December 11, 2021 | Trading Desk Notes For December 11, 2021

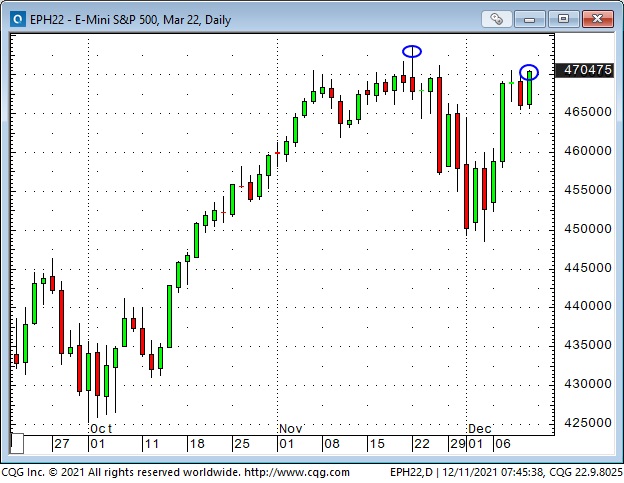

Bullish enthusiasm came roaring back this week – the S+P registered an All-Time High close – the DJIA rallied >2,000 points from last week’s lows

The S+P hit All-Time Highs Monday, November 22, but closed down on the day. Three sessions later, waves of heavy selling in illiquid conditions on Thanksgiving Friday caused the index to close 163 points below Monday’s high – the biggest down week since January (and a Weekly Key Reversal Down on the chart.)

The following week saw violent intra-day price swings. Late in the day on Friday, December 3, the S+P traded ~250 points below the previous week’s highs, volatility levels had soared to near the highest levels YTD – and then, the tide turned, the index bounced and closed ~40 points off its lows.

The Sunday, December 5th afternoon futures session opened higher, and by mid-morning Tuesday, the S+P had rallied ~170 points from Friday’s lows. The market chopped sideways within a narrow range the next three days, and Friday registered an All-Time High close (~27 points below the November 22 ATH.)

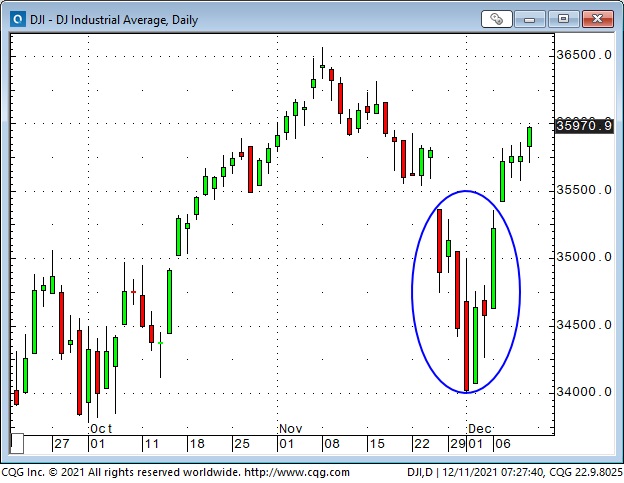

The “cash” DJIA (not the futures) registered a big “Island Reversal” on the charts. Some folks see that as a bullish pattern.

AAPL surged to New All-Time Highs this week with a market cap of ~$3 Trillion – up ~ $500 Billion from month-ago levels. (See a great list of global company market caps at https://companiesmarketcap.com/)

ARKK (last year’s darling) is down ~44% from its February highs – while the S+P is up ~18% since mid-February.

Concentration

Everybody knows that a handful of Big Cap tech stocks account for ~25% of the weighting of the S+P 500 – but here’s another look at concentration: The Nasdaq total YTD return is ~21%. Five stocks (AAPL, MSFT, GOOGL, TSLA, NVDA) account for ~2/3 of those returns. The Nasdaq total YTD return is less than 6% without those five stocks.

Passive capital flows boost Big Cap stocks

One of the reasons Big Cap companies keep getting bigger is that a tidal wave of money has flowed into the markets this year. More than half of that money has gone into passive investments, which track/mimic the indices. (There has also been a flow of capital leaving actively managed investments for passive investments.)

The PMs who “manage” passive funds allocate money according to the index weightings. So, for every dollar of new money they invest in S+P tracking funds, ~16 cents goes into AAPL, MSFT, and AMZN. It’s a bit like a perpetual motion machine; the more money coming in, the bigger the biggest cap stocks get relative to other stocks.

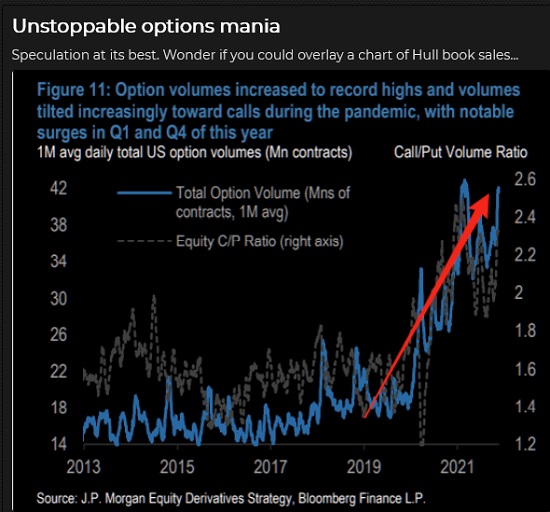

Active capital flows boost options volume (and meme stocks)

The smaller half of the tidal wave of money flowing into the markets goes into “active investments.” This covers everything that is not “passive” and includes both managed and self-directed “investments.” “Active” could range from old-fashioned mutual funds with stock picking, “value-seeking” portfolio managers to YOLO kids rolling the dice on short-dated OTM options.

Interest Rates

Prices of long-dated Treasuries have been trending higher for the past several weeks (yields have been falling), and they rose to new YTD highs when the stock market rattled investors’ nerves last week. With the stock market rising this week, bond prices fell.

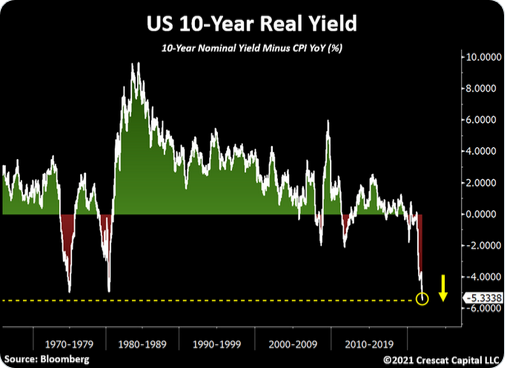

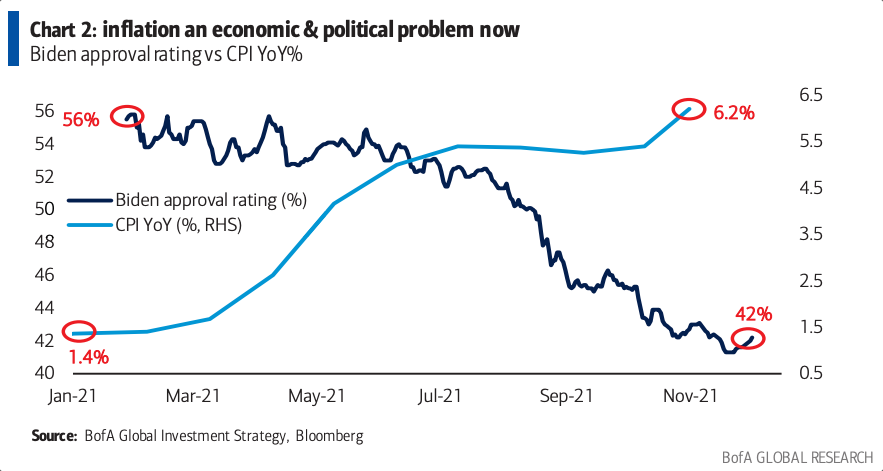

With the CPI at 6.8% and the ten-year Treasury yield at 1.47%, the 10 Year Real Yield = negative 5.33%. This is not the best “measure” of inflation (for instance, the 10-year Tips/Treasury breakeven rate is 2.52%), but MSM will feature this (sensational) number.

Currencies

The US Dollar Index has been relatively steady at ~96 for the past four weeks, a 16 month high. Speculators have accumulated the largest net long USD position in the currency futures market since June 2019.

The Canadian Dollar fell for six consecutive weeks as the USD rallied and commodities (especially crude oil) fell, but it bounced a bit this week (WTI rallied ~$10 from last week’s lows and stock markets surged higher.)

The CAD may have rallied ahead of Wednesday’s BoC meeting in anticipation of a more hawkish tone, but that hawkish tone was not forthcoming, and the CAD fell Wednesday through Friday.

Commodities

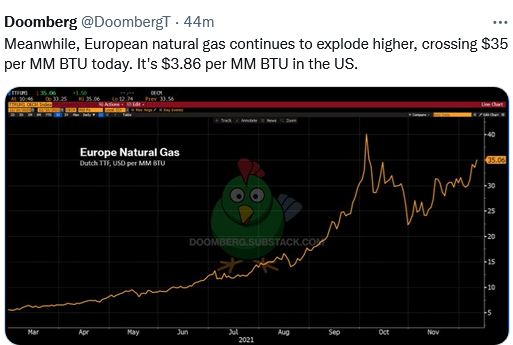

The broad Goldman Sachs Spot Index reached a 7-year high in October as crude oil hit a 7-year high. The index drifted lower and then took a sharp drop late in November as WTI crude extended its decline from ~$85 to ~$62. The index bounced back the past few days as investor sentiment improved and WTI bounced ~$10.

My Short-Term Trading

Last week I bought the S+P and the CAD a few times – expecting investor sentiment to bounce after the sharp tumble that began on Thanksgiving Friday. Net, net my P+L was down ~0.50% on the week. I was early on my “rebound” call.

As noted above, the S+P made its low last week late Friday and rallied ~40 points into the close. When the market opened higher Sunday afternoon, I maintained my BTD mentality, but I waited for the Monday day session (for confirmation) before buying the S+P.

The market rallied during the Monday day session and soared in the overnight session. I covered the trade mid-day Tuesday for a gain of ~120 points (roughly equivalent to ~1,200 Dow points.)

I shorted the S+P a couple of times later in the week, thinking the market had rallied too far, too fast, but I was stopped for small losses on those trades.

I shorted the CAD when it fell back following the Wednesday BoC meeting. I’ve remained short CAD, which is the only position I hold going into the weekend. My P+L is up ~1.25% on the week, not counting unrealized gains on the short CAD.

On my radar

I’ve generally been bullish on the USD this year, but I haven’t capitalized on that view. (There is always room for improvement in trading!) Over the years, I’ve noticed that currency trends often go WAY further than what seems to “make sense,” and then turn on a dime and go the other way. Those reversals often happen around the end of the year, so I’ll watch for that over the next month or two.

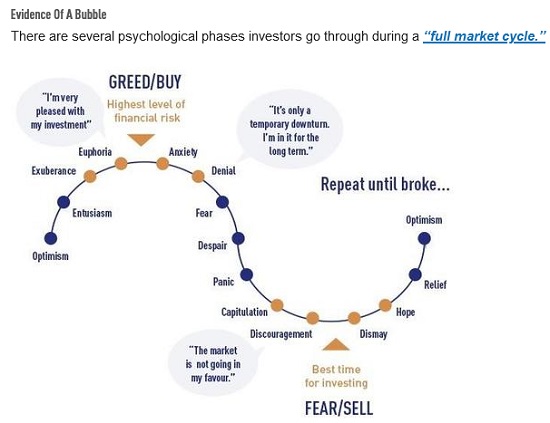

Too many people believe that it’s easy to make money buying stocks – so we may see a correction there.

Thoughts on trading

Stories: Last week I wrote that I don’t like to “buy” stories. For instance, I don’t want to buy copper (simply) because the “story” says electrification demand and limited new mine supply automatically means that copper prices will go up.

That doesn’t mean that I ignore stories. Stories have a life cycle, and I think it is essential to know where they are in their cycle. For instance, George Soros liked to say that when he saw a bubble forming, he bought the market in anticipation of the bubble growing and taking prices much higher.

I’m skeptical of stories because they cause people to focus on the “why” to buy rather than the “when” to buy. A good story is also seductive, which may encourage poor risk management practices – and I genuinely believe that good risk management contributes more to long-term trading success than any crystal ball.

When I hear a good story my first thought is always: “Who doesn’t already know that?”

Wizards: In the past two weeks, I’ve referred to the RTV interview Jack (Market Wizards) Schwager recently did with Peter Brandt. In that interview, Jack talks about what the “Wizards” have in common. He said that most of them started their trading career with poor performance, and it took years for them to “find their way” to becoming super successful, and they had to change their methodology as markets changed.

Jack also noted that some wizards had no problem managing other people’s money. Other wizards could not do it – they felt bad/guilty every time they took a loss, which killed their ability to trade freely.

Reminiscences: My bedtime reading lately has been Reminiscences Of A Stock Operator by Edwin Lefevere. I bought my first copy of that book more than 40 years ago (it was written over 100 years ago) and I have re-read it every couple of years. I had forgotten how good it is. It is the story of a trader learning how to trade (he “reads the tape“) but at another level, it is a fantastic and very honest, story about The Trading Life. I recommend it to you.

Quotes from the notebook

“It is normal/typical to think, “I’ve missed the move…I can’t buy it here after it has rallied so much!” But most money is made not by picking bottoms but by going with the trend and especially as the trend accelerates near the end of the move.” John Burbank, RTV interview with Alex Gurevich 2019

My comment: I picked this quote because I wish I were more like that! Some guys make it look easy!

When a market is going down, you have no idea how far down, down is!

It’s not a problem until it’s a problem, and then it’s really a problem.

There is never just one cockroach.

Do more of what is working and less of what is not working.

Dennis Gartman, many times, over the years

My Comment: Dennis was a trader in the old “South Room” at the CBOT, trading GNMAs and T-Bonds, in the late 1970s when I first visited the Chicago trading floors. I didn’t meet him then – we didn’t meet until the early 1990s (when his daily letter used to come by fax), and we became good friends over the years. He put a lot of work into writing his daily letter and passed along many good insights and observations – such as the quotes above.

A Small Request

If you like reading the Trading Desk Notes, please do me a favour and forward a copy or a link to a friend. Also, I genuinely welcome your comments. Please let me know if there is something you would like to see included in the TD Notes. Thanks, Victor

Barney is getting ready to show me around the golf course.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair December 11th, 2021

Posted In: Victor Adair Blog