April 24, 2022 | Into the Fire

If you haven’t noticed—perhaps because you live on Mars—inflation is here. Not just in the US but almost everywhere. Prices for everyday goods and services, including necessities like food, are climbing rapidly. The US Consumer Price Index rose 8.5% in the 12 months through March… and we know it understates categories like housing.

These year-over-year comparisons may improve a bit as the “base effect” makes the lookback period start at a higher level. That won’t necessarily mean prices are falling; inflation will remain a problem even if prices stabilize. Higher living costs have a cumulative effect the longer they last.

This is from the latest hot-off-the-press Hoisington quarterly letter (which Over My Shoulder members will get next week):

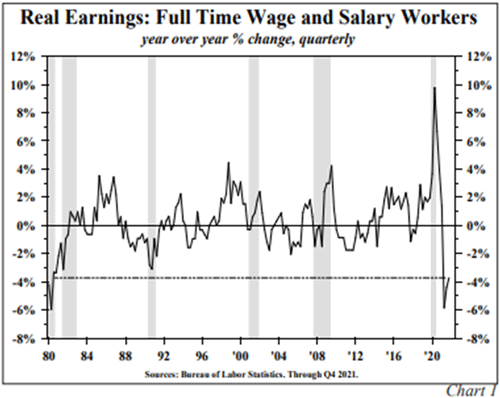

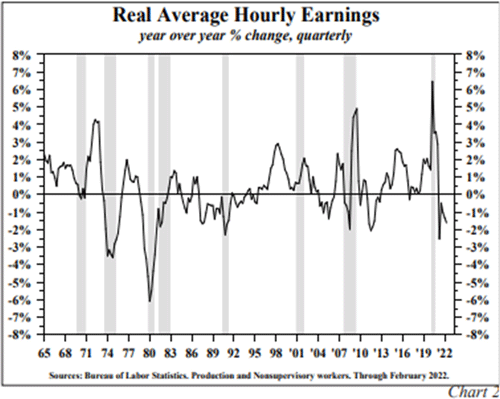

“Most Americans have suffered a substantial fall in their standard of living over the past 12 months. In the latest available 12-month change, 116.2 million American wage and salary workers suffered a 3.7% decline in their inflation-adjusted paychecks, the largest drop since 1980 (Chart 1). This alone more than offsets the gain in income going to the 6.5 million newly employed in latest 12 months. In addition, salary workers suffered a larger loss in standard of living than hourly employees (Chart 2). Inflationary damage to the 70 million retired Americans cannot be calculated in precise terms, but qualitatively the situation is not good. Those covered by Social Security received a 5.9% cost of living adjustment (COLA), however most private pensioners do not have COLAs.

Source: Hoisington

“A rough estimate is that approximately 50 million or more retirees’ real income has been seriously eroded by the 40-year decade high inflation rate. Summing those whose income trailed price increases (116.2 + 50) yields a figure of approximately 170 million Americans. The sizeable adverse impact of inflation is consistent with a decline in real disposable personal income in 11 of the 13 latest months. Eighty five percent of U.S. households make under $150,000 a year, with many living from paycheck to paycheck or on steady salaries. The imbalance between those who benefitted and those who were harmed from the monetary and fiscal policies pursued over the last two years is abundantly clear. The 8.5% inflation rate has dramatically lowered the standard of living of over 170 million individuals.”

This was the result of a massive monetary policy error which was pointed out over a year ago by numerous Nobel laureates and mainstream economists, and well, lots of less-well-known analysts like me. The Fed even did not include a section on policy rules in its February report to Congress which it has used since 2017 as it clearly showed they were behind the curve. Like they could hide it.

As bad as conditions are, they have the real potential to get even worse. Today we will explore how China’s latest COVID lockdowns will affect the global economy. Hint: It won’t be good. We may be out of the frying pan and into the fire.

First, let me remind you the SIC 2022 is just a little over a week away. I can’t tell you how grateful I am to see all these amazing speakers coming to the aid of my readers… because frankly, we need all the help we can get at this point. (Click here to see the full faculty list—it’s quite impressive. Henry Kissinger, David Rubenstein, Felix Zulauf, Ron Baron, Tom Hoenig, Niall Ferguson, Joe Lonsdale, Frank Luntz, Charles and Louis Gave and Anatole Kaletsky, Howard Marks, Cathie Wood, William White, and 40+ more! The energy and crypto panels are powerhouses!)

As you know, I’m convinced we’re heading into a recession, possibly a severe one. The Fed messed up by raising rates and reducing their balance sheet too late, and the time that passes until they finally get their ducks in a row will not be pretty. Inflation numbers could potentially rival the late 1970s and ‘80s… and do yourself a favor and get your Virtual Pass to this vital online conference. You’ll be glad you did.

Above Zero COVID

In some ways we are replaying early 2020. Back then a mysterious virus was ravaging China, causing the government to restrict movement and shut down much of the economy. Our initial worries were about how it would affect our supply chains.

As it turned out, the virus spread and most of the world went into varying degrees of closure, sparking a global slowdown which reduced the demand China would have fulfilled. As a result, we never really saw the full impact of losing China’s exports. Demand then returned with a vengeance, thanks to fiscal and monetary stimulus. Now we have vaccines and treatments for the virus. It’s not gone but is more manageable now… except in China.

China’s “Zero COVID” strategy sought to stop the virus via brute force. It worked well, too. Since mid-2020, cases would pop up here and there, often brought by travelers. The government would respond swiftly with quarantines and mass testing, then it would be over. The more transmissible Omicron variant appears to have derailed this plan.

Worse, the virus can feast on a Chinese population with almost no infection-acquired immunity and very low vaccination rates. The vaccinated minority mostly received Chinese-made vaccines that are far less effective than the mRNA vaccines used in most developed countries, which China could have licensed but the government chose not to. This hubris will tragically cause tens of thousands of unnecessary deaths. It makers me weep for the Chinese people. Now, they’re locking down because they have little choice. Uncontrolled spread would be devastating.

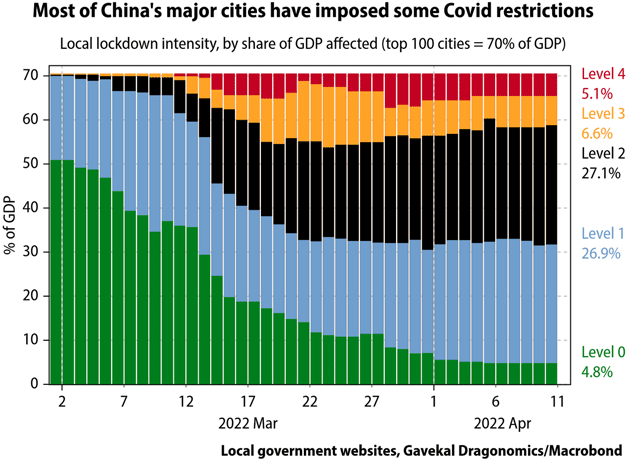

Gavekal has been tracking local restrictions in China and recently produced this chart. It weights the cities by contribution to GDP.

Source: Gavekal

In early March, cities representing over half of Chinese GDP were at Level 0 with no restrictions. By mid-April less than 5% were in that category, while almost 40% of GDP was at the harsher levels 2‒4.

Gavekal’s Dan Wang (one of my favorite writers) lives in Shanghai and shared what it was like.

“This wasn’t supposed to happen here in China’s largest and most cosmopolitan city, with some 26 million people. Shanghai had been, after all, the best-managed city in China throughout the two years of the pandemic, a model where local authorities imposed minimal restrictions while making sure outbreaks stayed controlled. But as cases rose through March, residents and officials grew anxious. An official who heads Shanghai’s mental-health department went on television to tell residents they must ‘repress the soul’s yearning for freedom,’ prompting amused citizens to create memes that satirized a spiritual turn in party-state officialese.

“Ten days later, Shanghai declared a temporary, staggered lockdown that swiftly became indefinite and all-encompassing. Our shutdown rivaled two of the country’s toughest: Wuhan at the beginning of 2020 and Xi’an at the end of 2021.

“Residents were allowed out of their apartments only to take PCR tests. Few businesses could operate. People struggled to obtain basic necessities like medical supplies, elderly support, and food. Most restaurants and supermarkets were no longer able to make deliveries. Local authorities then took charge of food distribution, making residents dependent on government-organized food packages. People quickly chafed. When they started to sing and chant on their balconies, the government sent up a drone with a megaphone that repeated, ‘Please repress the soul’s yearning for freedom.’ It wasn’t as funny the second time around.”

This isn’t the orderly, efficient China the government likes to portray. People forcibly kept in their homes without food or access to medical care, serenaded by propaganda drones, pets being killed, and inhumane camps for those who test positive sounds more like a dystopian nightmare. Many other stories and videos, some from Westerners living in China, confirm that impression, though. The images on Twitter are depressing.

Exactly how bad is the COVID outbreak, in terms of illness and death? We have no way of knowing. The Chinese data on COVID is clearly fake. I think we can assume it was serious or threatening to become so. There’s no other reason to impose such conditions.

As I write this there are reports the lockdowns are easing in parts of Shanghai. But other reports say that’s not true, and that the lockdowns will continue until mid-May. In any case, the economic effects may only be starting.

Sidebar: There may be more than just a simple Zero COVID policy in play here. There has always been a serious rivalry between Shanghai and Beijing. If there is a serious anti-Xi faction, it is centered in Shanghai. Serious China watchers I follow think part of the Shanghai lockdown is a clear warning to Shanghai leaders to toe the line.

More Inflation Pressure

Shanghai is one of the world’s busiest ports, and not just for exports. Many components and materials arrive by ship then leave again as finished products. It is a giant, well-orchestrated symphony that usually works well. But right now, it’s a mess.

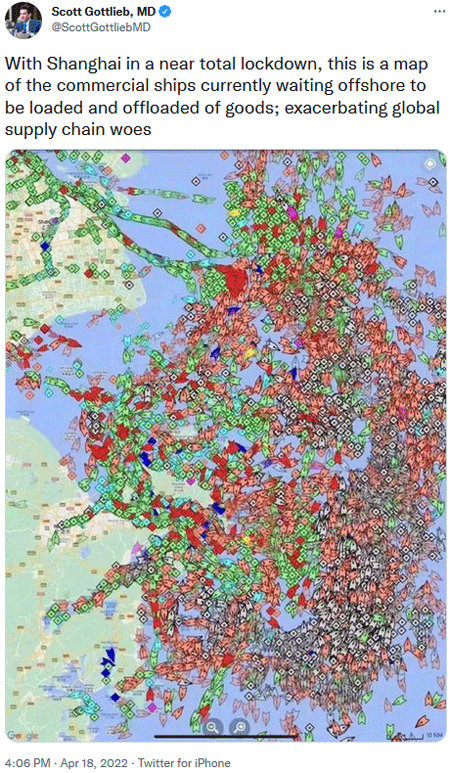

Here’s a tweet from Dr. Scott Gottlieb, former FDA director.

Source: Scott Gottlieb

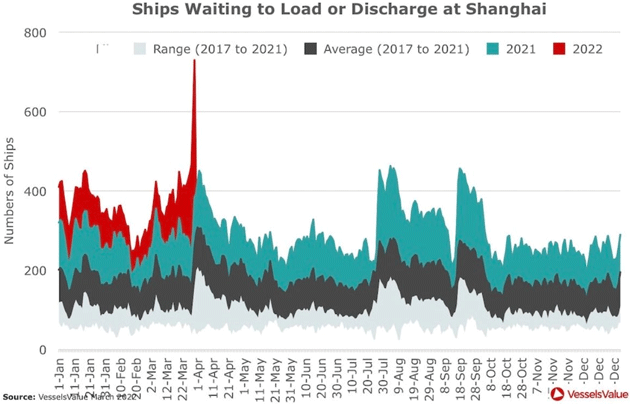

This can be seen graphically in another way. Almost twice as many ships are waiting near Shanghai ports as opposed to last year, which was already well above average:

Source: VesselsValue

This is what three weeks of downtime does. Ships arrive and can’t unload or be loaded because the workers who would do it are in lockdown, so they pile up. Remembers the stories last year about Los Angeles and Long Beach? Shanghai is that same situation on steroids. It has a cascading effect, too. Supply chains need predictability. The right stuff must show up in the right place at the right time.

Chinese authorities know this, of course, and will work to unsnarl the ports. But at this point a lot of delay and damage is locked in. We will probably see echoes of the Shanghai snarl around the world as delayed shipments arrive all at once, causing clogs at the receiving end.

Unlike 2020, this time the rest of the world is opening instead of closing. The impending recession will hit demand eventually. For now, though, consumer and business spending remain strong. People are waiting for stuff from China that isn’t going to arrive as expected—some of it already paid for. This will add to inflation pressure as prices rise for goods that are suddenly in short supply.

Now, combine this with food and energy prices that were already rising even before the Russia-Ukraine war, plus a Federal Reserve that is seriously behind the curve and looks likely to clamp down hard. This would be a perfect inflationary storm even if China were running smoothly, which it clearly isn’t.

The developed world is about to take a whale of a hit. But China may take a bigger one.

New Dilemmas

I wrote a letter back in January called Beijing’s Dilemmas. That was barely three months ago but now seems like years. The dilemmas I described, including the early stages of today’s COVID wave, are still there and more have developed.

For one, the domestic economy is still in precarious shape following last year’s Evergrande real estate collapse. The Xi government’s “common prosperity” plan is a giant change in direction from “capitalism with Chinese characteristics.” Managing it requires a deft touch, which COVID doesn’t help. The joke in China is that common prosperity now means common poverty and no food.

China’s harsh COVID measures seem brutal to many Westerners, but were quite popular in China, at least until now. People felt generally safe from this threat that was ravaging the rest of the world. Leadership portrayed this as proof of its own superiority over the West. This makes abandoning the policy difficult, even though it’s obviously not working anymore. People aren’t going to forget going hungry in their own homes. That hits the regime’s credibility, with unpredictable effects.

Nor is that all. As growth weakens in the rest of the world, China’s export sector will weaken, too. That’s not entirely bad; the government has long sought to rebalance and build domestic demand. But they need it to happen gradually.

Then there’s energy. China was having an energy crisis even before the war, with electricity blackouts increasingly common. China isn’t participating in the Russia sanctions but remains exposed to global energy prices, which have surged. It may replace some of this by increasing imports from Russia—maybe at bargain prices—but there are practical limits. Pipeline and shipping capacity isn’t infinite.

It’s an open question how long Russia can maintain current production levels without the Western companies who have now left. Schlumberger and Halliburton have left Russia. How do you keep your wells operating, let alone drill without them? I can guarantee you that US production would fall dramatically if those two companies decided to not operate in the US. They are vital to world oil production. Russia doesn’t have that expertise, let alone the equipment. This will be a slow-moving development, and sadly, it means energy prices will keep rising.

Beijing has also been walking a fine line between its “Great Power” ambitions and its US and European customer relationships. The foreign companies who once saw abundant opportunities in China face new conditions that are often less attractive. Ditto for Chinese companies seeking to sell high-tech goods overseas.

US Treasury Secretary Janet Yellen this week talked about “friend-shoring,” clearly implying that US companies should secure friendlier sources for their supply chains. Many companies are trying to figure out how to bring production back to the US. China’s original attraction was price. Different supply chains mean input costs will rise. More price increases and inflation.

Now, on top of that we can add the Russia-driven changes. As recently as January, Xi and Putin were proclaiming a “no limits” alliance. Neither seems to have expected the furious reaction to Russia’s Ukraine invasion, and certainly not the economic part of it. Beijing is caught in the middle. Having seen Russia amputated from the world economy in a matter of weeks, China needs to avoid getting the same treatment. This limits its ability to take advantage of the situation.

And just to make matters even more interesting, the Chinese Communist Party will hold its National Congress later this year, which will determine whether Xi Jinping stays in power. You might think there is no serious doubt about it. His re-election is certainly likely. But it’s not guaranteed, and he needs to keep the party elites on his side.

These are a bunch of giant risks and question marks the world doesn’t need right now. Markets certainly don’t need them. We have them nonetheless.

Meanwhile, Back at the Fed

A few random quotes that hit my inbox Friday morning:

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

From David Rosenberg:

“Powell is going to crush inflation in the cyclical parts of the economy that he can control and, in the process, generate a 1982-style recession—brace yourself for it.”

From Peter Boockvar:

“As a reminder, since the early 1980s each rate hiking cycle ended below the peak of the prior one. In Q4 2018 the Fed stopped when the fed funds rate got to 2.25–2.5%. So, the rather quick pace and much higher level of rate hikes currently priced in, 50bps at each of the next three meeting, an ultimate near 3.5% fed funds rate by next summer and an annualized pace of QT of $1.14 Trillion, would be by far the most aggressive tightening stance seen in a post-Volcker world if the Fed actually follows through. And it won’t just happen in a vacuum in order to tame inflation.

“Decades of easy money have medicated an entire economy on a low cost of capital and given markets reason to achieve ever higher multiples and ever tighter credit spreads. It is why the investing world has changed this year and why the coming few years will be quite different than the previous. While investing has seemed ‘easy,’ it never is and now is ever more difficult and challenging. With the S&P 500 still trading at 19X earnings, the NASDAQ by 27X, the Bloomberg high yield index spread to Treasuries of 344 bps vs. the 10 yr average of 435 bps and 20 yr average of 510 bps, there is just no room for error here.”

From Gavekal:

“In the eurozone, the recent acceleration in inflation and the accompanying rise in bond yields as the market has priced in future policy rate increases from the European Central Bank have helped to drive a steep fall in real M1 growth. As eurozone HICP inflation [European CPI] has risen from 1.3% YoY in March 2021 to 7.5% in March 2022, and as the yield on 10-year bonds has climbed from -0.5% last August to 0.9% today (the fastest increase in more than 20 years), real M1 growth has sunk to 3% YoY, its slowest since 2013.”

The ECB is preparing to abandon its insane negative yield policy. Ten-year German bonds now yield almost 1%. This is affecting bond prices all over the world, including in the US. European finance ministers are beginning to pressure Christine Lagarde to fight inflation just like Jerome Powell is being forced to. This will bring about recession in Europe, if it hasn’t already begun. I regularly get a long chart-filled private briefing on the economies in Europe. This morning it was simply ugly.

Palm Beach, Polo, and Baby Formula

This weekend I’m taking my first airline trip in what seems like forever to Palm Beach for a polo match, of all things. Some friends of mine are looking at starting a new business and are interested in having me participate. Evidently potential investors will be there. I’m not actually certain what to wear. Is it a faux pas to wear a polo shirt to a polo match? I am told it will be fun though. And I will be with friends, which I also miss.

Your generous help for our recent Ukraine fundraising efforts resulted in seven large buses moving 500 women and children from Lviv to Krakow every day, now more than 6,000 since we started. Thank you! It is dangerous just to get to Lviv, but to reach safety in Poland women must avoid human traffickers posing as friends trying to “help” with transportation. It is a serious problem.

It is time to hit the send button. Remember, we always get through recessions and the world is going to be much better in the future. I am still long humanity. And remember to sign up for the SIC. And don’t forget to follow me on Twitter, where I am getting a little bit more feisty. It is actually quite fun. Have a great week!

Your excited about the SIC analyst,

John Mauldin

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin April 24th, 2022

Posted In: Thoughts from the Front Line