February 14, 2022 | Have Used Car Prices Peaked? Not Quite Yet

Cars used to be the quintessential depreciating asset. Drive a new one off the lot and you were immediately down 40%. Subsequent declines were slower, but they never really stopped.

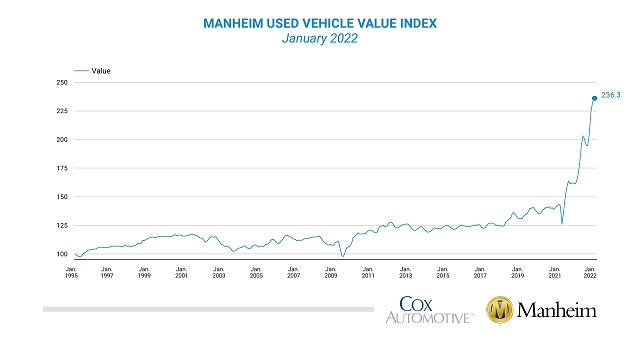

But that was before Fed stimulus escaped from its financial asset silo and inundated normal life. Now, cars – even used ones — are more like houses: You buy one and expect it to appreciate. Since 2020, the price of a typical 2-year-old vehicle has soared by 50%, to nearly as much as a comparable new model – giving would-be buyers a clear sense of what it’s like to live with an evaporating currency.

Meanwhile, new car prices – which put an effective ceiling on used car prices — are starting their own parabolic rise as panic buying sets in. From ABC News:

‘Out of control’: Buyers paying thousands over sticker price for new cars

Looking to buy a new Kia Telluride sport utility vehicle? Expect to pay $48,509 — more than $3,700 above the manufacturer’s suggested retail price.

Luxury SUVs like the Range Rover ($117,890) and Cadillac Escalade ESV ($102,584) are selling for $3,000 to $6,000 over MSRP, according to Edmunds, which compiled a list of the top 10 vehicles with the largest market adjustments in the fourth quarter of 2021.

Markups on sports cars are even more dramatic: dealers are asking (and getting) 5% over MSRP for the Corvette Stingray ($86,511) and 8% for Ford Mustang Shelby GT500 ($91,611).

“People are accepting these prices without complaining … they’re going with it and making the plunge,” Jessica Caldwell, Edmunds’ executive director of insights, told ABC News. “Dealer markups are happening all over the board. Manufacturers don’t really have control over it.”

The automotive industry has not been immune from the price hikes impacting nearly every industry. Desperate consumers are starting to surrender to the new reality: discounts, incentives and negotiating are so 2019.

In December, consumers paid on average $709 more than the suggested transaction price, Caldwell said, noting that the upward march in prices really took hold in August.

“We have not seen this happen before on an aggregate level,” she said.

And markups are impacting nearly 90% of car buyers, according to one estimate, forcing some automakers to threaten a dealer crackdown.

‘Out of control’ luxury markups

It’s the Mercedes-Benz G-Class, the boxy, ultra-luxe UTE driven by celebs and socialites, that may be the most extreme example of dealership markups. The base G-Class costs $174,650 though new owners are shelling out an additional $30,405 on average — if they’re lucky to get one at all. Caldwell said she knows of one woman who recently paid $50,000 above MSRP for a G-Class. Some Mercedes dealerships are even asking $337,000 for a 2021 AMG G 63 G-Class — more than $150,000 above the MSRP, according to Caldwell.“This woman thought she got a good deal,” said Caldwell. “Consumers feel pressure to buy right away because inventory is so low.”

Long road to normal

As with most other inflation-related questions, “transitory versus permanent” is the burning issue here. Obviously used cars can’t rise at their current rate for much longer without pricing most buyers out of the market.

Meanwhile, General Motors CEO Mary Barra had some comforting things to say at the company’s recent Q4 investors call:

“We’re definitely seeing [supply chain] improvement in the first quarter over fourth quarter. The fourth quarter better than the third quarter. And we really see with the plans we have in place now, by the time we get to third and fourth quarter, we’re going to be really starting to see the semiconductor constraints diminish.”

But relief – in the form of falling used car prices — might still be a ways off. Production of new cars isn’t projected to meet demand until 2025. Combine this ongoing supply shortfall with increased electric vehicle tax breaks (designed to increase demand), and it’s hard to imagine used car prices reverting to, say, 2019 levels anytime soon.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino February 14th, 2022

Posted In: John Rubino Substack