July 26, 2025 | Trading Desk Notes for July 26, 2025

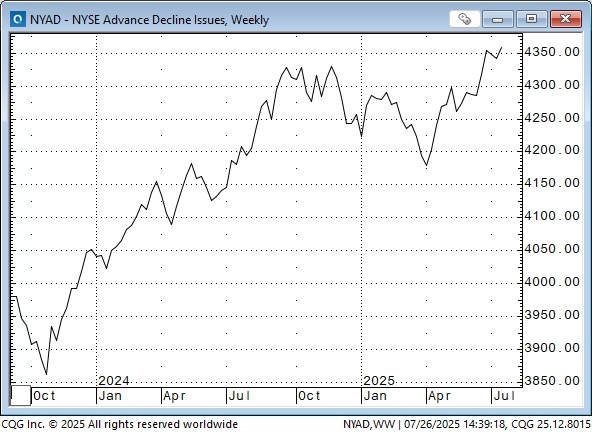

Markets are not expecting RISK!

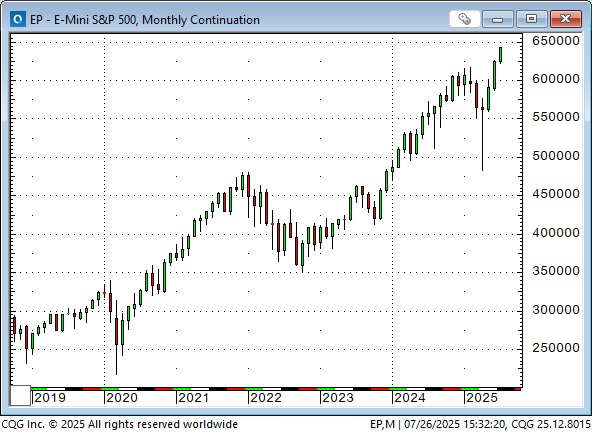

The leading global equity indices are at or near all-time highs. The S&P is up ~33% from the April lows, the NAZ is up ~42%. (NVDA is up >100%.) (Open interest in the S&P futures market fell to an 18-year low this week. Perhaps because one S&P futures contract is now worth more than three times what it was worth at the lows in 2020.)

The Nikkei futures reached an all-time weekly high close this week, up ~39% from the April lows, buoyed by the “trade deal” announced mid-week.

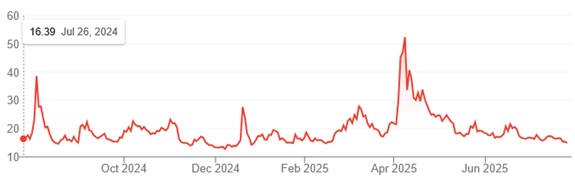

The VIX is near 12-month lows. The spike in April is no longer within the 90-day lookback window in quant models.

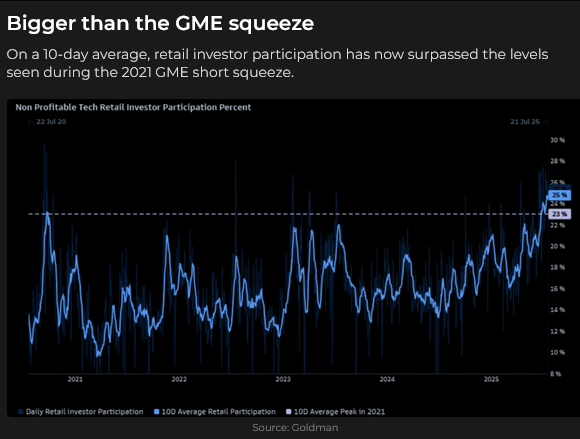

Retail is buying aggressively.

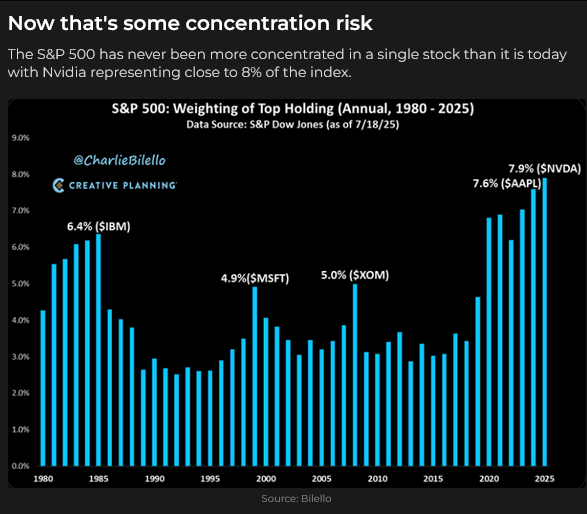

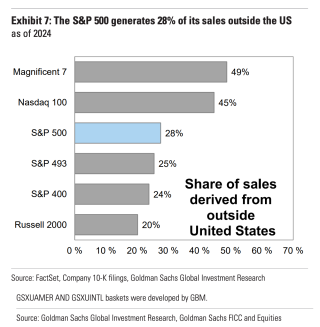

Concentration is not a worry.

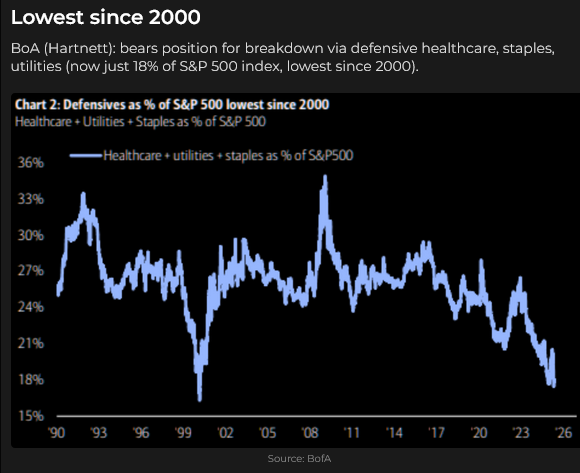

Classic defensive market sectors have been ignored.

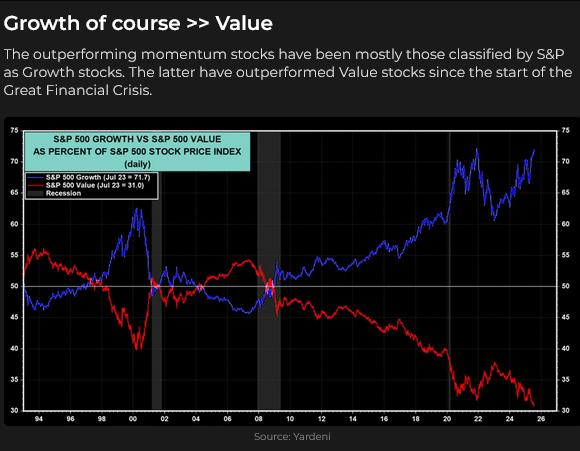

Growth stocks have hugely outperformed value stocks.

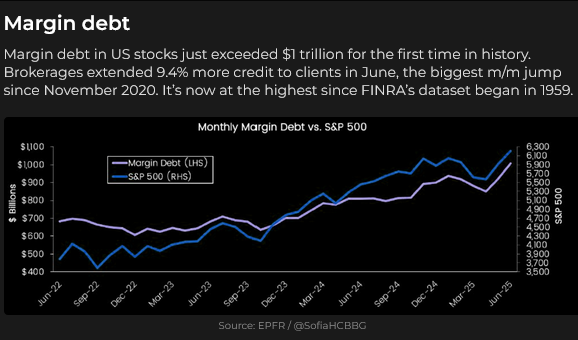

Margin debt is at record highs.

Valuation metrics indicate “pricy” stocks, as Bloomberg notes that the S&P is valued at 3.3 times sales, a record high. The price-to-cash flow, price-to-book, and price-to-dividends ratios are also near record highs. The dividend yield is at multi-year lows.

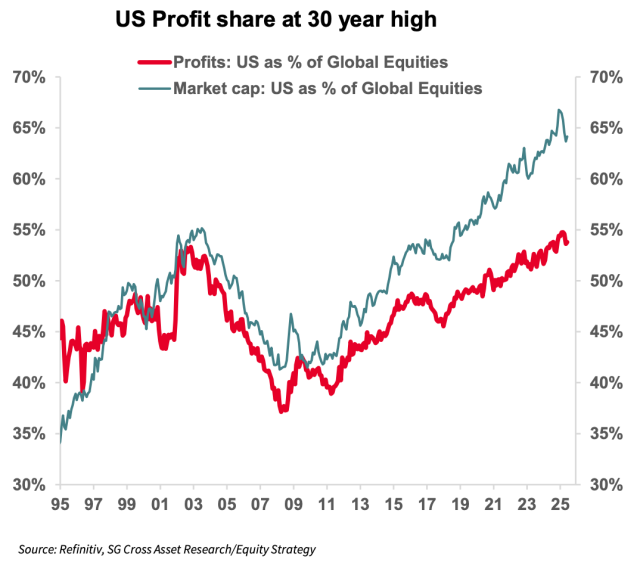

Strong American corporate profits have attracted global capital.

Corporate quarterly reports: About 30% of S&P companies have reported, with 84% beating EPS estimates and 79% ahead of top-line forecasts. (Is anybody surprised?) As more companies report, the blackout window on corporate buybacks will diminish. August is historically the best month of the year for buybacks, with consensus brokerage estimates for 2025 totalling over $1 trillion.

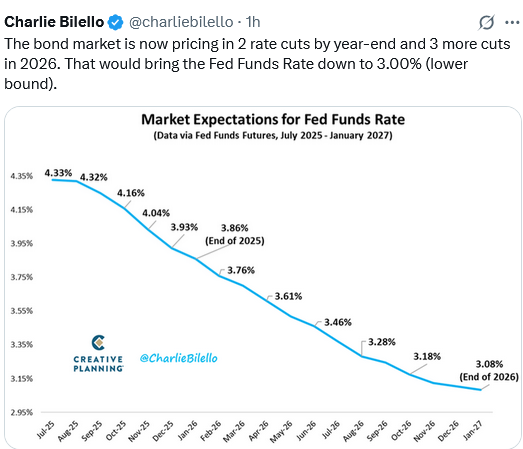

Interest rates

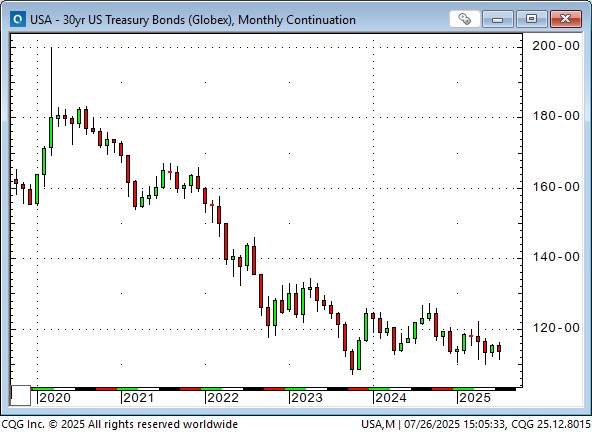

Despite concerns of “a coming tsunami” of bond issuance (at higher yields) to cover the “spiralling” US government deficits, the long bond is still trading above the 16-year lows it made in October 2023. (Total open interest in US exchange-traded interest rate futures is at an all-time high.)

Investment-grade corporate bond premiums are now at a 20-year low relative to benchmark US Gov’t debt, as investors “reach for yield.”

The FOMC and the BoC will announce their interest rate policies on Wednesday, July 30. No change is expected.

Currencies

The US Dollar Index turned higher at the beginning of July after falling ~14% YTD, but couldn’t sustain the rebound this week.

The Euro rallied ~17% from its January lows to 4-year highs at the end of June. (The Euro futures contract represents ~40% of the total open interest of all currency contracts traded on the CME, which is why I refer to it as the “Anti-dollar.” If traders want to be generically short the USD, they buy Euro futures.)

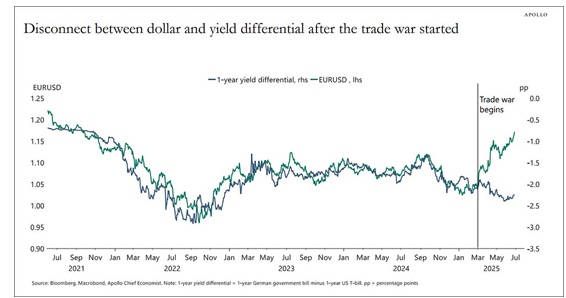

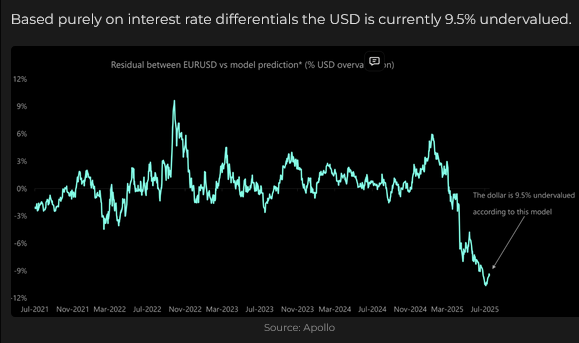

Historically, there has been a tight correlation between interest rate differentials and the EURUSD exchange rate. (For instance, if US s/t interest rates rose relative to European s/t interest rates, the USD would rise vs the Euro.) But that tight correlation ended in March when the Euro rallied even as US interest rates rose relative to European rates.

When historically tight correlations break down, that usually means “something new” is impacting the “relative value” calculation. (For instance, there was a (at times) strong negative correlation between the gold price and the US Dollar/US interest rates before the Russian invasion of Ukraine. If the USD was strong, and/or US interest rates were rising, the gold price was falling. When gold rallied dramatically from late 2022 forward, without a dramatic fall in the USD or US interest rates, analysts searched for “something new” that was contributing to the rising gold price, and they “discovered” that the substantial increase in central bank gold buying “blew away” the previous USD/gold price correlation.

Some analysts have “discovered” that the recent breakdown between the EURUSD exchange rate and interest rate differentials is another expression of “the end of US exceptionalism.” In simple terms, investors prefer the Euro over the USD, even though German 2-year yields are ~1.95% compared to 3.95% in the USA.

One reason for this Euro preference is “Trump.” Another is that while the S&P is up ~8.5% YTD for American investors, for Eurozone investors, it is down ~7%.

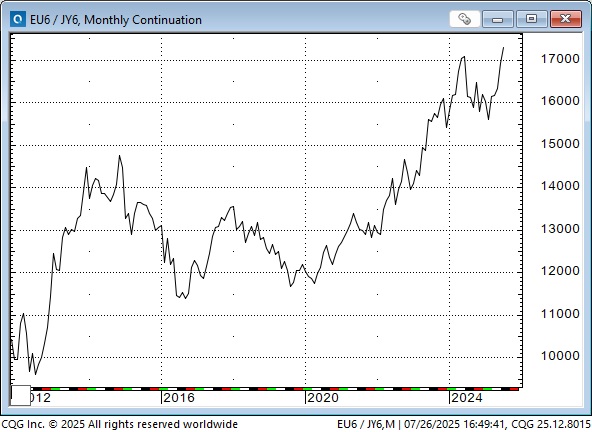

The Euro rose to an all-time high against the Yen this week. The trend has been strong for the past five years, but began in 2012 (when the Yen was at an all-time high against both the USD and the Euro), when Abe introduced his Three Arrows program to revive the Japanese economy.

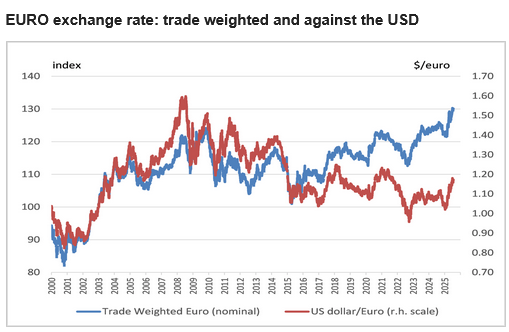

The Euro trade-weighted exchange rate is also at an all-time high (because the Yen and other Asian currencies are at, or near, all-time lows against the Euro). It must be increasingly difficult for Europe to export to Asia or compete with Asia in exporting to the rest of the world. Perhaps the Europeans (to say nothing of the Swiss with their sky-high Franc) don’t want to see their currency strengthen!

I started this edition of the Trading Desk Notes by saying that markets are not expecting RISK! I think markets are underestimating the risks not only from trade wars, but also from potential currency wars.

The summer doldrums may continue through August (no guarantees on that!), but I wouldn’t be surprised if financial markets look a lot different after Labour Day. If the markets are stressed, I could see a stronger USD, higher interest rates, increased volatility, and lower stock prices.

Quote of the week from Kevin Muir, The Macrotourist

Song of the week – Kenny Rogers – The Gambler

My short-term trading

I covered my short British Pound puts for two ticks early this week when the Pound rallied. I had sold them for 35 ticks, so, all in all, my short GBP futures/short GBP puts trade was a sweet trade.

I was briefly short the S&P mid-week and was stopped for a slight loss.

I’m flat going into the weekend. It’s summertime.

The Barney report

We’ve had hot weather lately, and Barney is always wearing a fur coat, so when we’re out for a walk these days, he sometimes stops and takes a break to cool down. I’m ok with that!

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the stock markets at all-time highs, copper at an all-time high, and the prospect of markets “getting real” after Labour Day. You can listen to the show here. My spot with Mike starts around the 1-hour 4-minute mark.

This Week In Money

I did my monthly interview with Jim Goddard on the This Week In Money show this morning. We talked about how the summer doldrums affect markets and how they might change dramatically after Labour Day. We also discussed stocks, gold, copper, currencies, Trump’s pressure on Powell, and the possibility that Trump’s August 1 deadline for “trade deals” could add some volatility to markets this coming week. You can listen to the show here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair July 26th, 2025

Posted In: Victor Adair Blog

Next: Debt & War »