May 9, 2025 | Warren Buffett Announces His Retirement

On Saturday, May 3 at a meeting with Berkshire Hathaway shareholders, Warren Buffett shocked the investing world in announcing his retirement as Chief Executive Officer at the end of 2025.

Buffett will stay on as Chairman of the board and his replacement will be Edmonton native and current manager of Berkshire’s non-insurance businesses, Greg Abel.

Will Berkshire Hathaway continue to be the powerhouse investment it was under Buffett’s 60-year tenure with a new person in charge?

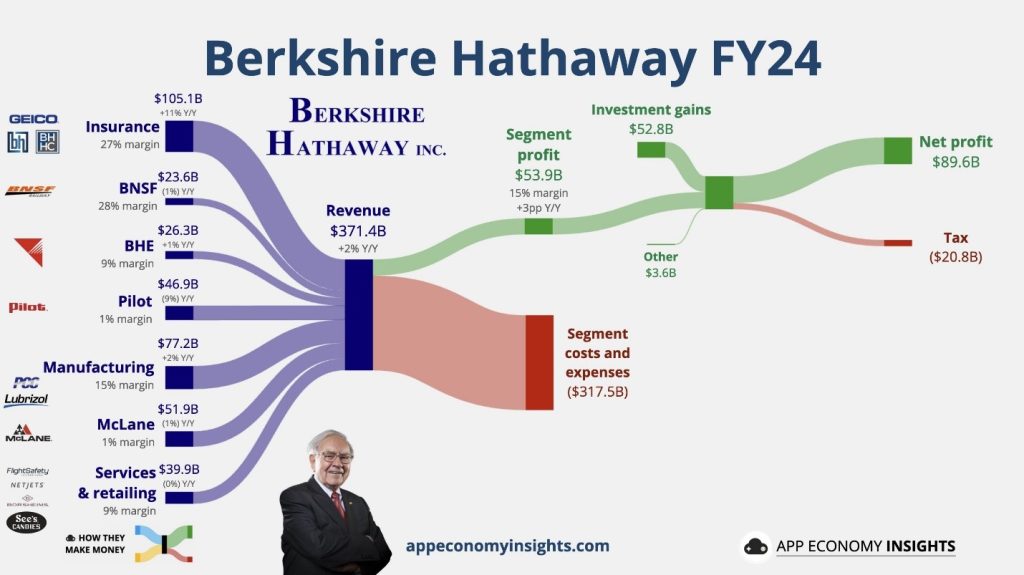

Berkshire Hathaway is a publicly traded conglomerate with its largest source of revenue being premiums from property and casualty insurance.

To understand this business, it helps to go back to Buffet’s 1999 letter to shareholders:

Our main business — though we have others of great importance — is insurance. To understand Berkshire, therefore, it is necessary that you understand how to evaluate an insurance company. The key determinants are: (1) the amount of float that the business generates; (2) its cost; and (3) most critical of all, the long-term outlook for both of these factors.

To begin with, float is money we hold but don’t own. In an insurance operation, float arises because premiums are received before losses are paid, an interval that sometimes extends over many years. During that time, the insurer invests the money. This pleasant activity typically carries with it a downside: The premiums that an insurer takes in usually do not cover the losses and expenses it eventually must pay. That leaves it running an “underwriting loss,” which is the cost of float. An insurance business has value if its cost of float over time is less than the cost the company would otherwise incur to obtain funds. But the business is a lemon if its cost of float is higher than market rates for money.

When Buffett took over Berkshire in 1965 he began investing this float according to the value investing principles of Benjamin Graham and bought stocks to hold and sometimes whole companies.

Warren Buffett in 1966 – Source: Omaha World-Herald

While he has made mistakes, the growth of Berkshire is remarkable.

Source: Berkshire Hathaway Company reports

Abel was mentioned by Buffett in early 2024 as a likely successor, which Hilliard covered in a post on March 1 – here.

The passing of Buffett’s mentor and long-time business partner Charlie Munger in November 2023 made it clear that Buffett needed to begin looking at the succession of Berkshire’s management more seriously.

With Buffett’s announcement, the stock market reacted negatively on Monday with Berkshire’s stock selling off by 5%. The stock was still positive on the year, up 13%.

Abel taking over won’t have a large impact on how Berkshire generates revenue or runs its business. The main question that market watchers are asking is what company will Berkshire acquire next.

With over US$300B in cash and short-term investments, there could be a wonderful company that Berkshire could acquire at a fair price, in Buffett’s words. Recently, Buffett hasn’t found one other than notable takeovers like Burlington Northern Santa Fe, a rail operator for $34B in 2009 and Kraft Heinz for $45B in 2015.

Hunting for these ‘elephants’ gets harder and harder but it’s likely that Abel will find one.

Berkshire usually makes large purchases when the stock market is in a correction. So, investors should take note that when Berkshire’s cash is at record levels, it’s a good time to be conservative with your own portfolio – as is the circumstance we are in now.

Fraser Betkowski

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth May 9th, 2025

Posted In: Hilliard's Weekend Notebook