July 4, 2025 | Clean Energy Reclaims Market Leadership

At the start of the year, the narrative was straightforward: fossil fuel producers stood to benefit from supportive domestic policy, while clean energy—out of favour politically and commercially—looked set to lag. Markets had priced in a resurgence in drilling, with investor consensus leaning heavily toward traditional hydrocarbons.

That view hasn’t aged well.

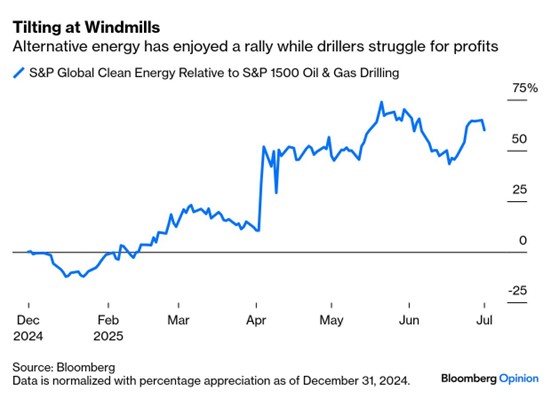

Six months on, the S&P Global Clean Energy Index is up meaningfully, while the S&P 1500 Oil & Gas Drilling Index has given back ground. The spread between the two tells the story: a 60% return for investors who bet on clean energy versus drilling.

This is more than just political irony. It reflects a market shift back toward fundamentals. Clean energy is reasserting itself, not because of policy support, but because of improving economics, maturing technologies, and renewed global capital flows. At a time when fossil fuel development faces structural headwinds—financing, permitting, ESG scrutiny—clean energy assets have started to look like durable growth plays, not speculative longshots.

The lesson is clear: forward-looking political forecasts, even when accurate, don’t always translate into sustainable trades. Much of the “drill, baby, drill” thesis was already embedded in asset prices by January. When policies took effect, there wasn’t much left to catalyze further upside.

Investment Implications

For allocators, clean energy is no longer a contrarian corner of the portfolio—it’s back on the board as a core opportunity. Names across solar, wind, and battery storage are seeing improving margins and global investor support. Meanwhile, speculative fossil fuel drillers remain vulnerable to policy friction, price volatility, and operational risk.

That doesn’t mean investors should blindly chase green momentum. Selectivity matters. But for portfolios that had rotated out of clean energy at the start of the year, it may be time to re-engage.

The energy transition narrative isn’t linear. But clean energy is showing signs it’s not just alive—it’s leading again.

Fraser Betkowski

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth July 4th, 2025

Posted In: Hilliard's Weekend Notebook