May 23, 2025 | Canadian Residential Real Estate Slump Deepens

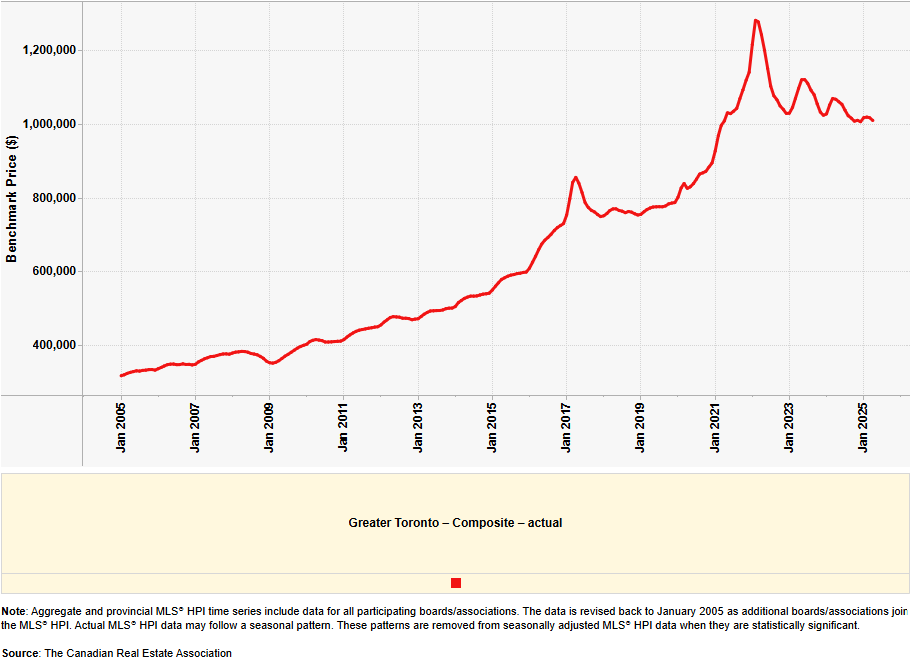

House prices in the Greater Toronto Area (GTA) have been falling since 2022, and it is estimated that houses have lost more than 20 percent of their value compared to three years ago.

Will the housing slump deepen?

Vertias Research recently published charts that show the shaky status of residential real estate markets in Canada and specifically in Toronto.

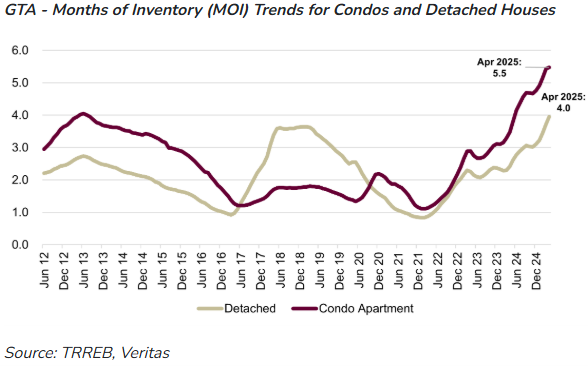

On these charts we see that months of inventory of condos and homes in the GTA are at the highest levels in at least thirteen years.

In the condo market it makes sense that there is a glut because there was a building boom in high-rise condominiums. For several years the number of high-rise construction cranes in the GTA was far ahead of most large cities in North America.

Many of the condo units built recently are small, around 500 square feet, designed for investors to hold as rentals or to flip quickly for a profit but few are built for families. Entire buildings were marketed, in some cases to foreign investors who might have been laundering money or just trying to ride Canada’s massive housing boom.

Now a surplus of condos in the GTA puts downward pressure on prices as we can see:

Source: TRREB, Veritas

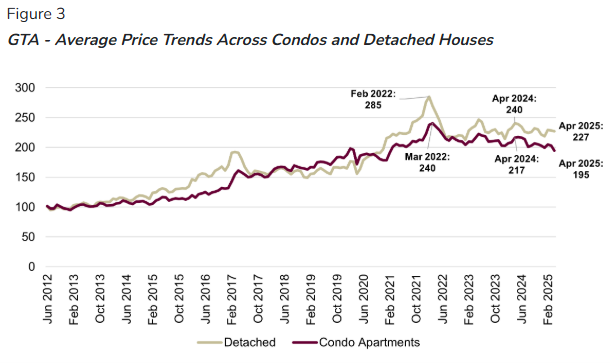

Detached dwellings are dropping in price, too. The average price for detached homes peaked near $1,300,000 but has fallen to $1,000,000 recently. Further losses are likely.

This decline is more than 20 percent, but the reality on the ground is worse than what the numbers show. These price declines do not consider the cost of renovations and rebuilding. Many homes are offered for sale after expensive upgrading or new building. So, if the cost of these investments were deducted from the selling price, losses we see today would be much larger. Home price indexes are not adjusted for these investments.

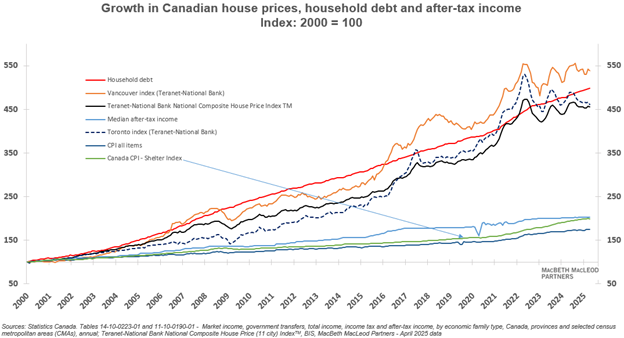

Our team has been tracking prices for Toronto, Vancouver and Canada for many years. To the data from Teranet-National Bank for house prices we added the key variables of household debt, CPI inflation, shelter inflation and median after-tax income. All series are based to 100 in the year 2000.

We see prices generally peak in 2022, while Vancouver (orange) has held close to its peak, and the index for all of Canada (black) has been sliding slightly lower since 2022. The debt level (red) continues to climb even as house prices drop, which lowers the quality of the collateral backing those housing loans. So far the number of foreclosures and power of sale transactions is low relative to past crises, but, if prices drop further, we expect a large increase in distressed property sales forced by lenders.

The small increases since 2000 in household income (blue) compared to the cost of housing (about 4.5 to 5.5x) ensures a crisis unless wages move higher. But with a recession looming that won’t happen.

The bursting of the housing bubble is underway, and it will get worse before it finds a bottom.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth May 23rd, 2025

Posted In: Hilliard's Weekend Notebook