January 14, 2022 | Bonds Remind Investors How Unsafe They Are

Financial advisors used to believe in a balanced portfolio between bonds and stocks. Central banks changed all that.

Breaking Traditions

We’re taught that stocks and bonds tend to move in opposite directions.

Money flows into stocks and out of safety plays like US Treasuries and the US Dollar when they want risk.

The opposite occurs when they’re fearful.

Typically, this leads the two to have a negative correlation.

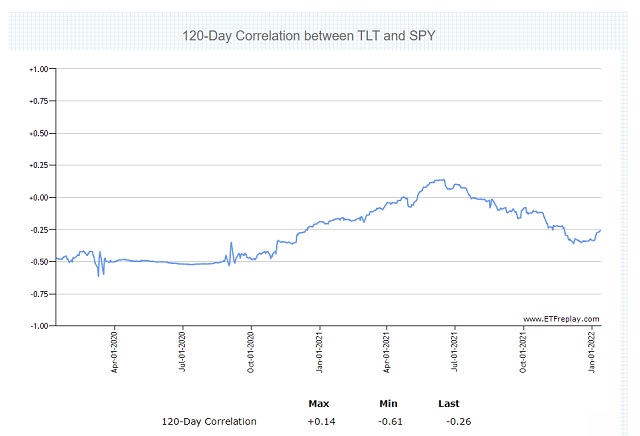

Correlations are measured on a scale from -1 to +1, where -1 means they trade perfectly in opposite directions, +1 perfectly in the same direction, and 0 they trade independent of one another.

Here’s a chart of that correlation between the SPY and TLT ETFs over the last 120 days.

What you’ll notice is that the correlation has been trending more and more towards zero. In fact, during the summer last year, the correlation was actually positive!

For long-term investors, this is a problem.

The negative correlation lets part of their portfolio rise when the other falls.

When that breaks down, they carry more risk.

Bonds Suck Big Time

For years, bonds outperformed their historical averages for two reasons.

First, the Federal Reserve purchased Treasuries outright as well as kept rates low.

Second, other central banks made their yields so unattractive, it made US treasuries the best choice out there.

The unprecedented Fed actions in 2020 sent treasuries to some of their highest levels in history.

With the Fed winding down its bond purchase program and set to raise rates, the upside potential is extremely limited with the downside quite large.

That’s why we’re seeing both bonds and stocks often sell-off at the same time.

The Bottom: Treasuries aren’t good investments these days.

Instead, we prefer cash for safety or shorter duration treasuries to limit risk, such as 1-36 months (SHY).

Commodities (GSG) are also a good place for safety, especially with inflation rearing its ugly head.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino January 14th, 2022

Posted In: John Rubino Substack