May 20, 2025 | Recession Watch: Unsustainable Interest Rates And falling Credit Scores

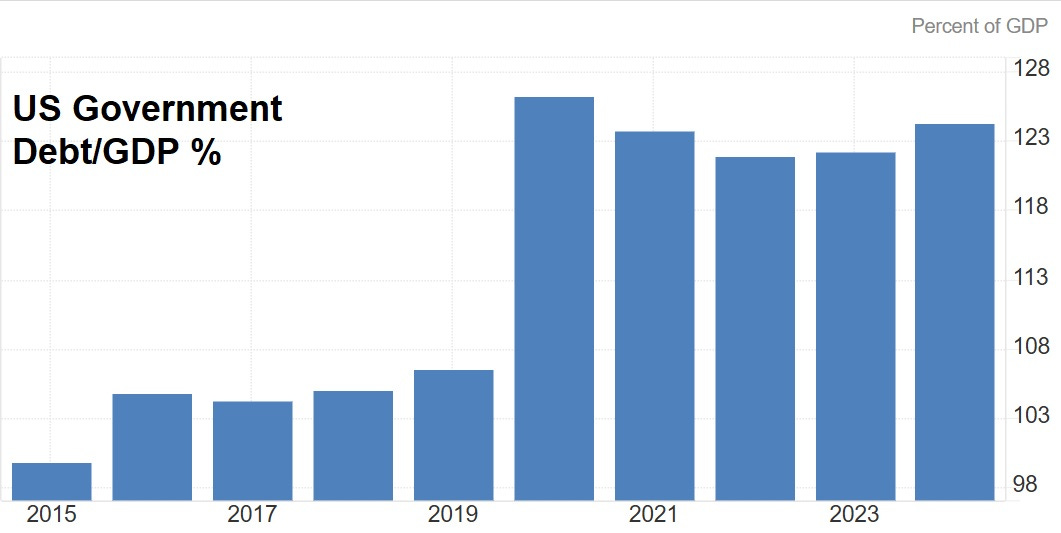

This week, Moody’s, the last bond rating agency that still gave the US a perfect score, joined its peers by cutting Treasury bonds from Aaa to Aa1. To which you might respond, “Duh. How can a country with a debt-to-GDP of 124% be an investment-grade credit at all, let alone AAA?

You’d be right, of course. Sovereign credit scores are premised on the fact that governments can create currency out of thin air, so they can’t actually default. To which you might respond, “But paying interest in a depreciating currency is also a form of default.” You’d be right about that, too.

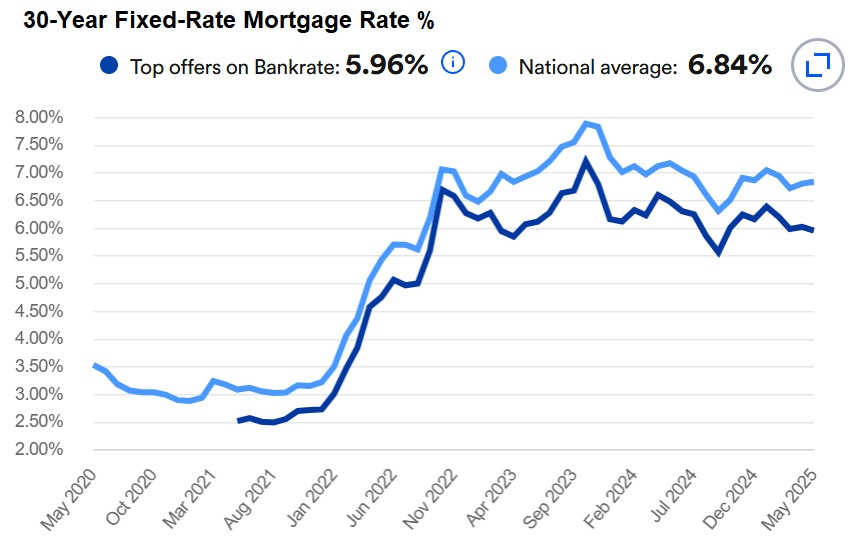

Global investors might actually get this, because US interest rates rose on the Moody’s news:

This interest rate translates into annual government interest expense of about $1.4 trillion, which, of course, has to be borrowed, thus ballooning future deficits, and so on, producing the long-anticipated fiscal death spiral.

Housing Stays Frozen

The following chart shows how cheap mortgages used to be and how much they’ve risen since then. With house prices at all-time highs, the only hope for a housing revival is if mortgages get dramatically cheaper. And that’s not happening.

And speaking of credit downgrades, look what’s happening to student loan borrowers

After several years in which student loan payments were optional, they’ve now shifted back to mandatory, with the US threatening to garnish the wages of deadbeats. That moves student loans back onto borrowers’ credit scores, in many cases crashing them:

Why are student loan delinquencies skyrocketing? Credit scores plunging for borrowers

(Marca) – For the first time in nearly four years, millions of Americans are facing the harsh financial reality of student loan delinquencies appearing on their credit reports. According to a recent analysis by the Federal Reserve Bank of New York, the end of the federal student loan payment pause has triggered a significant spike in delinquencies, leading to dramatic drops in credit scores and raising broader concerns about ripple effects across the credit economy.

The student loan payment freeze, which began at the onset of the COVID-19 pandemic in March 2020, lasted for an unprecedented 43 months.

When payments resumed in October 2023, the U.S. Department of Education granted borrowers a 12-month “on-ramp” period during which missed payments wouldn’t be reported to credit bureaus. That grace period expired in October 2024-and the first quarter of 2025 has revealed the financial fallout.

According to the Fed, nearly 6 million student loan borrowers-13.7 percent of those required to repay-were 90 or more days delinquent or in default in the first quarter of 2025. That figure, while slightly lower than the 14.4 percent seen before the pandemic, marks a disturbing return to pre-COVID patterns.

Another 23.7 percent of borrowers were behind on payments but less than 90 days delinquent, a number that could climb as economic pressures mount.

The financial consequences are already unfolding in devastating ways. The Department of Education and the Treasury have begun collections on defaulted loans, including garnishing wages, tax refunds, and even Social Security benefits. According to the Fed, the impact on borrowers’ credit is already significant and could worsen.

More than 2.2 million newly delinquent borrowers have seen their credit scores drop by over 100 points, with more than 1 million experiencing drops of at least 150 points.

While some of these borrowers already had subprime credit, an estimated 2.4 million had scores above 620, making them previously eligible for credit cards, auto loans, or mortgages. Many now find themselves suddenly locked out of traditional lending.

Where is growth supposed to come from?

Those $2 trillion annual deficits will persist, and a government creating that much money out of thin air and handing it to the already-rich is admittedly (temporarily) stimulative. Meanwhile, Trump, to his massive credit (no pun intended), is attracting a tsunami of foreign investment. That’s also stimulative.

But the vast cross-section of America that has student loans and/or would like to buy a house or a car can’t tolerate higher interest rates. And if the bond markets won’t lower rates, a “middle class recession” may have already started.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino May 20th, 2025

Posted In: John Rubino Substack