Global capital is all in with record leverage on growth and inflation bets. But is the consensus confident, or have they just stopped thinking?

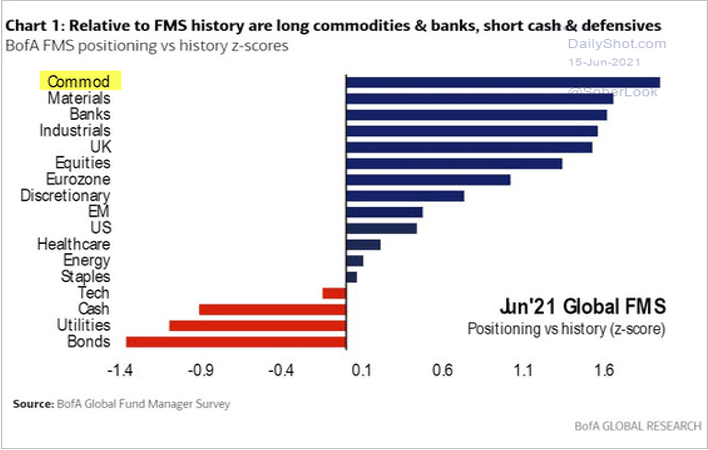

Not only are households holding their highest exposure to equities since the March 2000 secular peak. Global fund managers are also holding record-long allocations in pro-inflation commodities, materials, banks, industrials and other global equities with below-average allocations to rare deflation-defensive positions like cash, bonds and utilities (z-scores shown below courtesy of B of A: zero denotes the historical mean).

Just as emergency liquidity weakened the greenback from March 2020 to January 2021 and helped boost import and asset prices (aka inflation), the opposite also applies, and the dollar index has quietly not made a new low in nearly six months.

While monetary and fiscal funds have drowned the financial system, transmission through the real economy has failed because the cash flows are temporary, and bank loans, leases and wages have not been revived. Lance Roberts explains this well in The coming dollar rally:

Currently, there is no argument money supply has exploded without a corresponding increase in economic output. If there were, bank loans and monetary velocity would be on the rise. Unfortunately, such isn’t the case currently.

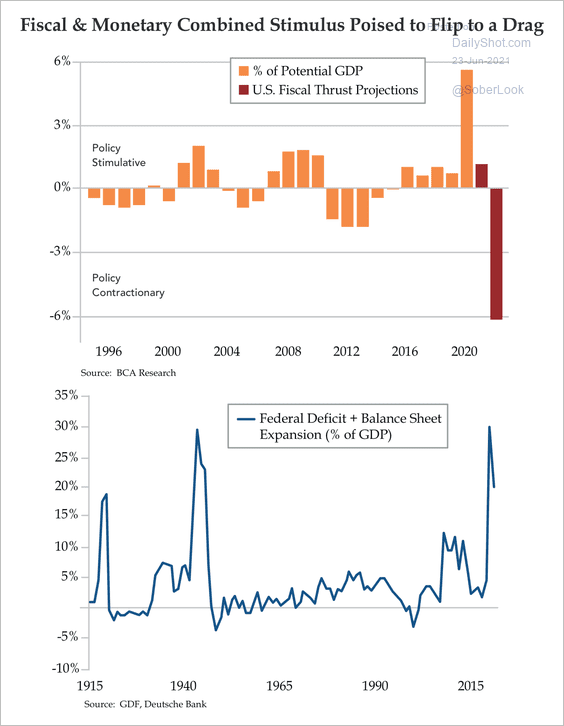

As shown below, after a year of literally doing the historic most, both monetary and fiscal stimuli are now contracting as central banks “reverse repo” ROE-suppressing excess cash from banks and governments struggle to agree on even bigger deficit spending.

The trouble with free money is that beneficiaries often expect more, and this typically ends in disappointment on all sides. Desensitized by a year of emergency help, less support will weigh heavy on risk markets in the months ahead.

Perhaps this is why Treasury Bonds have been rising again since March, stocks have moved sideways since April, and sentiment tokens like cryptocurrencies have halved.