March 12, 2022 | Taps Coogan: China Junk Yields Surge as Stock Market Implodes

With the war in Ukraine and imminently tightening monetary policy consuming most of investors’ bandwidth, it’s easy to overlook the historic meltdown happening right now in Chinese financial markets.

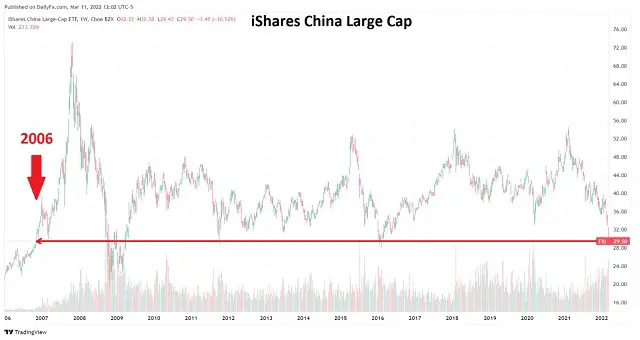

China’s benchmark Shanghai Composite is down about 37% from its 2015 high and is down over 47% from its 2007 all-time-high. The iShares China Large Cap ETF (FXI), one of the largest and most liquid China ETFs, is trading for $29.50 at the time of writing. It first hit that price on November 6th, 2006. It’s down nearly 50% from its highs last year and, amazingly, is down about 60% since its 2007 high. This is a Global-Financial-Crisis-like bloodbath for Chinese equity investors.

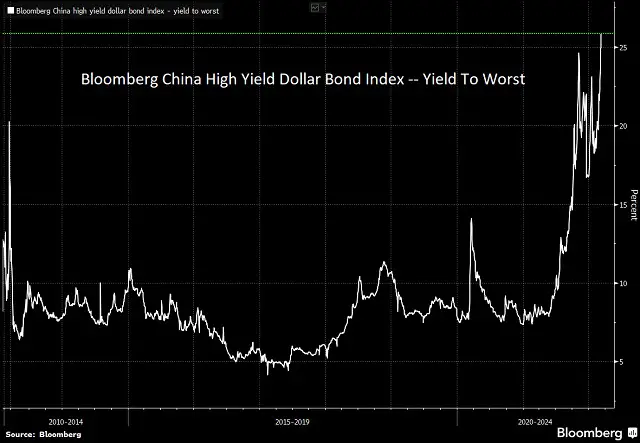

Meanwhile, Chinese junk dollar-bond yields have surged above 25%, the highest since at least the Global Financial Crisis.

The trouble in China is the culmination of many problems.

Its workforce, birth rate, and soon overall population are shrinking, posing enormous problems for an economic model that is still highly dependent on real estate development and the exploitation of cheap labor.

The decision to take a vibrant financial hub that was Hong Kong, a gateway for foreign capital flowing into China and a potential model for democratization, and intentionally destroy exactly that which made it a vibrant financial hub didn’t help confidence either. Nor does the dawning realization that Xi Jinping really is a genuine totalitarian Marxist intent on cracking down on seemingly everything and anything.

China’s exposure to Russia, the complexity of dealing with the sanctions on Russia, and the spike in the cost of China’s commodity imports don’t help either.

Anything down this much is eventually due for a bounce, maybe even a big one. However, history has shown over and over exactly where the Marxist-dictator-for-life governance model leads and that is exactly where China is now galloping towards.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino March 12th, 2022

Posted In: John Rubino Substack

Next: This Week in Money »