June 28, 2021 | Peter L. Bernstein on Risk

Peter L. Bernstein’s experience and emotional intelligence (EQ) helped him become a rare wise leader in finance. After serving in WW2, he took over the management of his father’s investment counsel firm in 1951, where he worked as a portfolio manager until 1973.

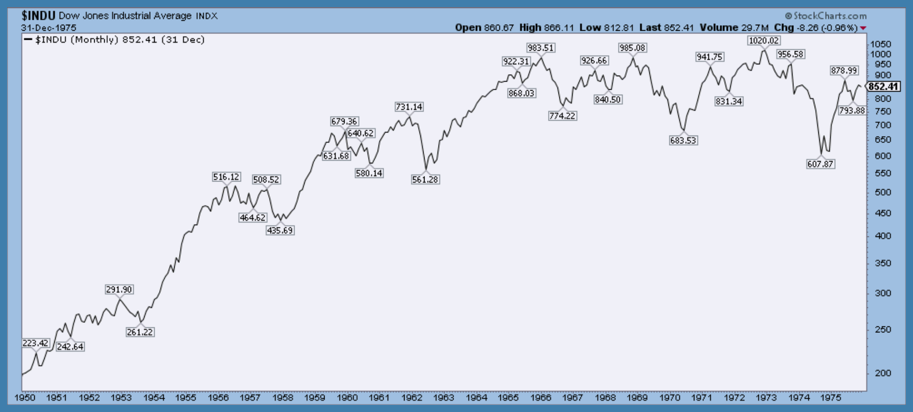

The first 15 years of his tenure coincided with one of the most rewarding secular bulls in market history. As shown below, the Dow Jones Index quintupled from 200 in 1950 to 1000 by 1966 and equity fund managers were celebrated like rock stars. Peter had the fortuitous timing of cashing out high, selling his firm to another in 1967 just as the mean-reverting secular bear of 1966 to 1982 was getting underway.

By 1976, the Dow Jones Index was back at the 607 level it had first attained in 1958–a nominal return of zero over 20 years. Peter came to understand that equity markets had become wildly disconnected from fundamentals and that participants had become over-confident and lacking in risk management: “What were we thinking?” he later wrote.

In 1973, Peter left the money management business to launch Peter L. Bernstein, Inc. and become the first editor of The Journal of Portfolio Management, a widely-read scholarly publication for investment managers and finance academics. He spent the last 36 years of his life writing and educating on the realities of financial risk and market cycles.

I had the good fortune of meeting Peter in 2007 and corresponded with him until his death in June 2009 at the age of 90. We spoke of the craziness that precipitated the 2008-09 financial collapse, and I would love to talk with him today. At least we still have his books. Against the Gods: The Remarkable Story of Risk (1998) and Captial Ideas. The Improbable Origins of Modern Wall Street (1991) and The Power of Gold: The History of an Obsession(2012) remain three of the most illuminating.

The discussion below from October 2005 is a fascinating time capsule. Keep in mind that this was taped just a couple of years after the 2002-03 market bottom, where stock markets had lost 50 to 80% and remained below their 1998 levels.

Peter Bernstein, Rob Arnott & Richard Bernstein WEALTHTRACK #0117 broadcast on October 21, 2005. Here is a direct video link.

I first discovered Peter when he upset the sell-side by telling a group of institutional money managers in August of 2003 that the ‘long always stocks’ approach was not good risk management. See Bernstein’s Shocking Words: Market Timing:

Now, however, Peter Bernstein, a respected name among investment professionals for his thinking about portfolio strategies and risk management, says it is time to question these cornerstones of conventional wisdom. If investors are to meet their financial goals, he says, they need to be more flexible and opportunistic.

“What if we can no longer be so confident that stocks are necessarily the best place to be in the long run,” Mr. Bernstein told a group of institutional money managers for endowments and foundations at a conference in late January. “What if moving around more frequently is now a necessity rather than a matter of choice?”

Mr. Bernstein then delivered the punch line: “I am talking about market timing — dirty words.”

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park June 28th, 2021

Posted In: Juggling Dynamite