October 8, 2021 | Tesla Results are Electrifying

Tesla released outstanding sales for the third quarter ending September 30, 2021. At 240,000 vehicles over three months, Tesla deliveries will soon reach 1 million vehicles annually. The rest of the auto industry remains in a deep slump.

Is Tesla’s rapid growth proof that the future is all-electric?

Tesla sales remain relatively small in comparison to the leaders, Toyota and Volkswagen. Both Toyota and Volkswagen were selling about 10 million units per year, out of peak sales of 97 million vehicles in 2017.

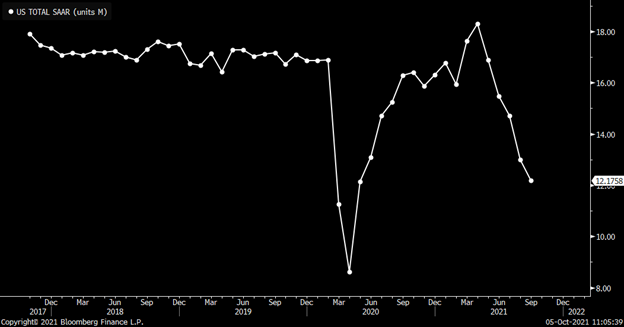

Vehicle sales in the all-important U.S. market slumped in the third quarter. At an annualized 12 million units, sales are about 1/3 below the greater than 18 million peak.

Only Tesla seems to be able to increase sales, albeit from a low base. And Tesla’s manufacturing capacity is set to increase further, with two new Gigafactories, near Austin, Texas and Berlin, Germany.

Industry sales forecasts for 2021 and 2022 are being revised lower. Analysts estimate that worldwide sales will not recover to 2019 levels until 2023. The estimate for 2021 is now as low as 77 million vehicles, while 2022 has been revised lower to 85.2 million.

In Germany, car registrations slumped 25 percent in September 2021 from September 2020.

Semiconductor chip shortages are mentioned most frequently as a reason for the sales slump, affecting production of 1 million units. But could it be that consumers are waiting for new versions of electric vehicles?

Apple has suffered from consumer confusion whenever a new iPhone is coming. Some people wait for the new model and sales of older versions suffer. This phenomenon is not new and even has a name, the Osborne Effect.

The Osborne Computer Corporation went bankrupt in 1983 after the founder started to publicize a new model long before it was ready to deliver. Sales of the existing model collapsed as dealers canceled existing orders while waiting for the new model. Competitors jumped in to offer a similar product. The company folded due to lack of buyers.

Most incumbent car dealers do not have access to a new electric vehicle to offer customers, perhaps leading to lost sales. The all-electric Ford Mach E is available now. GM has a current model, the Bolt, but that is the subject of a recall due to battery fires. An electric version of the Hummer and the Cadillac are coming soon. Mercedes has the EQ. Other manufacturers have models available, such as the Porsche Taycan and the Jaguar I-pace but they are very expensive. Many new offerings are coming in 2022, like Rivian, Polestar and Tesla’s futuristic Cybertruck.

The Polestar, source: Car and Driver

The Rivian, source: Car and Driver

Cybertruck, source: Tesla

It is possible that Teslas are what people want when buying electric. This chart shows Tesla’s stock market value at 450 billion euros, compared to Volkswagen at 78 billion and Daimler at 60 billion.

Should incumbents be worried?

Yes, they should. Tesla’s car 240,000 sales in the quarter were more than 50 percent of GM’s 440,000 deliveries.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth October 8th, 2021

Posted In: Hilliard's Weekend Notebook