April 16, 2022 | Trading Desk Notes For April 16, 2022

Are price reversals coming, or did we enter a new paradigm?

There are trend followers, and there are people who like to pick tops and bottoms. Some people love to believe that a new era is dawning, while others believe it is never different this time. Some folks are convinced that “X” is going to the moon, while others look for mean reversion.

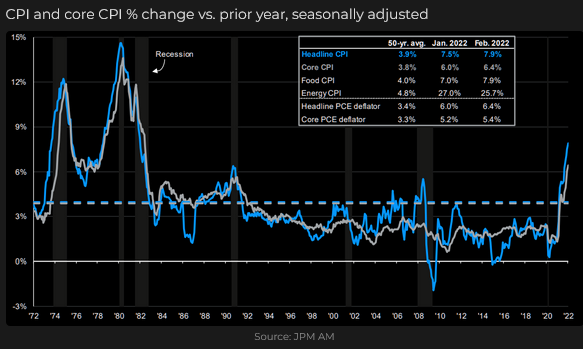

Inflation is at a 40-year high, real estate and share prices have soared the past few years, and now food and fuel prices are at All-Time Highs while a war rages in Eastern Europe.

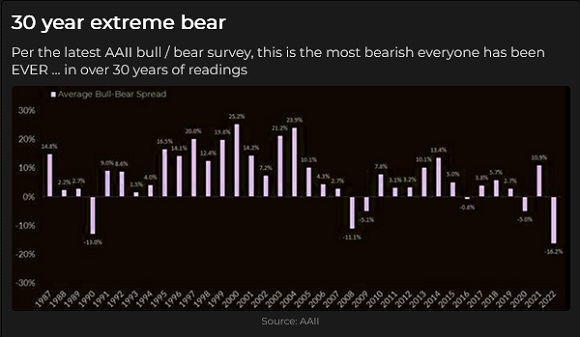

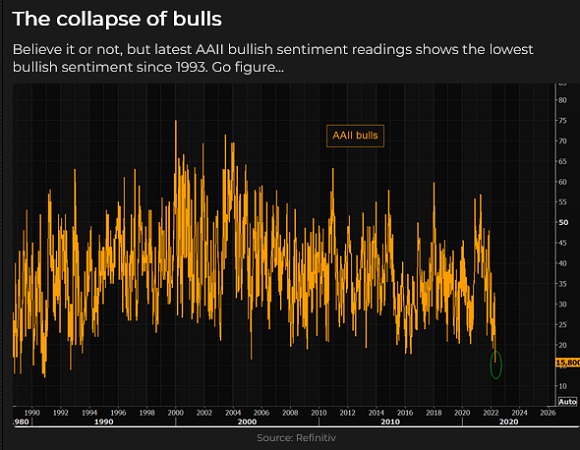

Bullish sentiment on the stock market is at a 30-year low; the bond market is falling like a stone, and lockdowns are spreading across China.

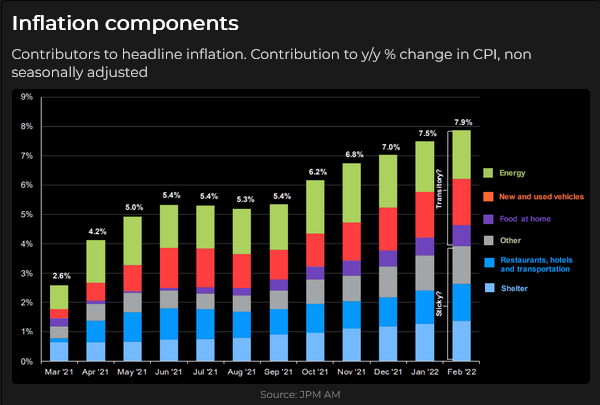

The Fed was slow to recognize that inflation was not “transitory,” but now they plan to tighten aggressively – to fight inflation. Good luck with that while governments maintain unrestrained fiscal policies and ass-backward energy policies.

While the Fed is tightening, the ECB, BOJ and the PBOC are dovish; the US Dollar Index is at a 2-year high, close to its best level in 20 years. The Yen is at a 20-year low Vs. the USD.

Is a paradigm shift underway? Yes. Is it different this time? No. Are markets setting up for reversals? Yes – depending on your time horizon. As the Talking Heads told us, it’s the same as it ever was.

Inflation

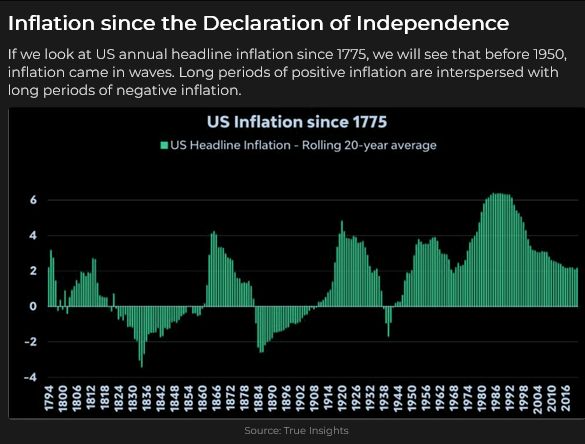

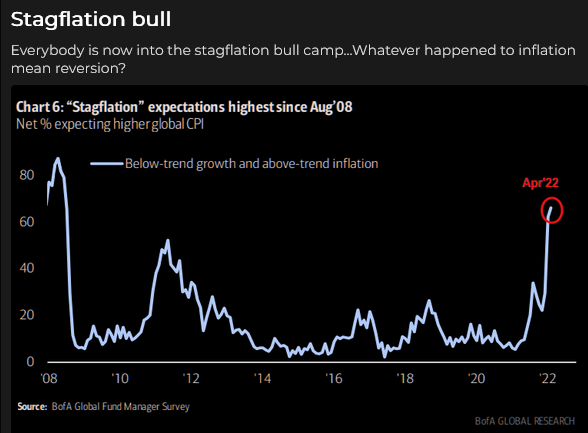

Inflation will recede from the current 40-year highs, but it is not going below 2% anytime soon. We are in a new era after years of relatively mild inflation (ex, stocks and real estate). Government fiscal policies crossed the Rubicon during the Covid period, and “demand destruction” is now “politically unviable.” Expect unrestrained fiscal policy to be maintained.

To quote my good friend Martin Murenbeeld in this week’s Gold Monitor: “Higher interest rates will not arrest the shift to security of supply and onshoring, nor will higher interest rates suppress higher commodity prices as a result of covid-related supply disruptions and the war in Ukraine.”

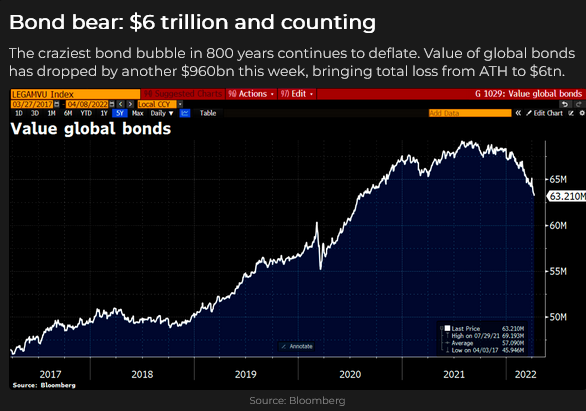

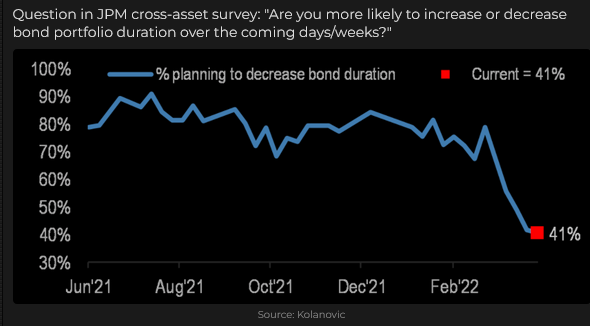

Bond yields have soared to a 4-year high

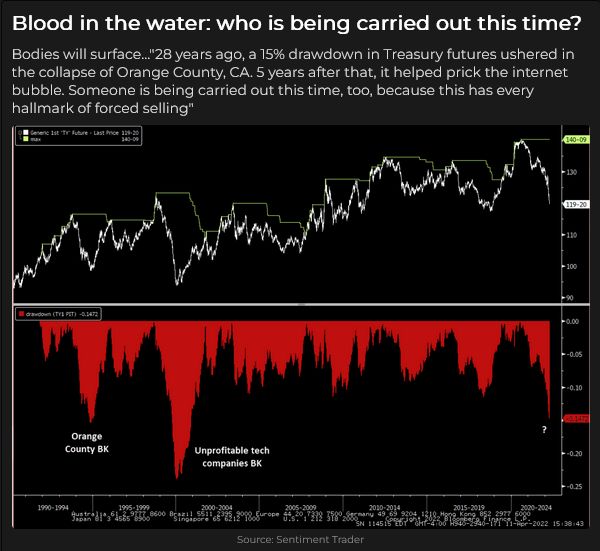

Bond yields have soared, and the rate of change is significantly faster than anything we’ve seen in decades. Somebody is badly wrong on this move, or maybe, instead of another Long Term Capital Management disaster, the pain is spread across millions of retirement accounts.

Ross Clark at ChartsandMarkets.com sees daily and weekly capitulations in the 10-year Note futures contract.

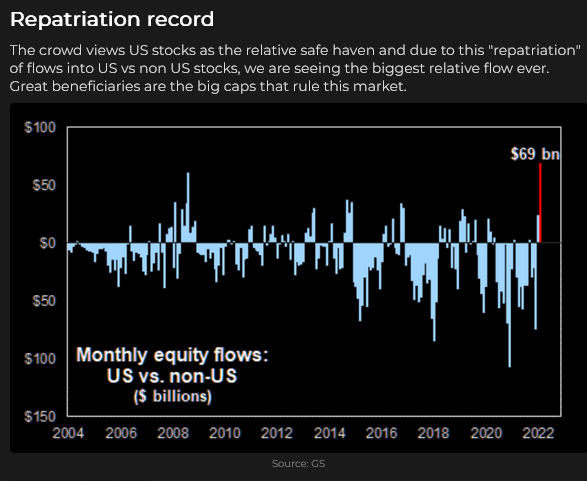

The US Dollar continues to rise.

Since the early 1980s, when I was a currency analyst, my mantra has been that capital comes to America for safety and opportunity.

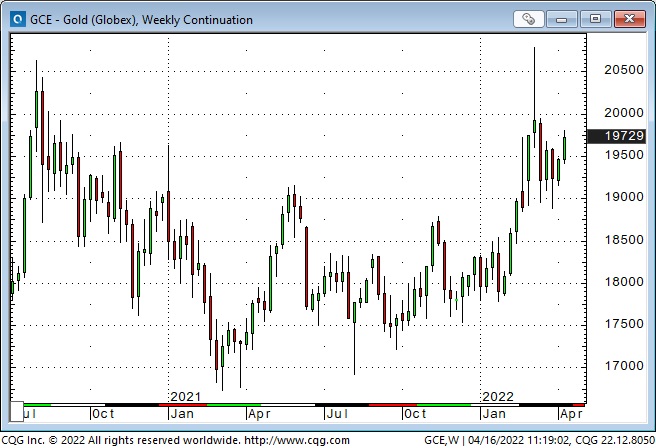

Gold rises even as the USD and interest rates rise

Martin Murenbeeld points out that capital is seeking safety when gold and the US Dollar rise at the same time. Peter Brandt writes that while he is long gold, he is nervous. Gold has had EVERY reason to go up but is struggling, according to him, and that is a red flag.

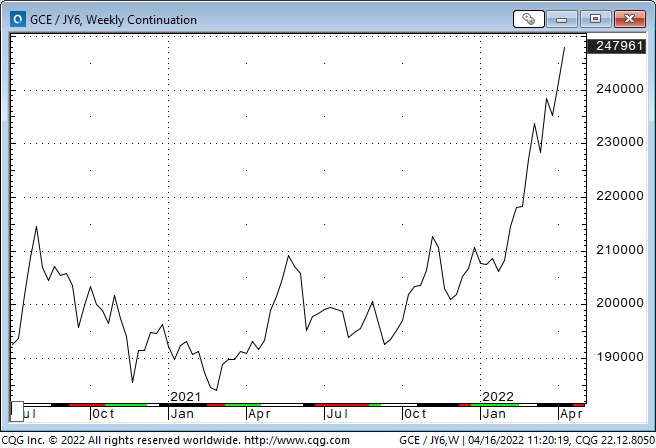

Gold is at an All-Time High in most European currencies and the Japanese Yen but has trended lower the past two years against stocks and commodities.

The Canadian Dollar

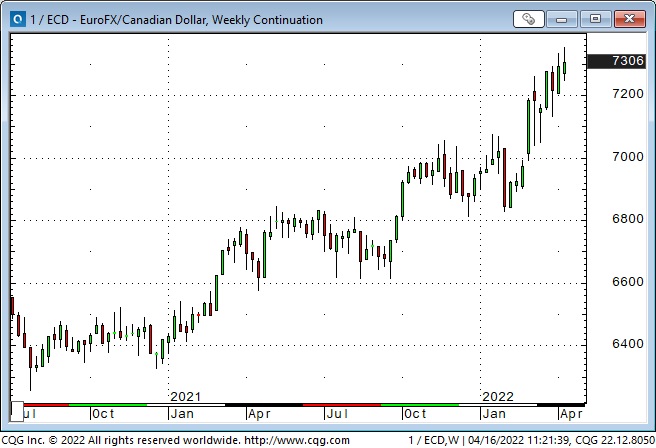

When I say that capital comes to America for safety and opportunity, the bigger truth is that money comes to North America. The CAD is at a 7-year high against the Euro, an 8-year high against the Yen, and the commodity-heavy Toronto Stock Exchange has been making new highs this year.

Energy markets

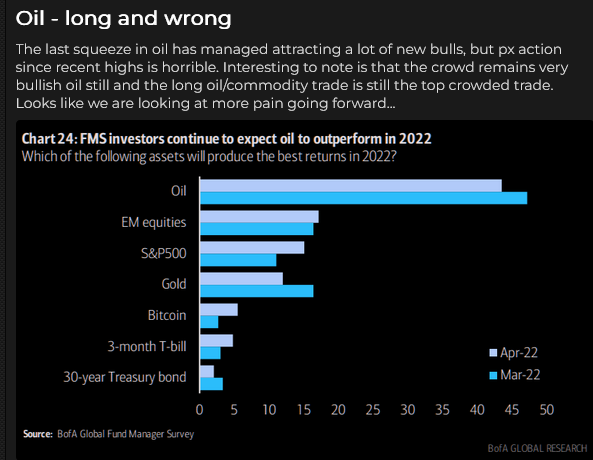

WTI crude oil spiked to ~$130 when sanctions were applied against Russia. Prices have fallen from those highs but have mostly stayed above $100 as markets are concerned that severe reductions in Russian exports will cause global supply shortages.

Another concern is that Russia has limited storage facilities. If they can’t export, oil fields will shut down – and it will be difficult to resume production even if sanctions are lifted.

China and India (and perhaps other countries) may be willing to buy Russian crude, but it may not be easy to deliver products from Russia to those buyers. Europe continues to import Russian oil.

WTI backwardation spiked in early March but has fallen sharply since then – perhaps supplies are not as tight as feared. (In this chart, the June 2022 contract trading to nearly a $20 premium over the December 2022 contract in early March. It is now ~$8 premium – about where it was before Russia invaded Ukraine.)

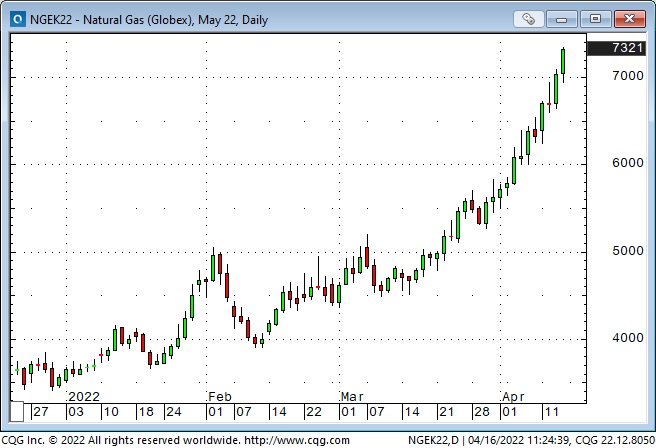

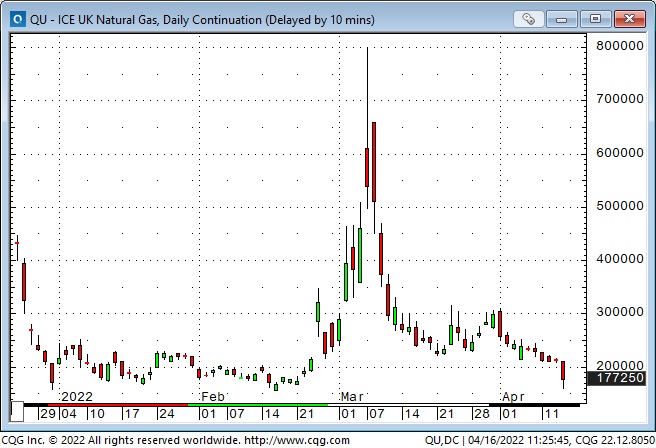

Nat gas prices have soared in North America (NYMEX is at a 14-year high) and fallen in Europe – it looks like the trans-Atlantic arb is working.

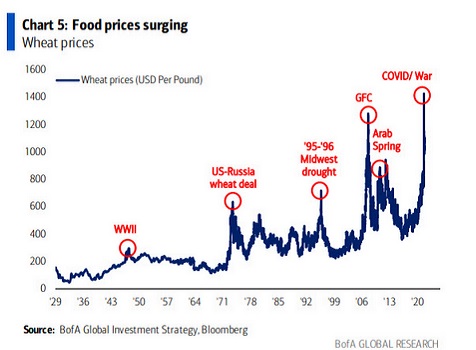

Food prices are rising.

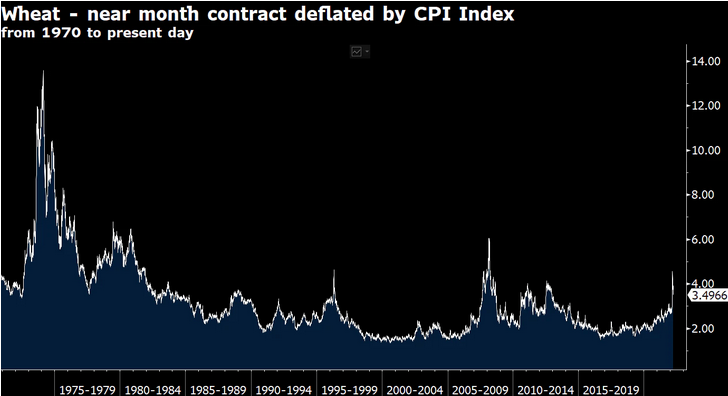

When someone is making the point that food prices are rising, they use a chart like this one:

But here’s another way of looking at it:

Stock indices have fallen over the past two weeks

The leading American stock indices have fallen as bond yields have soared in the past two weeks. It seems that “bad news” is everywhere, and bullish sentiment is at a 30-year low.

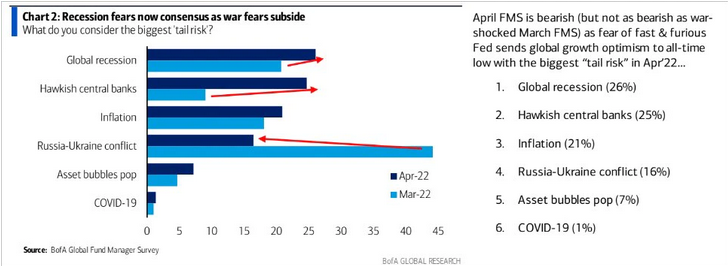

Bank of America does regular surveys of Fund Managers (FMS.) This chart shows that the biggest worry last month was the Russia/Ukraine conflict, this month the biggest concern is a global recession.

I’ve seen estimates that realized capital gains in the USA in 2021 were ~$2 Trillion and that taxes on those gains are ~$350 Billion. April 18 is the last day to pay 2021 taxes, so there has likely been some “tax selling” in the previous two weeks to raise cash to pay taxes. (Maybe that, and corporate buybacks being in a blackout period ahead of quarterly earnings reports, account for some of the recent price weakness.)

My short term trading

I expected stocks to rally this week, so I missed the move lower on Monday/Tuesday. I bought the S+P when it rallied back above 4400 on Tuesday, and it looked like I was on the right track by Wednesday’s close, but the market rolled over on Thursday, and I was stopped just above breakeven. I was flat going into the long weekend, and my P+L was up a hair on the week.

On my radar

This year, there have been several extreme moves in different markets (and metrics and geopolitics). I’m open to the possibility that we are in the early stages of significant paradigm shifts, and I’m also open to the possibility that narratives have set markets up for reversals. Given the short-term nature of most of my trading, I’m more inclined to look for reversal opportunities.

I won’t buy “something” that is falling like a stone (like bond prices or bullish stock sentiment), but if I see signs that a plunge is reversing, I will buy with tight stops. (I often have to buy and get stopped out more than once before I catch a move.)

Thoughts on trading

I always read in bed before falling asleep. This week my Kindle had a dead battery, so I rummaged through my bookcase and discovered (much to my delight) that I still had the first edition of Market Wizards (I had looked for it last year, and when I couldn’t find it I thought I must have given it away.)

I read chunks of the interviews with Michael Marcus, Bruce Kovner, Richard Dennis, Paul Tudor Jones and Ed Seykota before falling asleep.

I remember reading that book cover-to-cover when it first came out in 1989. It was invigorating back then because the interviews affirmed many of the things I believed about trading.

Thirty years later, it is still invigorating, and if you haven’t read it, I recommend it to you. (If you have read it, you’re probably smiling as you read this!)

Quotes from the notebook

“Most of us have been taught that we have a sound system (system 2) in the brain that, in an ideal world, overrides an impulsive and intuitive system (system1.) But it doesn’t really work that way. The more expertise we have, the more that expertise exists as a feeling inside our bodies – a fact that’s easy to visualize in surfers. Our knowledge moves from explicit to implicit. Scientists who study this call it visceral intelligence.” Denise Shull, The ReThink Group

My comment: I first encountered Denise Shull in a Real Vision interview in 2017, and I was intrigued by her ideas about trading on “intuition.” I had struggled with the notion that “risk management” meant overriding my intuition – that intuition was “bad” – like an overweight person impulsively grabbing a chocolate bar at the grocery store checkout counter. My experience was that my “intuition” often saw the right trade in a sea of contradictory information.

As I keep repeating, successful traders find a way to participate in markets that works for them. If intuition works for you, embrace it. If it doesn’t work for you, don’t use it.

The Barney Report

I typically watch more TV during Masters week than the rest of the year put together. Barney is only seven months old, so this was his first-ever Masters, but he seemed to like it.

Where does Barney go when the Masters is over? He watches the action on the local 18th fairway.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk about markets.

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The April 16th podcast is available at: https://mikesmoneytalks.ca.

This week I also did my monthly interview on Howe Street Radio. You can listen to the podcast here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair April 16th, 2022

Posted In: Victor Adair Blog