July 30, 2021 | Inflation and Interest Rates: All Roads Lead Back to Rome

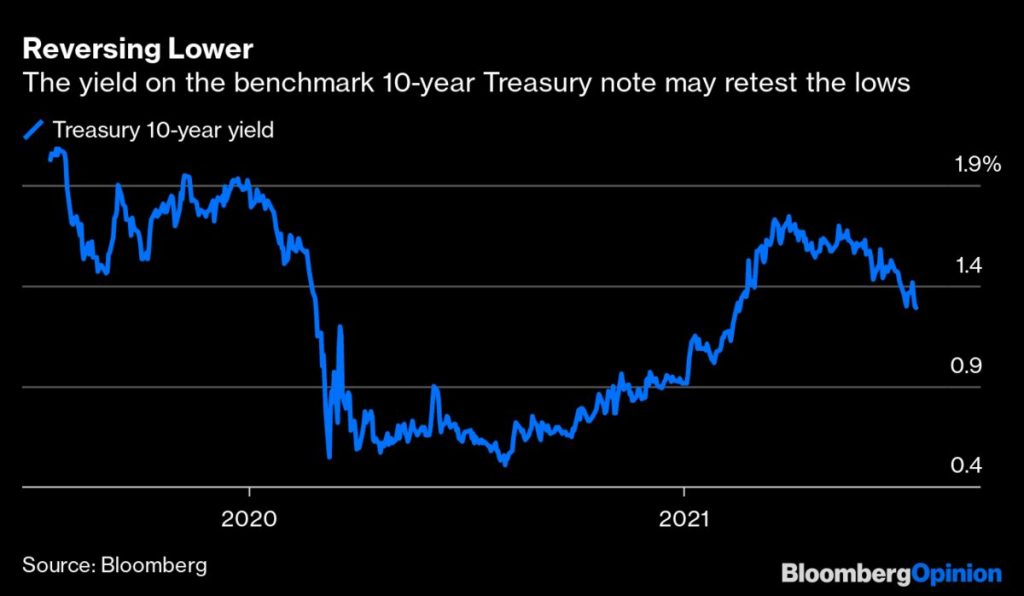

A. Gary Shilling’s excellent August Insight is out today (subscription only); some takeaways can be found in his recent Bloomberg Quint article here: With bond yields, something has to give, here’s the punch line:

The yield on the benchmark 10-year U.S. Treasury note averaged 0.79% from 2007 through last year after adjusting for inflation as measured by the consumer price index. It’s now minus 4.0%. If that’s not shocking enough, corporate bonds rated below investment grade, or junk, yield 4.57%, below the current 5.40% rate of inflation. Something’s got to give. To return to more normal conditions, either nominal yields must rise or inflation must recede. Bet on the latter.

While the risk-sellers continue their standard refrain that Treasuries are for dummies because inflation and interest rates are only headed higher, the reality is that higher rates are self-correcting in a global system where households, corporations and the investor class are all cash-light and heavily levered on the same inflated asset prices together. This makes the financial system highly interrelated and vulnerable to a psychological shift or demand shock at every moment.

In its latest 2021 Financial System Review, the Bank of Canada warns of contagion risks where buyer exhaustion, a crash in the stock market, cryptocurrencies or a weakening of international trade are just a few of many things that threaten a circular impact where home prices and incomes fall, contracting the entire economy.

In our massive global leverage cycle for the history books, all roads now lead to Rome: debt-fuelled pandemic spending inflated prices over the past year and brought forward future spending. In so doing, this has deflated future consumption power and demand, which suppresses longer-term inflation and interest rates–lower for longer.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park July 30th, 2021

Posted In: Juggling Dynamite