May 17, 2025 | Trading Desk Notes for May 17, 2025

Global stock markets continue to bounce back from their April lows

Given that the April 7 lows were created by extraordinary tit-for-tat tariff increases between the USA and China, the “much better than expected” meeting between the two countries last weekend inspired a gap-higher opening this week, especially in tech issues.

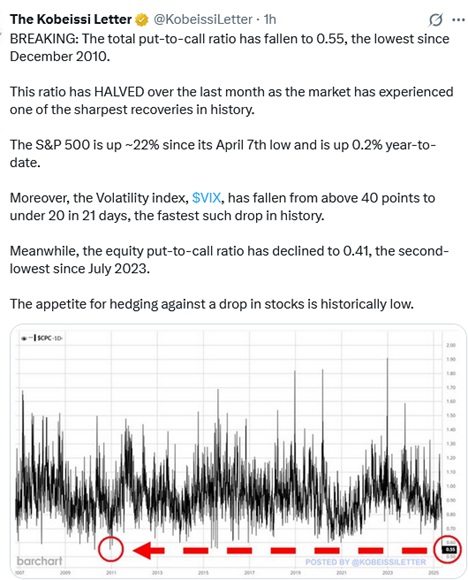

The S&P closed this week up ~23% from the April 7 lows, slightly above the 2024 close.

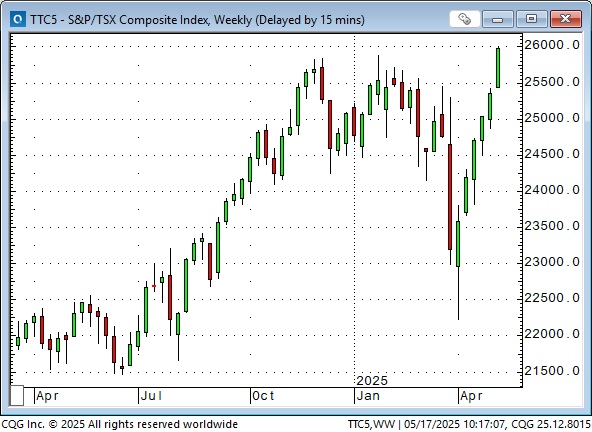

Canadian and German stock indices surged to all-time highs, rising for six consecutive weeks. What do Canada and Germany have in common? Both federal governments plan substantial debt-funded fiscal stimulus.

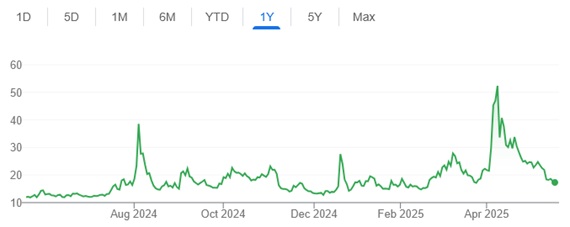

Volatility (the VIX) spiked in April to its highest level since the covid panic in early 2020, but has moderated as stock indices rallied back from the April lows.

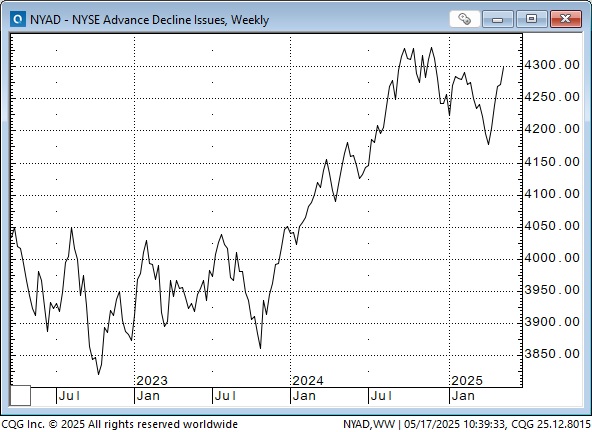

The NYSE Advance/Decline ratio reached a 5-month high this week.

Stock market sentiment was extremely bullish in January (Trump’s new “Golden Age” would lift “American exceptionalism” to new highs), then became extremely bearish in early April, with the S&P down more than 20%, and has now become extremely bullish again, with the S&P up ~23% in six weeks.

The swings from extremely bullish to extremely bearish and back to extremely bullish have been all about Trump. Tariffs have been the main issue, with a recent “assist” from improving (?) geopolitical concerns.

This week’s contribution to bullish sentiment: The USA and China appear to be on course to reach a tariff deal, while Trump “embraced Big Beautiful Deals” in the Mideast.

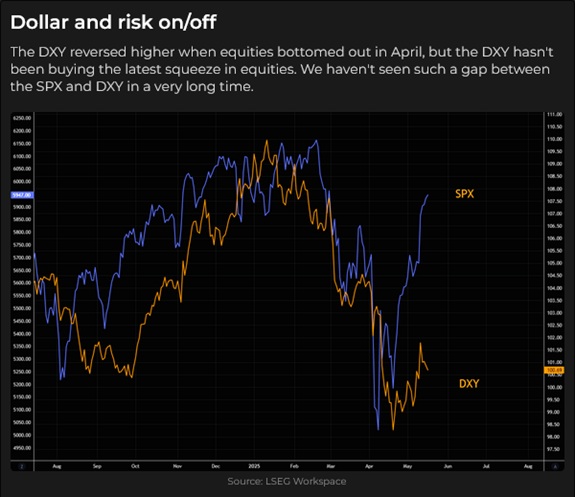

Currencies

The US Dollar Index rallied in Q4/24 with Trump’s election victory (blue ellipse) accelerating the rally. The index turned lower in January and plunged into mid-April as the Yen and European currencies rallied.

The USDX continued to weaken after the S&P bottomed on April 7 (blue ellipse) and finally turned higher on April 21/22 (pink ellipse), which was (as I described in last week’s notes) a Key Turn Date, when several different markets (including gold) reversed direction.

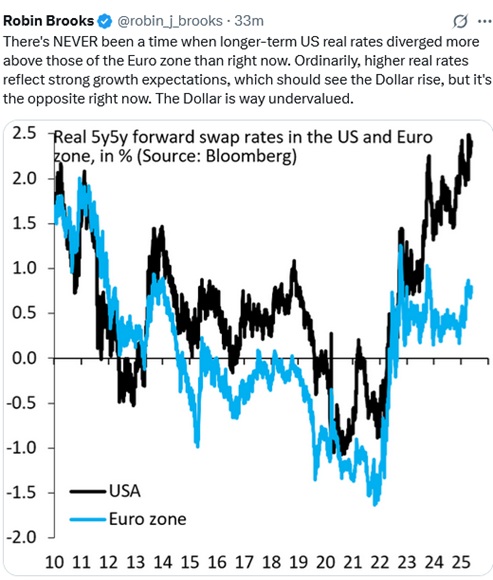

The USD weakness in Q1/25 was fuelled by thoughts that it was overvalued (especially against Asian currencies) and that Trump would want a “dollar devaluation” to reduce the American trade deficit. The decline accelerated as foreigners became concerned about Trump’s pronouncements and worried that the USA might renege on some of its overseas commitments. These worries likely contributed to some repatriation of capital from the USA.

The fact that the USDX has only rebounded ~3% from April’s lows (while the S&P has rallied ~23%) may indicate that foreigners are still “leery” about Trump’s lack of respect for longstanding international relationships. Then again, the discrepancy between the tepid USD rally and the soaring S&P may indicate that the “animal spirits” in the equity markets are engaged in “irrational exuberance!” Caveat emptor.

Alternatively, the USD may be a bargain at these levels!

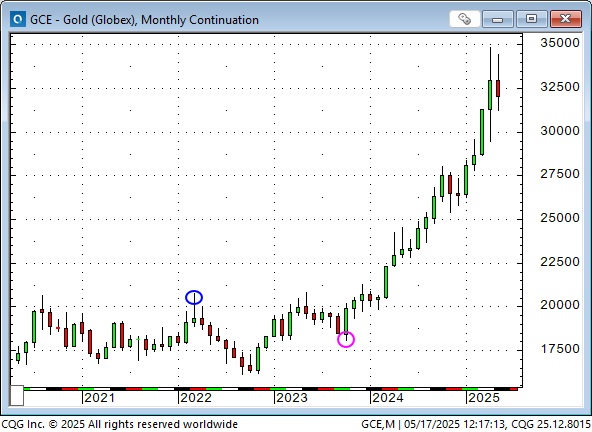

Gold

Gold soared to all-time highs of ~$2,080 following the Russian invasion of Ukraine (blue ellipse) but then trended lower for seven consecutive months (it fell nearly $500 or 24%) as the USD and US interest rates rose sharply.

The Hamas attack on Israel in October 2023 (pink ellipse) marked the beginning of a rally that saw gold nearly double in price, rising to ~$3,500 in April 2025. Central bank buying was credited with fuelling this advance.

Gold’s intraday price action has been very choppy since peaking on April 21, the same day the USD bottomed (blue ellipse). Several days have had more than a $100 price range between the highs and lows.

A kilogram of gold is 32.15 troy ounces. Would you rather have a kilo of gold or a Bitcoin?

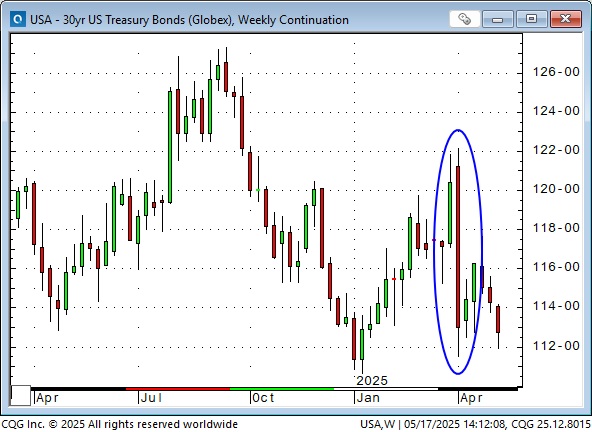

Interest rates

With the S&P down ~20% in early April, the forward short-term interest rate market was pricing in possibly five 25bps cuts by December 2025. Now, after the massive 6-week stock market rally, the market is pricing two cuts.

The week of April 7 was the worst for the long bond in years, and many analysts claimed that soaring bond yields, not the tumbling stock market, caused Trump to backpedal on his tariff demands.

Bonds rallied with stocks and the USD from the April 21/22 Key Turn Date (blue ellipse) but turned lower at the end of April. Yields are now back near the early April highs as the market worries about unsustainable government deficits. The Big Beautiful Budget may not have enough supportive Congressional votes.

My short-term trading

I started this week long the S&P and short bond puts. I was money ahead on both trades at last Friday’s close.

The S&P gapped ~80 points higher on Sunday afternoon (blue ellipse) following “great news” about the meeting between American and Chinese trade negotiators in Switzerland. But the market couldn’t sustain the opening bid, and I covered my position for a gain of ~80 points, thinking the market was pricing in more hope than substance over the meeting’s results.

As Sunday afternoon turned to evening (Pacific coast time), the market drifted sideways, and I went to bed happy to have taken profits.

When the European markets opened at midnight (my time), the S&P exploded for another 80-point rally (pink ellipse). In hindsight, it was very unusual for the overnight S&P market to trade sideways, with minimal volume, during the “Asian” hours, and then explode higher on the European opening.

I refused to “chase” the market, and it closed Monday on its highs and continued to grind higher all week. The good news was that I had the “patience” not to short it!

The 113 strike bond puts that I was short expired on Friday morning, so the clock was ticking in my favour on Monday and Tuesday with the puts remaining OTM. However, on Wednesday (blue ellipse), the bonds lurched lower, and my puts went into the money, so I decided to take a small loss and get out (I didn’t like the look of the bonds possibly closing at 4-month lows).

My P&L had a modest gain for the week, and I went into the weekend flat.

Thoughts on trading

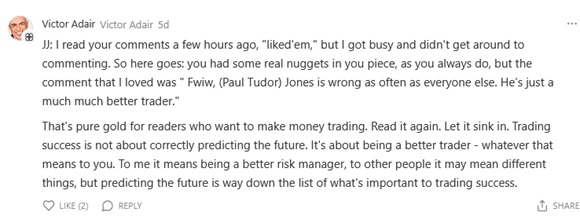

I posted this note in the comments section of Market Vibes on Substack last week:

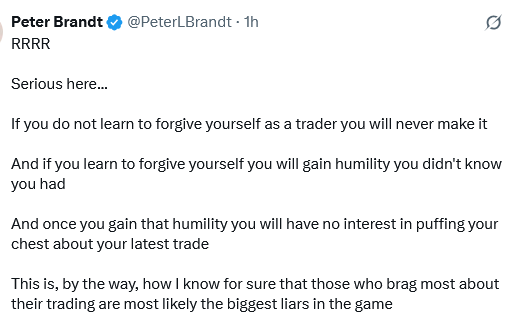

Here’s a gem from Peter Brandt on Twitter:

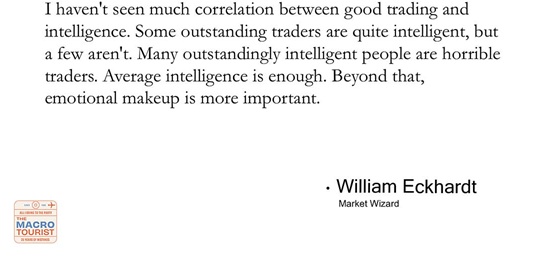

My friend Kevin Muir (The Macrotourist) posted this on his Substack:

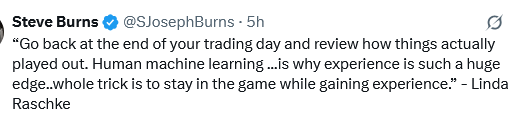

Steve Burns posted this gem from Linda Raschke on Twitter:

Jason Shapiro, from Crowdedmarketreports.com, made this comment in a YouTube video about two weeks ago:

“This is not a game of guessing where the price is going to go. This is a game of getting into a situation (a trade) where the risk-reward is skewed in your favour. “

“Your drawdown is going to reach your average annual return at some point – you’d better be comfortable with that. Drawdowns are your test – that’s when you find out who you are, why you trade.”

The Barney report

Two sides of my boy Barney:

1: Standing proudly on a log in the forest, surveying the landscape:

2: Snoozing in my reading chair, waiting for me to finish writing the Notes and wishing he were outside, standing proudly on a log in the forest.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the amazing rally in global stock markets over the last six weeks and why the Canadian and German markets are surging to new all-time highs. You can listen to the entire show here. My spot with Mike starts around the 42-minute mark. Be sure to also listen to my good friend and money manager, Paul Beattie, talk about the markets he trades.

Listen to Jim Goddard and me discuss markets

I did my monthly 30-minute interview with Jim Goddard this morning on the This Week In Money show. We discussed the wild swings in global equity markets from extremely bullish to extremely bearish and back to extremely bullish over the past three months. We also discussed why Canadian and German markets have gone to all-time highs, why the USD is “way behind” the rally in stocks, and my thoughts on gold, the Canadian dollar and WTI. You can listen to the entire show here. Be sure to also listen to my good, long-time friends Ross Clark and Mark Leibovit.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 17th, 2025

Posted In: Victor Adair Blog