October 26, 2021 | Remember Strikes?

Years (and years) ago, I was an unskilled 17- year-old who needed a job. So I drove out to a “foundry” (a factory that makes things out of molten metal) on the edge of town and asked if they needed any more workers. They said yes, hired me on the spot, and enrolled me in the local United Steelworkers union.

The work was hard, the conditions dirty and sometimes scary, but I made adult money and got to know men (it was all men) who supported their families with that single 8-hour-a-day job.

We even went on strike once. The union rep called each of us one evening and told us not to show up until further notice. After about a week, having gotten some of what they wanted, they called us back in. Very civilized and unremarkable, completely normal for the time and place.

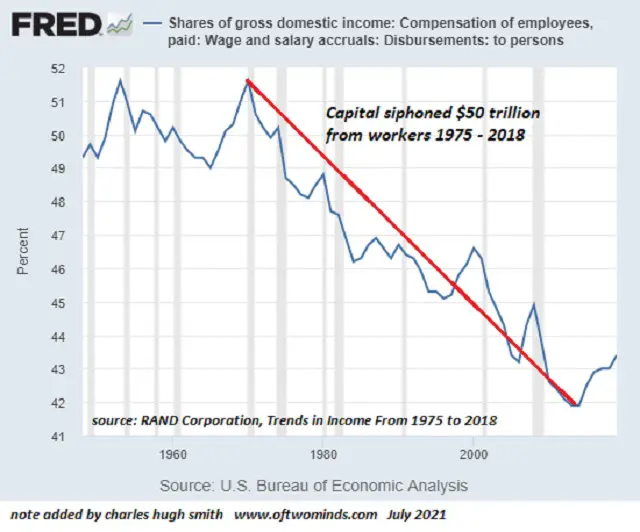

Then the whole concept of striking as a collective bargaining strategy disappeared. Factories began moving to China or Mexico, and the kinds of people who worked in foundries or assembly plants lost the power to negotiate with their bosses. No longer able to support families on one salary, they took ever crappier jobs, and – even with multiple family members working — fell from lower-middle-class to working poor. As a group, their share of national income crashed.

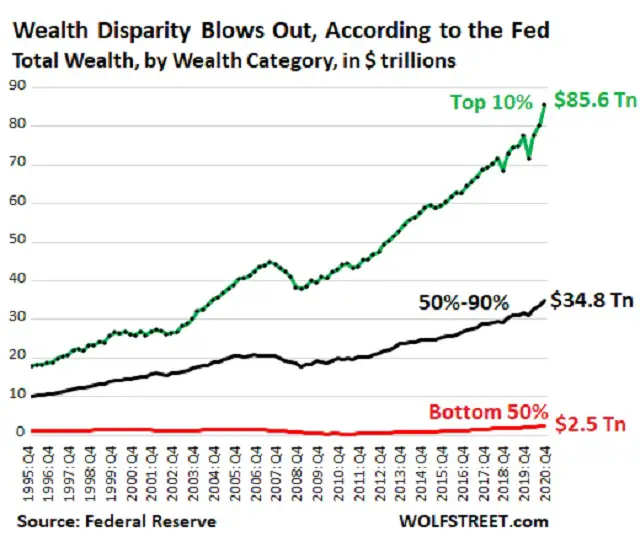

Meanwhile, the people who run those foreign factories — along with the bankers who structure the off-shoring deals and the politicians who enact free trade laws in return for generous campaign contributions — have done considerably better, rolling their ever-higher incomes into ever-growing stock, bond, and real estate portfolios. Today the richest 10% own the vast bulk of national wealth.

The Pendulum Swings Back

If this kind of trend seems unsustainable in a world where the 90% outnumbers the 10% (that is, in any world), well, it clearly is. There’s a limit to how rapacious an aristocracy can become before the pendulum starts swinging back towards the serfs. And this year it started:

Tight U.S. job market triggers strikes for more pay

(Reuters) – Thousands of workers remain on strike across the United States demanding higher pay and better conditions despite Hollywood make-up artists and camera operators reaching a deal over the weekend to avoid a walkout, and the tight jobs market has only emboldened them.

Kevin Bradshaw is an employee at Kellogg Co’s (K.N) cereal plant in Memphis, Tennessee, where most of North America’s Frosted Flakes are made. He feels anything but great about cuts to healthcare coverage,

retirement benefits and vacation time that union officials say the company is pushing for from about 1,400 workers on strike since Oct. 5 at plants in Michigan, Nebraska, Pennsylvania and Tennessee.

“Enough is enough,” said Bradshaw, vice president of Bakery, Confectionary, Tobacco Workers and Grain Millers International Union Local 252G at the Memphis plant. “We can’t afford to keep giving away things to a company that financially has made record-breaking returns.”

Some 60,000 behind-the-scenes workers on movies and TV shows on Saturday avoided joining the Kellogg strikers, but the near-walkout was the latest demonstration of force by union members who say they are fed up with meager or no raises and other givebacks. Kellogg officials could not be reached for comment but have said the company’s compensation is among the industry’s best.

So far, at least 176 strikes have been launched this year, including 17 in October, according to Cornell University’s Labor Action Tracker.

“Workers are on strike for a better deal and a better life,” Liz Shuler, president of the AFL-CIO, the nation’s biggest labor federation, said last week at a SABEW journalism conference.“The pandemic really did lay bare the inequities of our system and working people are refusing to return to crappy jobs that put their health at risk,” she added, noting that the term #Striketober was trending on Twitter.

“We have entered a new era in labor relations,” said Harley Shaiken, professor emeritus of labor at the University of California Berkeley. “Workers feel they’re in the driver’s seat and there’s plenty of lost ground to make up.”

Financial Earthquake

This long-overdue wealth rebalancing will change a lot of things, including:

Rising inflation and monetary policy tightening. When stocks, bonds and real estate go up, the Federal Reserve doesn’t count that as inflation. But when wages rise, the Fed finds that alarming. So expect the trend towards higher wages to generate scary CPI numbers which in turn lead the Fed to at least try to raise interest rates.

Near-term financial instability. Higher interest rates are good for retirees and savers who earn more money on their bank accounts and money market funds, but bad for the stocks, bonds and real estate that now dominate the economy. So expect the financial assets that account for the bulk of the 10%’s wealth to be “repriced” via bear markets.

Easy money ever after. Crashing financial assets would wipe out big parts of the global financial system, which the aristocracy will find completely unacceptable. So expect the Fed – as it has in every crisis since the 1990s – to reverse course and go back to aggressive monetary stimulus. Whether this “works” remains to be seen. One of these times it won’t. But so far, Fed capitulation has always been good for safe haven assets like gold and silver, making the investment implications pretty obvious.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino October 26th, 2021

Posted In: John Rubino Substack