July 7, 2025 | The Next Shoe to Drop

Happy Monday Morning!

Where do we start. This newsletter has been covering several big themes this year. We have long argued that housing starts are in the process of falling off a cliff. Both cities and provinces would start to panic as tax revenues dry up. They’ll be forced to ease development fees and boost demand side measures. We’ve also argued that CMHC’s rental financing program has been so successful, even too successful, that it would be scaled back. All three are playing out in real time.

Let’s start locally here in Vancouver.

The resale housing market continues to suck wind. Despite the Real Estate Board suggesting, “signs are emerging that sales activity is rounding the corner after a challenging first half to the year.” We disagree.

Home sales for the month of June were abysmal. It was the second slowest June in 20 years! Just barely behind June 2019.

What’s even more concerning is the pace of new listings, particularly in the condo space. There were nearly 3000 new condo listings in the month of June, surpassing all previous records.

So not only have investors stopped buying condos, they’ve actually become net sellers. Listings continue to outpace sales, adding to the bloated inventory pile. Obviously this is pushing prices lower.

Now imagine being a developer of new condos and seeing 7 months of inventory for sale on the resale market, falling prices, falling rents, and then trying to convince the investor market to pay 10-20% above resale comps for a product that won’t be delivered for another three years. Tough sell.

Unfortuntely there’s not a lot of room to cut prices. You already bought the land, and you can’t control commodity prices or interest rates. Development fees keep going up because, well, government. So, you simply can’t launch new product.

This is what WesGroup, one of Vancouver’s largest developers calls a cost of delivery crisis. “Housing projects across the country are being cancelled or delayed because they are no longer viable. Moreover, we are delivering housing at a cost that people cannot afford to purchase. I will say it again – This is a COST-OF-DELIVERY CRISIS.”

In other words, we really can’t build it for much cheaper and the market isn’t willing to pay the premium for brand new anymore.

And so, housing starts effectively go to zero. Or at least in Toronto they are.

There were just 42 new condos sold in the city of Toronto for the month of May. The ten year average for the month is around 2000 condos. In other words, this really is a crisis.

According to Altus Group, who tracks the data above, if this continues you can expect about 40,000 jobs evaporating in the GTA construction sector.

If you’re reading this and you’re a policy maker, it’s probably time to panic.

As expected, local politicians are starting to realize they have a problem on their hands. As housing goes, so too do tax revenues. A few weeks ago we saw the city of Vancouver adjust their development charges, allowing developers to effectively delay their development cost levies and community amenity contributions.

Now the BC government is doing the same on their side. Developers will be able to defer 75% of their provincial development fees for up to 4 years or until occupancy.

However, let’s be honest, we’re really just picking up nickels in front of a steamroller here. What you need is a significant uptick in demand to absorb any new condo launch.

Cue the foreign buyer.

Several weeks ago the Urban Development Institute, a lobbyist group for local developers sent a letter to federal Housing Minister Gregor Robertson arguing “Canada’s multi-family development model depends on pre-selling 60 to 70 per cent of units to secure construction financing. With the departure of both foreign buyers and domestic investors, this model is faltering and choking off the supply pipeline.”

The recent decline in real-estate market activity has “shown that (foreign buyers) were a critical component of the capital stack needed to get projects off the ground.”

The UDI wants the feds to amend the foreign buyer ban to allow foreign investment in newly constructed homes that carry rental covenants or demonstrable housing contributions. Something Rennie also advocated for several months ago.

In other words, the only ones eager enough to pay exorbitant prices for new condos are foreign buyers.

Removing the ban would be political suicide for any politician, but don’t be surprised if the ban quietly expires and doesn’t get renewed in 2027.

Until then, there’s going to be a lot of bodies floating to the surface. Something CMHC is starting to get worried about. They’re now carrying roughly 90% of all rental construction loans. That’s a lot of taxpayer exposure to a rental market with falling rents and no population growth.

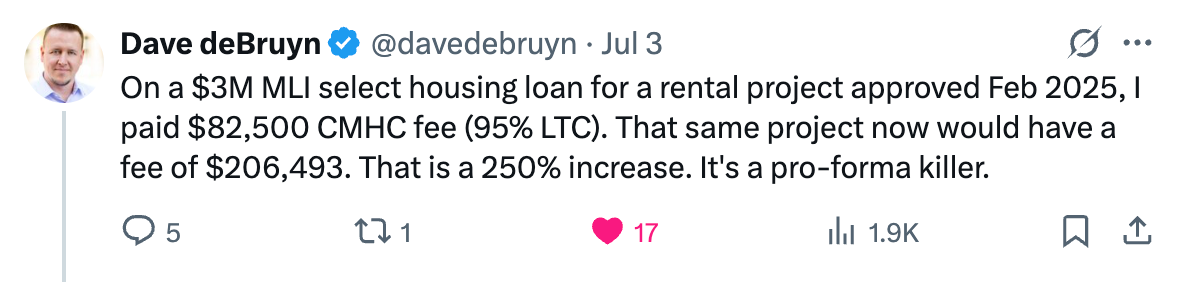

CMHC announced this past week they’ll be increasing insurance premiums for all Multi Family Loans.

The increases are significant.

It appears rental supply will be the next shoe to drop.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky July 7th, 2025

Posted In: Steve Saretsky Blog