July 21, 2025 | The Great Pivot

Happy Monday Morning!

Last week we wrote a piece called The Only Game in Town, in which we argued CMHC has financed nearly 90% of all new rental construction in the country, up from just 5% in 2017. They have become the only game in town and the financial exposure was concerning in an environment where rents are falling and immigration had slowed to a standstill.

It turns out you can have too much of a good thing. After all, water gives life, but a flood drowns it. And we are flooded with rental construction.

According to friend of the newsletter, Ben Rabidoux, there were another 11,000 rental units that started construction in June across Canada. That makes 33,000 in Q2 compared to just 20,000 TOTAL population growth in the most recent quarter.

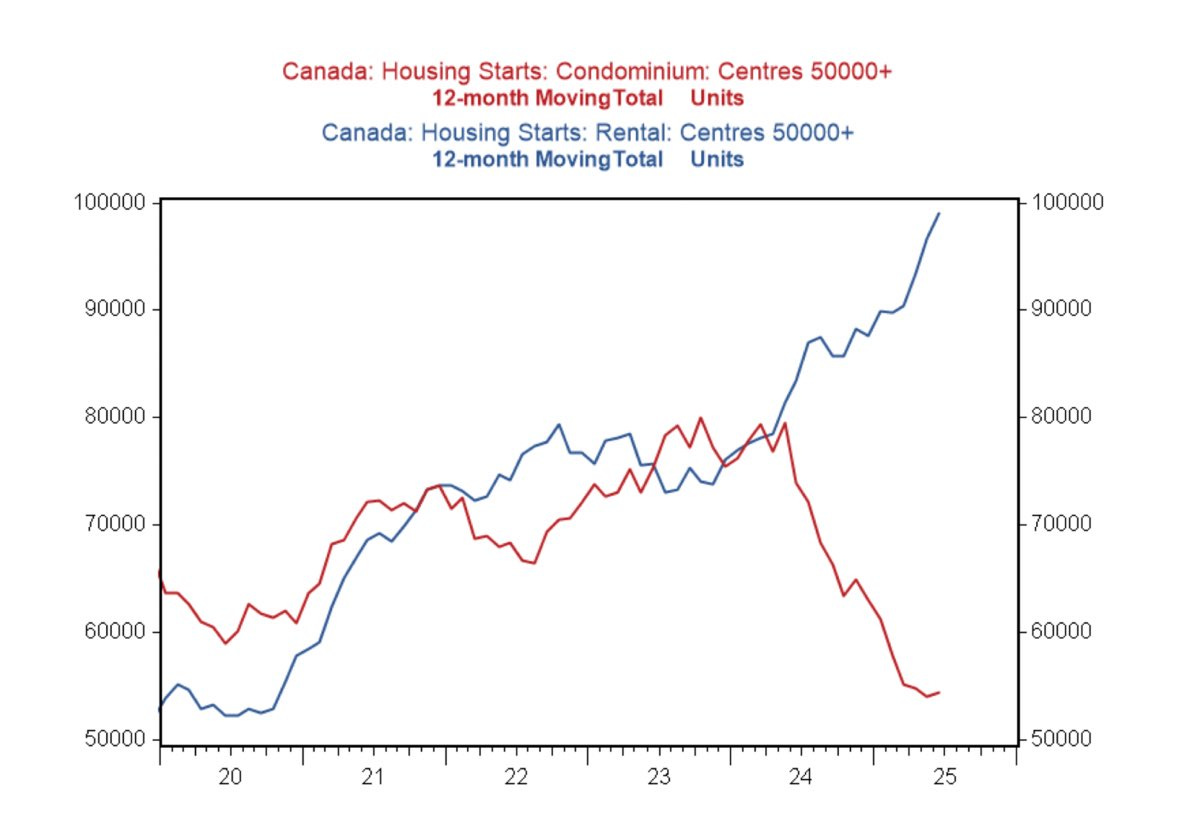

BMO also highlights the enormous pivot from pre-sale to rental condos.

This is what happens when the speculative frenzy in the pre-sale market comes to a dramatic end. Investors are no longer interested in financing new condos priced 10-20% above comparable resale product.

If you can’t build condos anymore then you either go out of business or you pivot. Many developers are being forced to pivot to rental, a business model that only works thanks to government sponsored financing.

It’s worth asking though, if government pulled the plug on CMHC financing, would anything get built at all today?

You’d have a massive hole in the pre-sale and the rental market.

And so, if you believe we are structurally short housing, you keep the game (and CMHC) going.

I believe we are going through a significant structural shift in how new housing gets financed. For decades we’ve relied on investors financing the pre-sale market, and ultimately these investors would supply rental housing, one unit at a time. In other words, your mom and pop landlord would buy a pre-sale, and rent it out upon completion.

Those investors have evaporated, taking the pre-sale market with it.

What we are likely to see is a continuation of purpose-built rental housing dominating the construction sector. Similar to what we saw in the 1970s.

This would have profound impacts on the industry as a whole. For better and for worse.

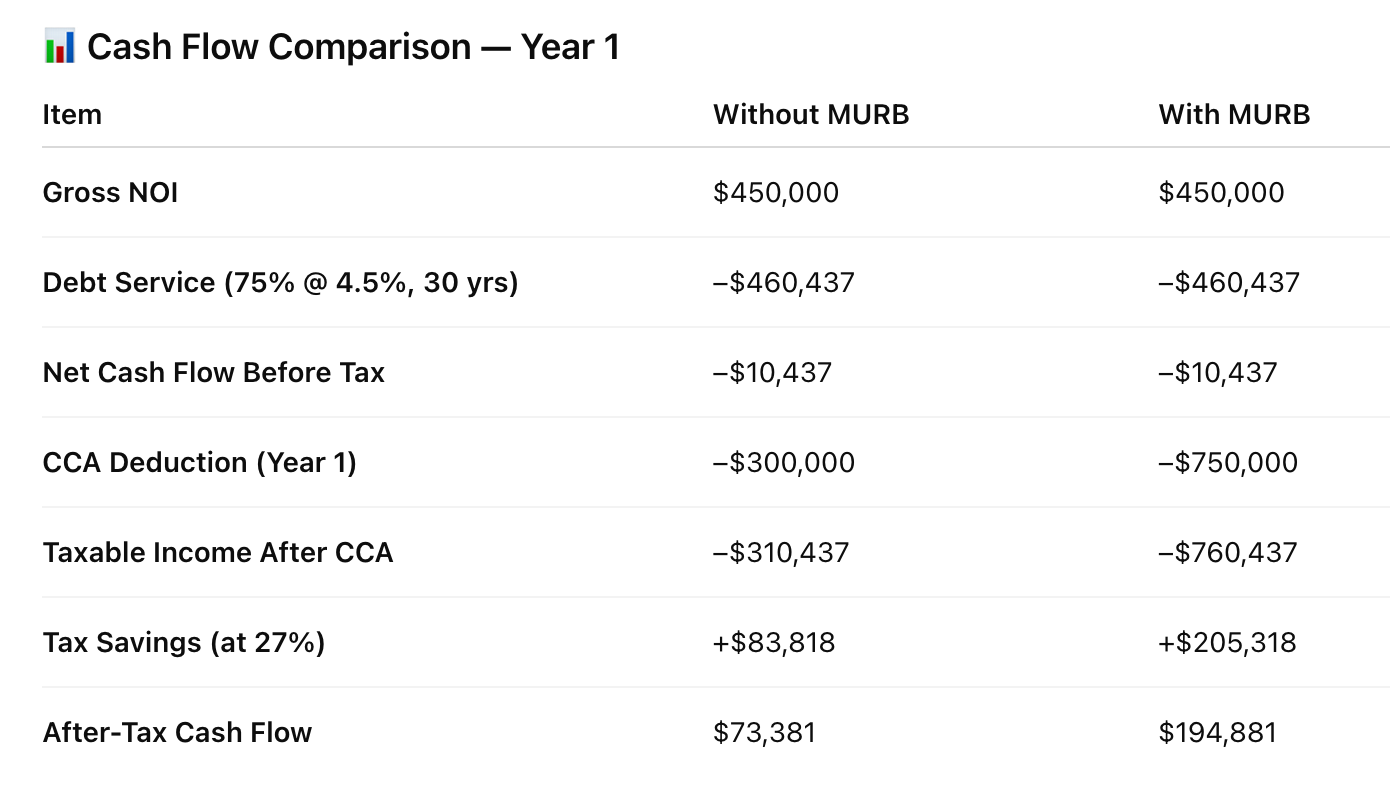

This pivot to rental housing could be supercharged if the Carney government follows through with their promise to introduce the MURB program. The MURB stands for Multiple Unit Residential Building, and it was a federal tax incentive program in Canada originally introduced in the 1970s to stimulate the construction of rental housing.

Under the original MURB program:

- Investors who bought newly constructed rental units in qualifying buildings (with at least 3 or 4 self-contained units) could deduct capital costs faster (through accelerated Capital Cost Allowance (CCA) — depreciation).

- This allowed investors to shelter other income from taxes by claiming large paper losses in the early years.

- Some programs also allowed losses from interest, maintenance, and other expenses to be written off against income from other sources.

- Many syndicates and partnerships were formed, where investors pooled money to build or buy apartment buildings and claimed the deductions proportionally.

Assuming Carney follows through, this would be another jolt for rental construction. Let’s take a look.

Assumptions:

- Building cost: $10,000,000

- Loan-to-value: 75%

- Mortgage rate: 4.5%

- Amortization: 30 years

- NOI (Net Operating Income): $450,000/year (4.5% cap rate)

- Corporate tax rate: 27% (BC general rate)

- Building portion of cost (depreciable): 75% of total = $7,500,000

- CCA (depreciation):

- Standard: 4% declining balance

- MURB: 10% straight-line for first 5 years

The tax incentives are significant. We believe, we are going through a structural pivot to how new housing gets financed in this country. The last few decades were dominated by the pre-sale market, but that started to shift in 2022 with the peak of the pre-sale bull market and the introduction of the MLI select program. This decade will be dominated by rental housing, financed and tax incentivized by the government.

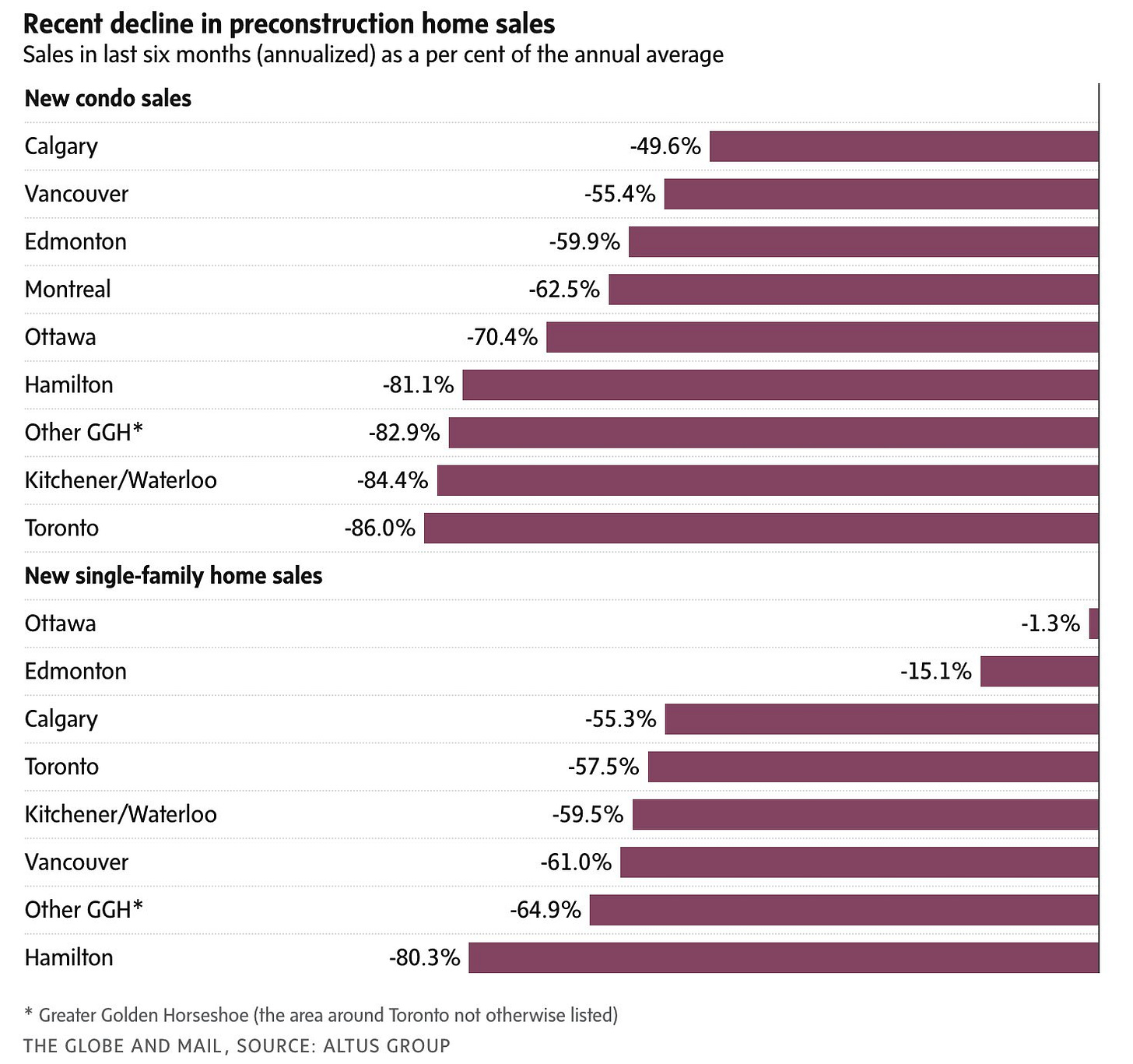

The collapse in pre-sales has been significant, and is unlikely to see a material recovery in the next few years.

New construction home sales this year are running as much as 86% below their 2020-2024 average.

Entire business models have been built on the pre-sale. From pre-con Realtors, to micro condo developers, we believe the industry will need to pivot accordingly, or the beatings shall continue until morale improves.

And while we belive we are building too much rental housing in the near term, as evidenced by falling rents, there is little to suggest the pivot from pre-sale to rental is going to change anytime soon.

Case in point.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky July 21st, 2025

Posted In: Steve Saretsky Blog