July 14, 2025 | The Only Game in Town

Happy Monday Morning!

Last week we wrote a piece titled ‘The Next Shoe to Drop’ in which we suggested CMHC’s exposure to the rental market had gotten so large, so quick, it’s created quite the dilemma.

The program in question is called the CMHC MLI select. An insurance product that helps finance rental housing by offering up to 95% LTV and 50 year amortizations, at artificially low rates thanks in part to the government guarantee backstopping the loans.

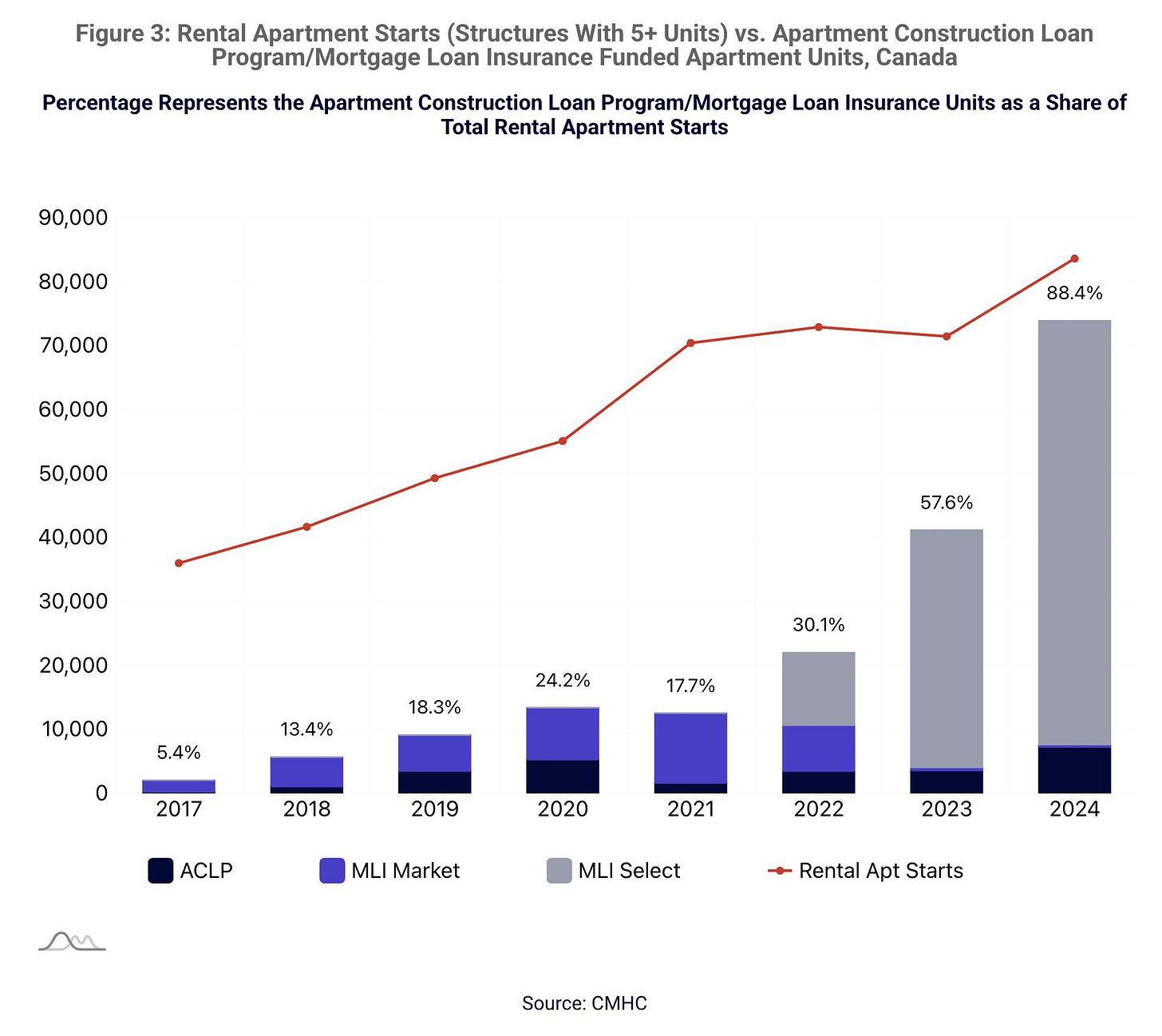

The program has been so successful it’s spurred record rental construction across the country. According to Ben Rabidoux of Edge Analytics, nearly 7% of Canada’s entire existing rental housing stock is currently under construction.

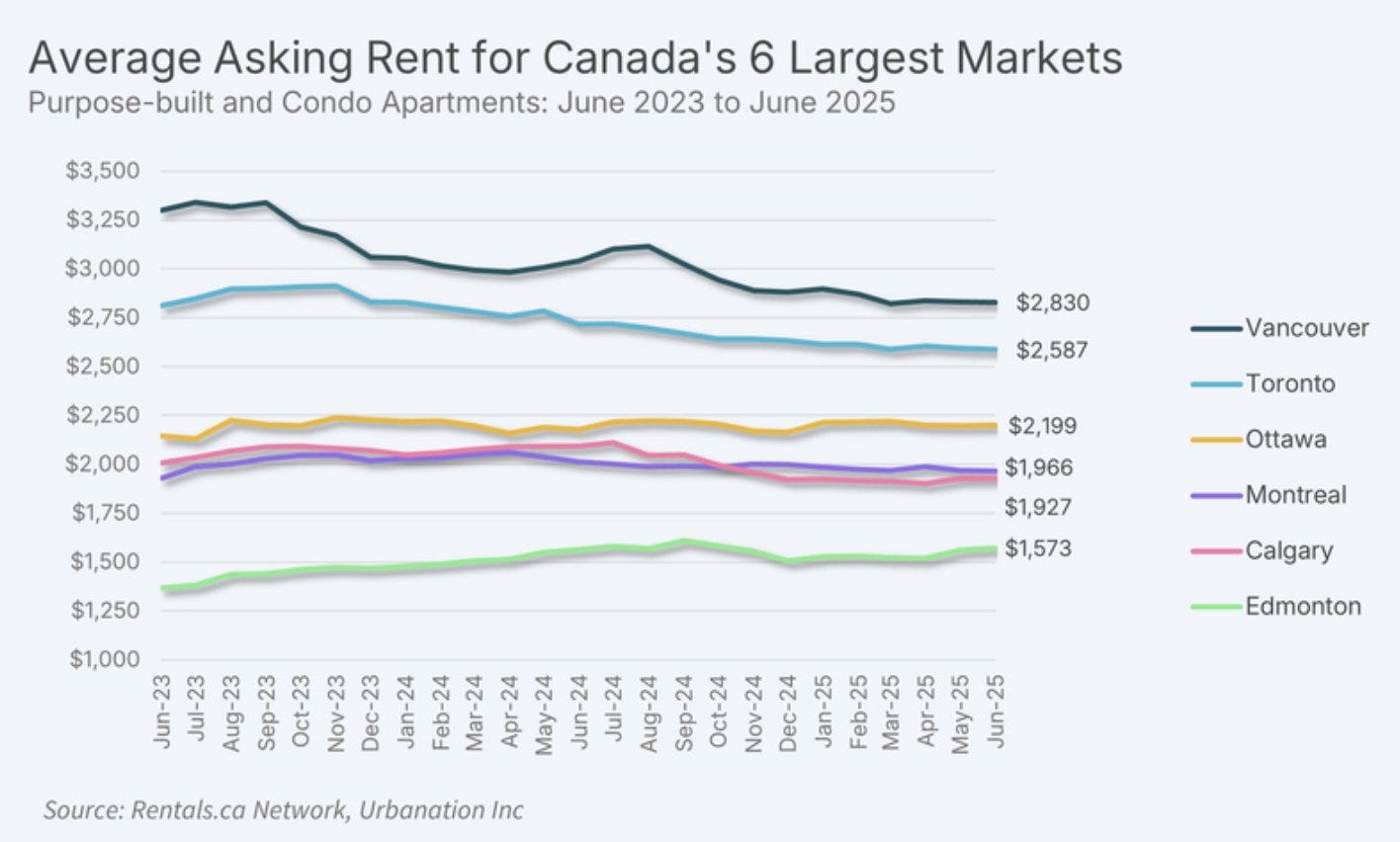

This, combined with immigration reforms, has spurred a significant reduction in rents nationwide. Asking rents in Canada fell for the 9th consecutive month in June. Rents are falling in every major metro except for Edmonton.

According to CMHC’s internal data, the average asking monthly rent fell between 2 per cent and 8 per cent in condos and rental-only apartments.

“It is quite evident on the demand side that there have been signs of weakening,” said Tania Bourassa-Ochoa, CMHC’s deputy chief economist, adding that there were stronger rental declines in regions with slower population growth.

This is encouraging for restoring housing affordability, but ironically, could become problematic for Canada’s mortgage insurer.

Falling rents, higher vacancies, and rising cap rates, are not good for business. Especially when you’ve financed 95% of the project and you’ve become the only game in town. CMHC has pushed their exposure to the rental construction business from 5% in 2017 to nearly 90% today.

There appears to be an “oh shit” moment inside the halls of CMHC, which as we reported last week, have suddenly increased insurance premiums by a significant margin.

For construction loans specifically, the premium increases are significant: for example, a 95 % LTV new‑construction deal with a 50-year amortization that might have previously carried about 2.80 % premium could now reach 5.775 %, more than double the old rate.

The contrast is even more stark when compared to the premium when the program launched in spring 2022, when it was 1.25 per cent, meaning premiums for this type of leverage will have more than quadrupled since that time.

“Capital adequacy risk has risen from moderate to high due to high multi-unit volumes and the upcoming transition to the new Multi-Unit MICAT [Mortgage Insurer Capital Adequacy Test] framework taking effect January 1, 2026 as directed by OSFI.

The higher premiums may mean projects on the margin do not move ahead due to weakened economics.

So just to summarize, CMHC’s rental construction program has been so successful it’s spurred too much new supply, and is now pushing rents lower. This is putting pressure on the balance sheets of the developer and CMHC. As a result, the government has made the decision to slow the program.

In other words, We support affordable housing — so long as someone else figures out how to pay for it.

Remember the polticial promises to build 500,000 new homes every year?

Well, pre-sales have evaporated and now we’re curtailing the rental side.

The decison makes financial sense, but it is rather ironic.

Affordability shall remain illusive, as the collateral of the loans depends on it.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky July 14th, 2025

Posted In: Steve Saretsky Blog