June 6, 2021 | Charts For A Crazy World: Hot Money Spawns Weird Trends

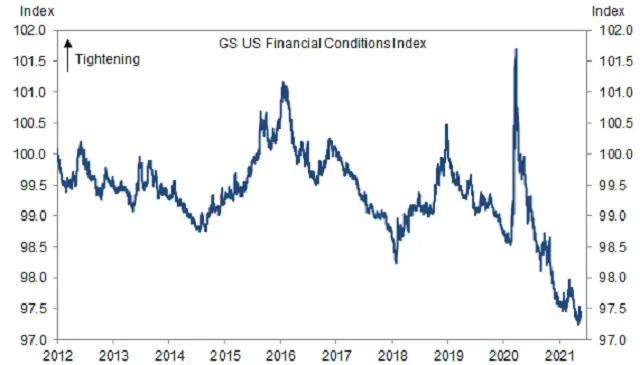

This is a time of almost supernaturally-easy money. US financial conditions, in fact, have never been this accommodative, which is why junk bonds, CLOs, NTFs, cryptos, and meme stocks have been able to attract so much hot money.

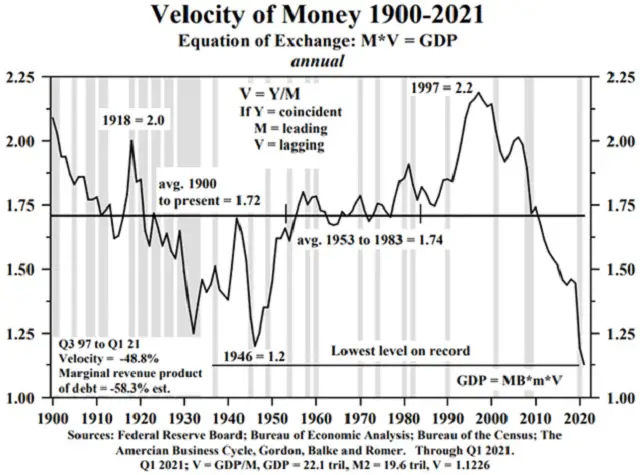

But the velocity of money – i.e., how often a given dollar is spent in a given span of time – has cratered. Consumers, it seems, aren’t nearly as enthusiastic as speculators.

This raises (at least) two questions:

1) Can the government force its citizens to spend money even when they’re terrified and/or depressed?

2) What happens if the velocity of money starts to rise, i.e., if economic behavior returns to normal? Won’t all that recently-created money careeing around the financial system be wildly inflationary and force the Fed to tighten way more aggressively than anyone now expects? If so, are we risking an inflation spike followed by an epic taper tantrum?

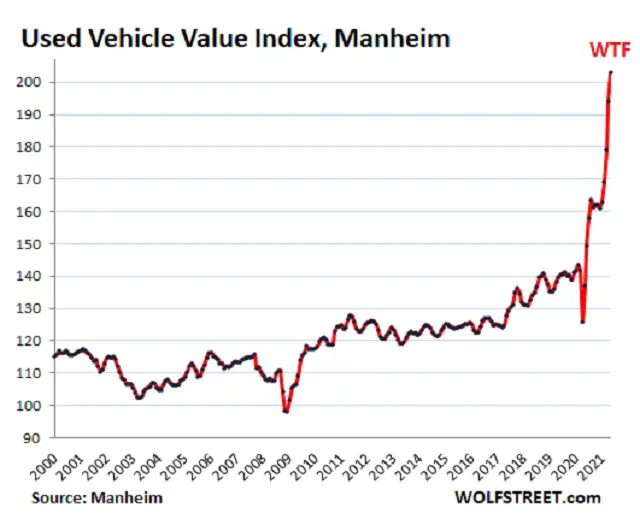

This could already be happening. Used cars are suddenly behaving like cryptocurrencies…

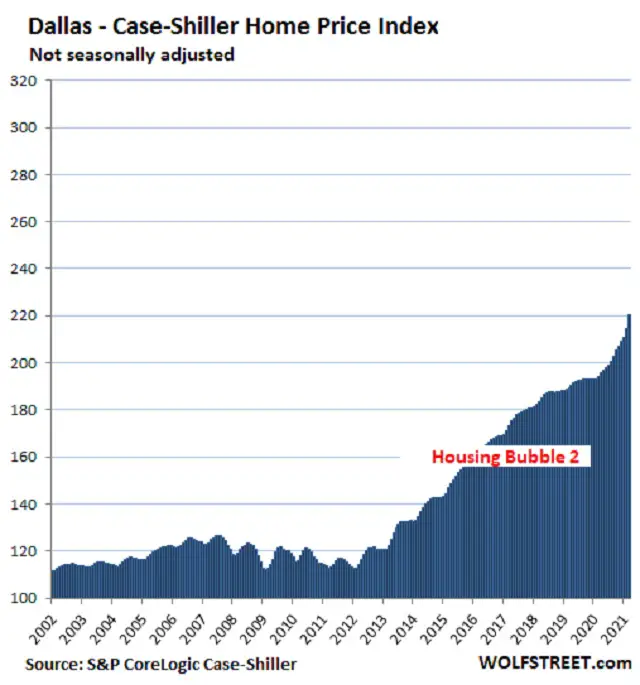

… as are houses …

Cars and houses are two of the least likely things to spike in a recession. Yet they did, right through the pandememic lockdowns and mass-layoffs.

This is, without question, inflation, but is it broad-based enough for normal people to start noticing? Yes and no. It’s definitely spreading from stocks and bonds to cars and food. But a lot of it is still hidden by governments and companies that don’t want to acknowledge it. One way this is accomplished is via “shrinkflation” in which prices stay the same but portions shrink or quality declines. The next chart shows that the process was already under way in the candy market before the pandemic.

By definitiion, shrinkflation can’t go on forever (or your Snickers bar will simply disappear). But quality can deteriorate for a long, long time, so it’s not clear when most people will conclude that inflation is real. Someday, though, they’ll have to.

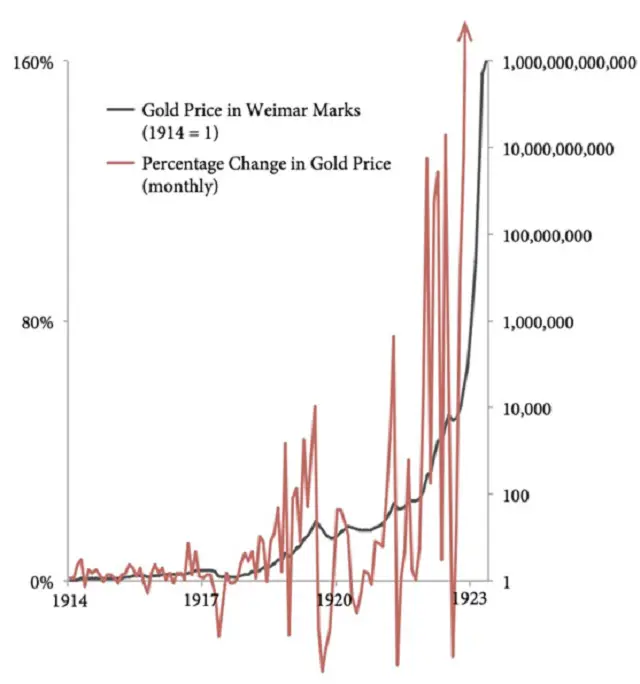

Which brings us to gold and silver, the things that normally spike when inflation starts to run wild. Here, to take the most extreme possible example, is what gold did during Weimar Germany’s early-20th century hyperinflation.

If you think you know volatility, just wait.

Lately, a growing number of people have begun to wonder if all these strange financial trends (along with UFOs and lab-engineered viruses) are designed to achieve some broader, as yet unannounced goal. They may be right.

Guess we’ll just have to see what the man and his dog want from us next.

——————————–

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 6th, 2021

Posted In: John Rubino Substack

Next: Technology Rules »