As I have explained many times, the finance industry charges the richest fees, packaging and promoting corporate securities (equities and corporate debt), as well as real estate and commodities. Because these assets tend to rise with inflation and fall with deflation, the bias inherent is to forecast inflation and further price gains, regardless of valuations or market cycle. High yield or junk debt is also high-risk and thus traditionally has to pay higher yields to attract buyers. For this reason, it also pays fatter fees to the financial sector, which helps companies issue and sell this debt to the public.

On the other hand, government bonds are an institutional product used by pensions, insurance companies, foundations, and the most sophisticated high-net-worth investors. They do not need to pay high fees to the finance sector for retail marketing or distribution.

As a result, most financial folks have a bias against government bonds even though on a total return basis, they have outperformed stocks (S&P 500) by 3.5 times since 1980, with much lower volatility and capital loss risk. They are also one of the few assets that can offer negative correlation/diversification benefits when other asset markets deflate.

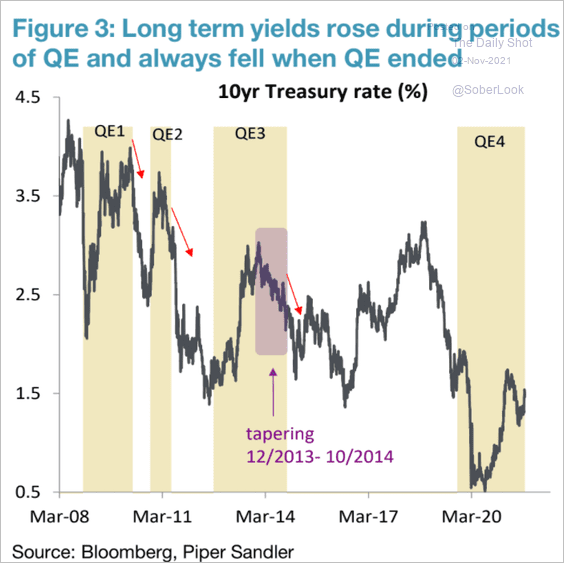

Case in point, as commodities, high yield bonds and equities have been plunging of late, North American government bonds have been rising with the U.S. dollar. These moves are typical of periods where growth and inflation expectations (at a lag) are falling. The chart below, courtesy of The Daily Shot, shows the downward yield trends during past Fed tapering “Q.E.” efforts.

Even more than usual, portfolio managers and retail came into the latest risk-off selling with the highest concentration of equities and the lowest weight of bonds and cash on record, all while being the most levered ever. Ditto for CBOT traders who were massively net-short Treasuries in October.

All of this helped lay the conditions for a sharp rebound in treasury prices (falling yields). U.S. 10 and 20-year yields have moved back to levels seen in February and March of 2020. The Treasury market is not buying the inflation hype and is pricing weaker growth and deflationary weights in 2022.

The discussion below explains what only those of us ‘paid to see’ can acknowledge.

The Federal Reserve, and other central banks, buy tremendous amounts of government securities and this should impact bond prices. Should, but doesn’t. That’s because there’s an even more powerful force than the Fed, the bond market itself. We review the 2007-19 evidence. Here is a direct video link.