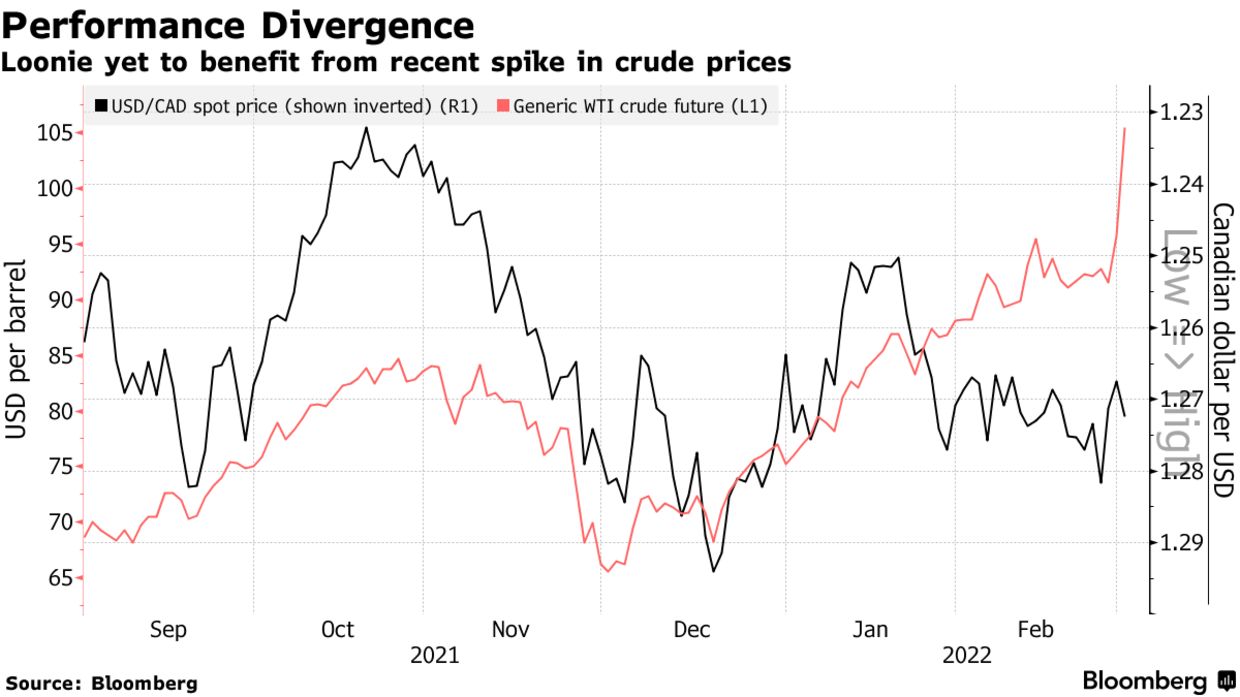

Since December, despite a parabolic move in fossil fuels (priced in U.S. dollars), the Canadian dollar has not followed along for the ride. This is not a bullish vote on Canada (see chart below and Canada’s currency washed out by U.S dollar haven appetite.) With money supply and trade now retreating globally, asset bubbles are bursting, and highly levered participants increasingly need cash to make a mountain of payments. The lion’s share of payments globally is due in U.S. dollars.

Yes, Canada has oil and gas, and 12% of the TSX index comprises companies in the space. But, for years now, the bulk of our economic momentum has come from blowing up a housing bubble and the TSX Index, which most Canadian portfolios and funds track, has a third of its weight in financials (nearly three times the weight of fossil fuels).

Financials do not fare well late in credit cycles as the yield curve moves to zero and then inverts. Canadian financials halved in the 2001-02 and 2007-09 bear markets and tumbled 27% in the 15-day plunge in March 2020. And Canadian debt levels in households and corporations are much more extreme, coming into this downturn, than any time in the last 22 years. Cash flows were already tight without any rate hikes, and the recent leap in food and fuel prices taxes daily consumption and exacerbates broad financial strain.

Financials and the TSX Index remain heavily overbought, concentrated and overvalued in this environment. Buy and holders be warned.

In this clip, David Rosenberg offers a good summary and updates on the Canadian interest rate cycle.

David Rosenberg, president, chief economist and strategist at Rosenberg Research, joins BNN Bloomberg to discuss his reaction to the Bank of Canada’s first interest rate hike since 2018. He notes that if the BoC and the U.S. Federal Reserve really want to get inflation down, aggressive rate hikes will come at the expense of the economy. Here is a direct video link.