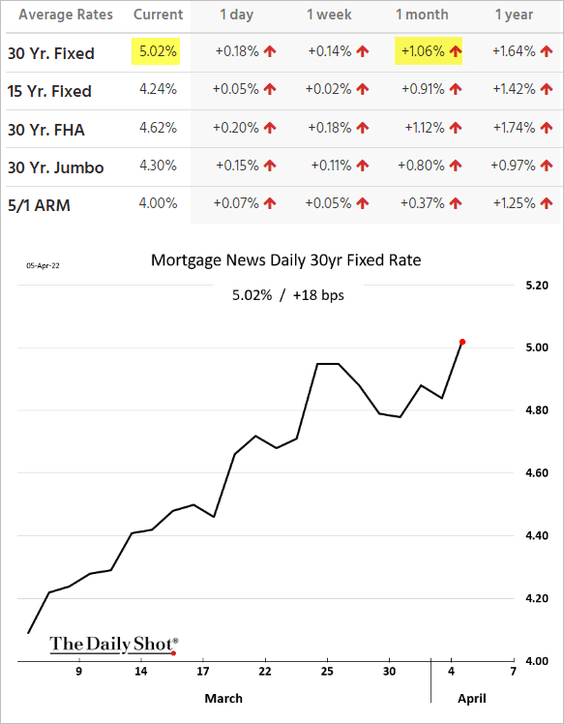

Canadian 5-year fixed mortgage rates have moved above 4% and (as shown below) US 30-year mortgage rates above 5%, up more than 1% in just the last month (similar leap in Europe). This rapid 25% increase in interest costs, coming amid highly indebted households and corporations, is the most significant financial shock since 2007.

Bond markets have now priced in the most aggressive central bank hiking cycle in the last 45 years, as shown below courtesy of Bloomberg.

In the process, the Bloomberg Global Aggregate Bond Index (shown below) has fallen under the key 100 ‘par value’ level for the first time since 2008. This level turned out to be a lucrative buying opportunity for bonds in 2008. As the economy slows, and central banks end up walking back their tightening plans, it’s likely we will look back on this latest rate shock as another valuable opportunity to add the highest quality bonds at higher yields than we may see again for a few years.

Cycle analyst Eric Basamajian discussed the rate shock ramifications in the interview below and offers an insightful big picture on the housing market, economic cycle and more. Host Hartman asks him about many of the mainstream bullish talking points.

Eric Basmajian, economic analyst and founder of EPB Macro Research. Jason Hartman and Eric discuss the rapid decline in real personal income and standard of living, how the rate shock will filter through to the housing market and much more. Eric also talks about the single most important variable to understand where the next 10 years of the real estate market are going and the four corners of an economy: income, consumption, employment and production. Here is a direct video link.