January 21, 2022 | The End of the Property Bubble in China

The end of the property bubble in China has arrived. The likely next stage is liquidation, with the government deciding who writes off the bad debts that have been created.

China’s property bubble is second to none. The size of total debt, the scale of investment in property and the participation of households are all unprecedented.

This bubble started to form in the 1990s, when the Chinese people were first allowed to invest in home ownership. For most of them this was new, as the government was the sole owner of land and housing previously.

Under Deng Xiaoping leadership the private sector took the lead in building apartments for millions of Chinese families who wanted to own property. Many property developers became billionaires, and their overnight success earned them a spot among the richest people in the world.

Today the current leadership in China is reigning in private entrepreneurs. Almost daily there is another announcement of changes in the rules that would tighten the grip of the government, and the Party, on the private sector.

President Xi Jinping’s “common prosperity” policy is on a direct collision course with the property billionaires.

Property developers are usually drowning in debt; unfathomable amounts of debt of both types, onshore and offshore. The onshore variety, in yuan, can be handled between the government, the banks and the developers. But offshore debt, borrowed in U.S. dollars, is a big problem.

The largest developer, Country Garden Holdings, tried to raise money in the bond market last week but met a cold shoulder. Consequently, Country Garden bonds took a hit, trading at a 22 percent discount to par value. The shares hit $16 in early 2018 and have drifted lower since, down about 60 percent from that peak. Country Gardens’ debt is rated only one notch above junk now.

Source: Bloomberg

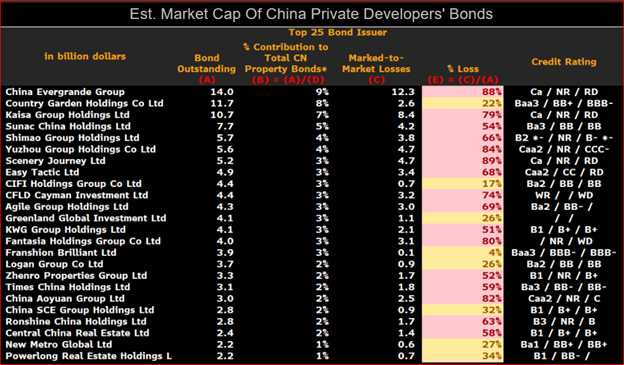

In the 350 bonds outstanding in the offshore market, there is a total par value of $151 billion but the trading value is only $69 billion. If those bonds had to be liquidated quickly losses would be even steeper and more than $100 billion could disappear. These losses would accrue almost entirely to foreign investors in North America, Europe, London, Dubai and elsewhere. Bond investors are nervous.

This crisis has been building since before July 2021, when I first wrote about the well-known and troubled developer, China Evergrande, here, “A gray rhino could rock the world”. Evergrande bonds are trading at an 88 percent discount.

The Chinese government has the resources to “make good” on these losses. Large state-owned property developers with $1 trillion of value could absorb those bad debts if the government wished.

But that wouldn’t stop the property bubble from bursting, as China’s population has stopped growing and property speculation is already universal.

If property values decline, selling inventory will get more and more difficult and further price cuts will become mandatory.

Who will take the hit? Government, households, “billionaires” or foreign investors? Perhaps ‘all of the above’ is the correct answer.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth January 21st, 2022

Posted In: Hilliard's Weekend Notebook

I suppose the concrete & steel urban fabric and transportation system built isn’t going anywhere so what’s the big deal ?

Would you rather own a bunch of defunct websites in the digital age ?

Disinvested Cities is a big issue in America .

At least an abandoned website does not have ongoing maintenance costs. Look in any casino around the world and you will find Chinese gamblers. Luck / fortune is part of their culture. If / when the CCP loses control of this the economic shock will impact housing and related commodities worldwide. Chinese retail sales figures and the currency are dropping. The time for the introduction of property tax was 1998 when housing investment was opened up.

Very good article. Jim, in your next interview with Hilliard can you please ask him to comment on the massive LGFV ponzi scheme that is also starting to unravel in China’s property market and how that will accelerate the collapse in Chinese property prices soon….

https://ca.finance.yahoo.com/news/shadowy-china-firms-spend-billions-210000919.html