April 2, 2022 | Another Train Wreck in the Making

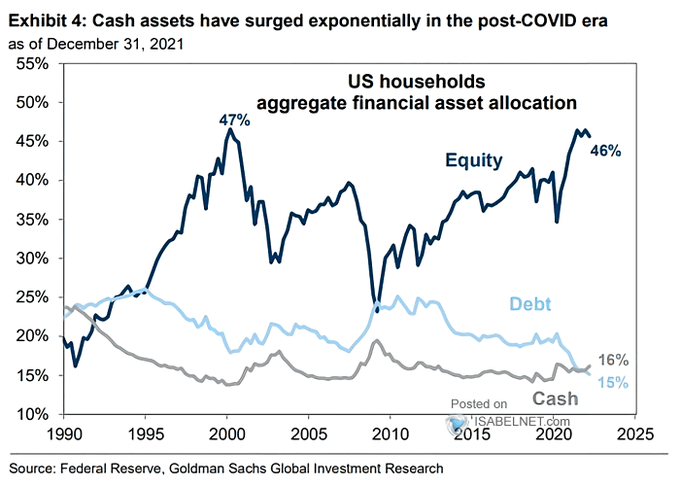

Below is the chart showing the present 46% allocation of household net worth to equities, versus just 15% to bonds and 16% to cash. This level of risk-concentration to equities was seen at the 2000 tech bubble top and, to a lesser extent, the 2008 bubble top. However, allocations to the least risky bonds and cash are lower today than those previous risk cycle peaks. As a result, household net worth is heavily exposed to the downside of a bear market and recession. It is especially precarious because unemployment will rise as equity and housing prices fall—another train wreck in the making.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park April 2nd, 2022

Posted In: Juggling Dynamite

Next: This Week in Money »