October 30, 2021 | Trading Desk Notes For October 30, 2021

Tesla soars – stock indices hit new All-Time Highs

Tesla’s market cap was ~$1.14 Trillion at the end of October- up ~$340B for the month. $340B is more than the total market cap of 481 of the companies in the S+P 500. Massive buying of (very) short-dated call options helped accelerate this week’s rally following Monday’s news that (recently bankrupt car rental company) Hertz would buy 100,000 Tesla cars over the next 14 months – an order valued at ~$4B.

The broad market indices were inspired by the Tesla rally and closed the month at new All-Time Highs. The Nasdaq and the S+P were up ~7% in October – their best monthly performance YTD.

Short-term interest rates are sharply higher – yield curves are flatter

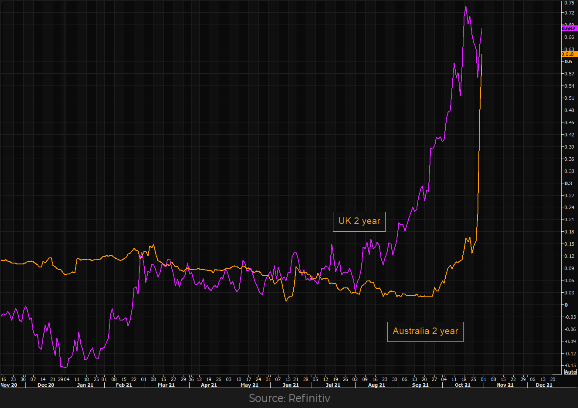

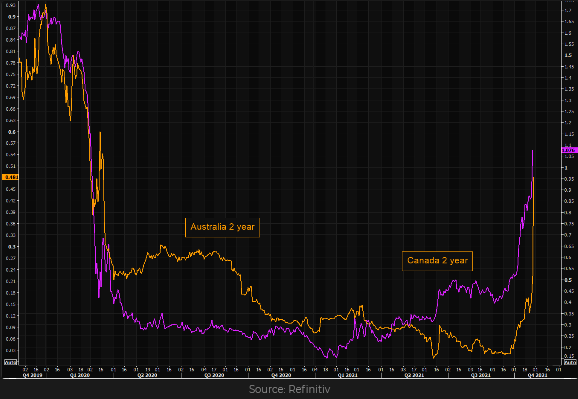

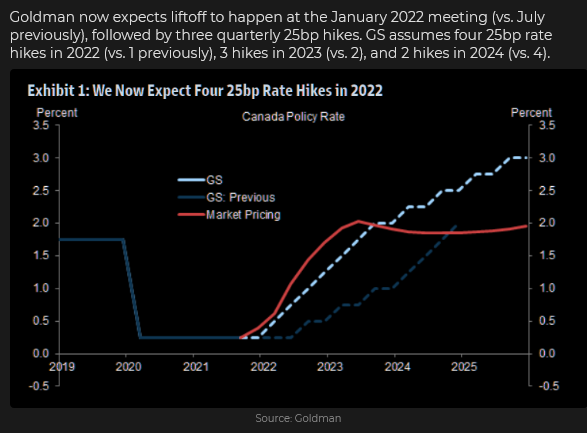

Most “Western” Central Banks have maintained that inflation was “transitory,” but recently, some of them (BoE, BoC, RBNZ, RBA) seem to be changing their minds. They have started to reduce (or halt) QE programs and have begun to raise interest rates or pencil in increases for 2022. The Fed is expected to announce formal plans to reign in their QE program at next week’s scheduled meeting.

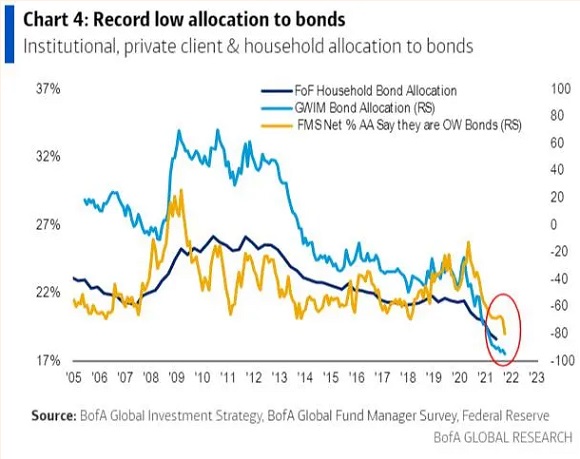

Bond yields trended higher after hitting All-Time Lows in August 2020, but they have been steady/better recently, while short rates have soared, causing a dramatic flattening of the yield curve. The “street” has been hugely bearish of bonds (while analysts like David Rosenberg and Lacy Hunt have been bullish) mainly because of inflation fears. Is the flattening curve a sign that the bond market sees weaker economic growth ahead? Does the bond market fear that CBs may be tightening into a recession?

Big moves in the currency markets

The US Dollar Index hit a 13 month high three weeks ago, slipped lower for the next 12 days, but closed the month with a powerful rally on Friday. COT data as of Oct 26 show that net spec positioning remains long the USD Vs. most currencies – especially against the Yen and the AUD.

The Euro is ~58% of the USDX, and the EURUSD chart is virtually a mirror image of the USDX. However, since mid-September, the Euro has plunged Vs. the Swiss Franc and the British Pound.

The Japanese Yen has been especially weak against the USD (down ~10% YTD) and down >5% since mid-September.

The Canadian dollar is one of the few actively traded currencies that has rallied against the USD this year (the Russian Ruble and the Chinese RMB are also up YTD.) The CAD rallied nearly a full cent following the surprise tightening from the BoC on Wednesday (CDN 2Y yields now ~1.05% Vs. US 2Y yields at 0.52%), but the CAD could not sustain those gains as the USD surged Vs. all currencies on Friday.

The red-hot commodity rally takes a breather

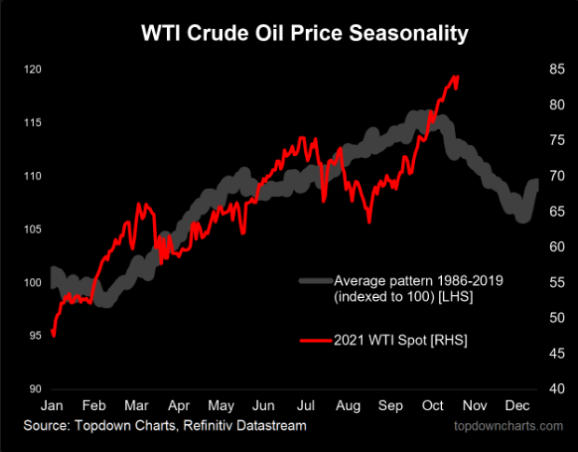

WTI crude oil touched a 7-year high last week around $85 but fell back ~6% at this week’s $81.50 lows. Chinese coal and iron ore prices are sharply lower. US NatGas prices have fallen back a bit after hitting 13-year highs, while UK NatGas prices are down ~60% from the record highs hit four weeks ago – albeit at prices that would have been All-Time highs six weeks ago.

My short term trading

I started this week flat – but per the “on my radar” section of last week’s Notes, I was looking for an opportunity to short stock indices. I sat through the (Tesla-inspired) rally during the Monday day and overnight sessions. I shorted the S+P on Tuesday after it fell back from ATH, bounced and then slumped lower. In a short-term time frame, I was selling a market that was falling away from a lower high.

The market fell overnight Tuesday, dropping below both the Monday overnight lows and the Tuesday day session lows – my trade seemed to be working. However, the market couldn’t sustain the breakdown, so I covered my position early Wednesday for a slight loss.

I shorted Dow futures during the Thursday day session (the Dow looked to be the weakest of the NAZ, S+P and Dow indices) only to have it rally strongly into the close on earnings announcements. I held the position overnight and saw the market drop slightly below my entry price, but, once again, the market had an excellent opportunity to sell off – but didn’t take it! I covered the trade for another small loss early Friday day. I’m flat at the end of the week. My P+L is down ~0.20% on the week.

In hindsight, my bearish bias was wrong – the NAZ, S+P and Dow all rallied this week. The good news was that I kept my losses very small.

On my radar

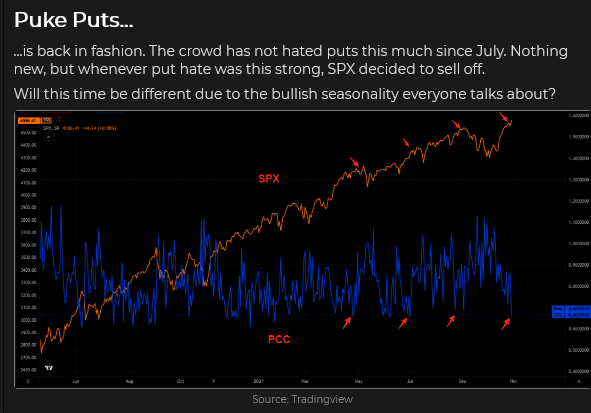

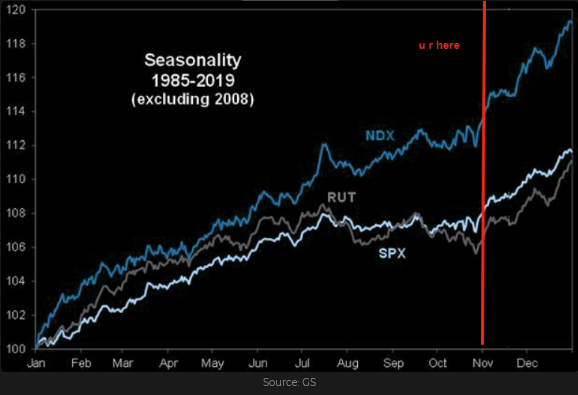

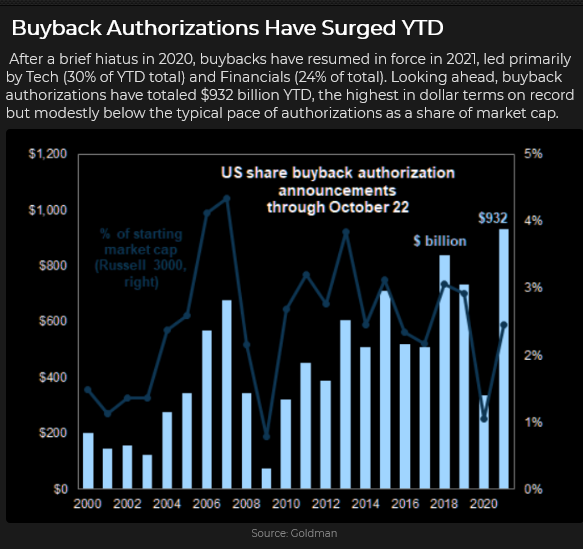

Stock market sentiment (at least in terms of put/call buying) is exceptionally bullish. AAPL and AMZN (~10% of the S+P market cap) had disappointing earnings reports. Seasonality, Buybacks and capital flows are bullish. This week, the Fed statement could jolt the market (the Toronto stock market fell hard on the BoC hawkish surprise.)

It was unusual to see the USD and the US stock market both strong on Friday. For the past two months, the correlation between the USD and the stock markets has been strongly negative. Maybe the FX market had a month-end rebalance – or perhaps the FX market has a different “take” on next week’s Fed meeting.

Like last week, I’ll be looking for opportunities to fade irrational exuberance in stocks and commodities. I won’t sell new highs, but I’ll look to shoot markets in the back if they have started to fall! (h/t Bill Fleckenstein.)

Thoughts on trading – using and moving stops

My friend Peter Brandt says that his net profitability, over time, is much more a result of how he manages his trades – not why he entered the trade. I agree, and like Peter, my trading style results in many small losses (hopefully no significant losses), lots of slightly bigger winning trades, and the occasional big winner. (Peter says that 100% of his net profits, over time, have come from only 15% of his trades.)

Stops are a vital part of my trading process. I develop a bias on the market, but I will wait for price action to create a setup before I take a position. (I won’t trade a market that I know nothing about solely because price action has made a good setup. I realize that some very successful traders can trade a SYMBOL without knowing what is behind the SYMBOL, but that approach doesn’t suit me – maybe someday I’ll change.)

Let’s say my bias is that irrational exuberance has taken the stock indices too high too fast, and I think they are at risk of a reversal. (My bias comes from a variety of technical, fundamental, sentimental and intuitive inputs.) I won’t sell stock indices simply because I think they are “over-valued” – they could quickly become more over-valued. (I’ve never been short Tesla.) I want to see the market turn down before I get short. (Turn down means different things in different time frames – I try to keep the time frames of my trading and analysis in sync.)

Let’s say my time frame is a few days to a few weeks. I’m not looking for the stock market to fall to zero – I’d be delighted to catch a move of 50 – 100 points in the S+P or 500 – 1,000 points in the Dow, and I think that could happen within my time frame. I don’t want to sell the market simply because it has dropped from a high – at the least, I want to see a pattern where the market has fallen from a high, bounced to make a lower high and has now turned lower again. (Ideally, the market has made an “M” top – with a lower right shoulder – on more than one time frame.)

Let’s say I see a good setup developing. The first thing I’m going to ask myself is, “If I short the market here, where will I put my stop?” I want the stop to be where I know I’m wrong on the trade – the stop isn’t defining a dollar amount of risk. If my stop point is too far away from the potential entry point (too much money is at risk), I either don’t make the trade, or I look for another way to make the trade. For instance, I reduce my position size or look at an option strategy to reduce risk (for example, buy puts or write puts against a short futures position), but that creates a whole new series of risks that will need to be managed!

Let’s say I short the market and enter a stop. I understand that the market could gap higher than my stop (over a weekend or an extreme event), and I will get filled at a worse level than my stop. Those things sometimes happen.

I think of a stop as the “limit” on how much I’m willing to lose when I enter the trade. As time passes and prices change, and different “news” hits the market, my stop point needs to be re-assessed.

For instance, on both short trades I made this week, I covered my positions before the market rallied to my stops because “things had changed” since I had entered the market. Specifically, prices had fallen below my entry points but had not continued lower. (The market had an excellent opportunity to drop – but didn’t take it.) I no longer wanted to be short, so I covered the trades and cancelled my stops.

If prices had kept falling, I would have re-assessed my stop point – I would likely have lowered my stop to a new level that made sense at that time. Rinse and repeat if and when prices kept falling.

Quotes from the notebook

“Wait for the market to set up in a way that you like and then try to put on a position as close as possible to your stop-out point to reduce capital risk relative to the potential return.” Mac Kaylan – Vancouver 1998

My comment: Before I knew Mac, I traded based on my market opinions. For instance, if I liked gold, I’d buy gold. I’d use stops, but Mac got me thinking more about using setups not only to limit losses but to “time” my entry points.

“Conventional Wisdom is one of the greatest oxymorons in history!” Howard Marks

“Conventional Wisdom matters because it can become a self-fulfilling prophecy.” George Friedman

My comment: I agree with both of these quotes! My friend Kevin Muir likes to say that if something (in the market) is obvious, then it’s obviously wrong! That’s the oxymoron part. The truth is, something (in the market) can be wrong and get even worse – before it gets right. That’s the self-fulfilling prophecy part.

“There are buyers higher and sellers lower.” Tommy Thorton Hedge Fund Telemetry

My comment: This is a beautiful insight into momentum. Why would you pay more for something tomorrow when you can buy it cheaper today? Why? Because it’s going up!

“You gotta get your mind right.” The Warden to Luke (and near the end of the movie – Luke himself says this) in the film Cool Hand Luke starring Paul Newman as Luke 1967

My comment: In that amazing movie, the warden wanted Luke to see the “error of his ways” – the mistakes he was making by trying to break out of prison. He tried to break Luke’s spirit – to make him a docile prisoner, but perhaps he was also pointing out a fact – there was no escaping from that prison and until Luke truly understood that running was impossible – until he genuinely “got his mind right” he was going to experience a lot of pain.

From a trading perspective, “getting your mind right” would mean being in sync with the market – rather than fighting it and experiencing a lot of pain.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair October 30th, 2021

Posted In: Victor Adair Blog

Next: This Week in Money »