Materials (XMA) -15%, Pharmaceuticals -11%, etc. Canada’s TSX is off just -10% because it has been supported to date by its concentration in the late-cycle hold-outs of fossil fuels and financials–this doesn’t last indefinitely.

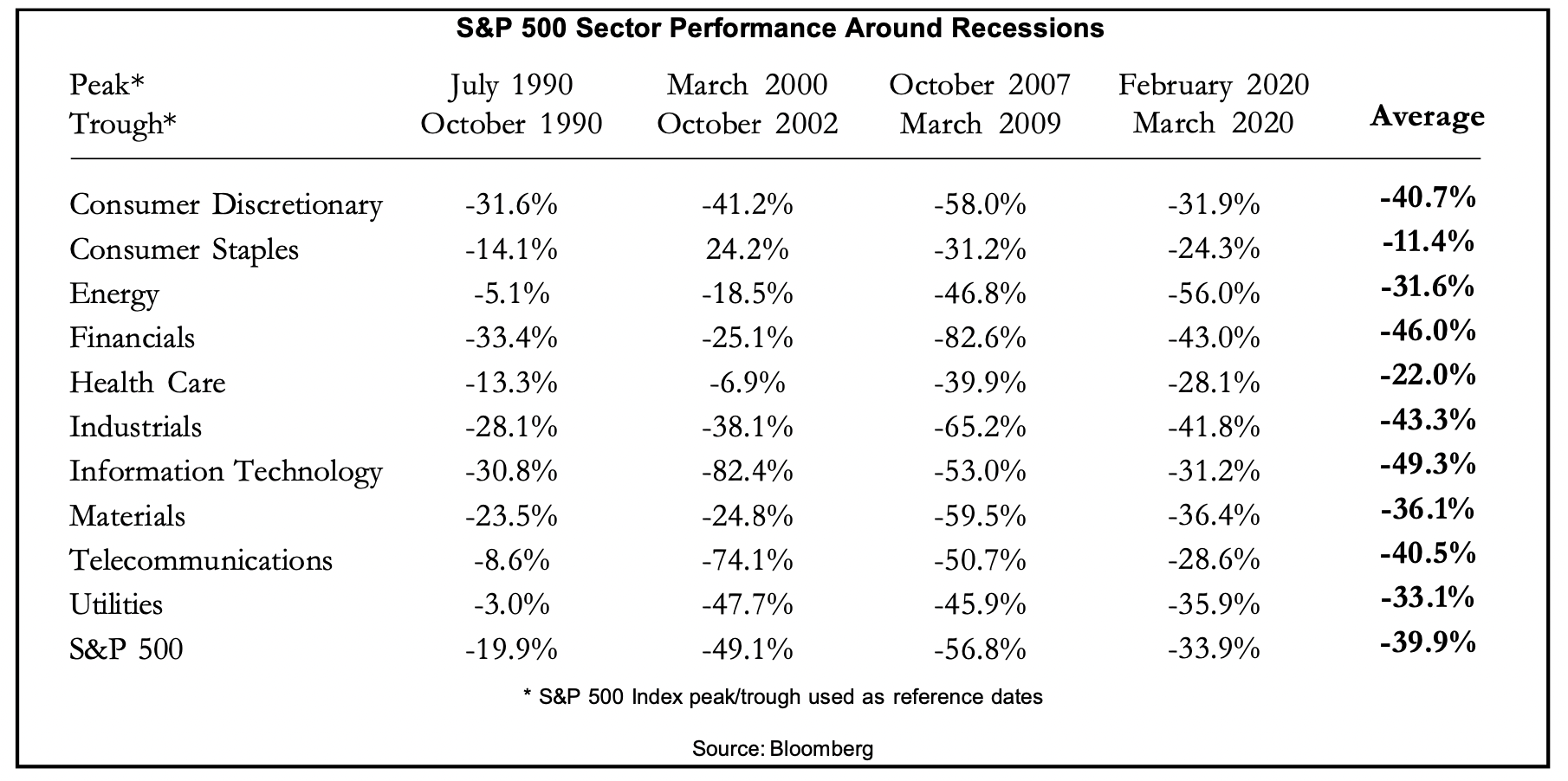

As shown below, courtesy of Gary Shilling, equities of all stripes tend to lose in bear markets. Or, as I like to say, different coloured jelly beans are still jelly beans, and they’re all marked down when jelly beans are liquidated.

While bonds have also sold off year-to-date on interest hike fears, at least they have mandated capital return dates and interest payments. Equities trade on hope with no guarantees. As the economy slows and monetary policy eases, credit quality matters and the highest-grade government and corporate bonds tend to rebound in price. In contrast, lower-grade debt tends to follow equities lower. Unlike the unusual v shape rebound from the 2020 lows, it’s also typical for share prices to take years before they recover their prior cycle peaks. Buy and holders are set for another rough go.

Rates, inflation expectations and contagion from falling markets to housing and the economy–too few connect the dots. The discussion below does better than most.

David Rosenberg, president, chief economist and strategist at Rosenberg Research, joins BNN Bloomberg to discuss the latest inflation data out of the U.S. Rosenberg shares his very bearish commentary on how sticky inflation will be in the months ahead. He warns about the measures central bankers could take to tackle it, including the possibility of 75bps rate hikes. Here is a direct video link.