May 19, 2025 | Saving Housing

Happy Monday Morning!

Canada has a new housing minister. Gregor Robertson, former mayor of Vancouver, has been anointed by Prime Minister Carney with the hopeless task of fixing Canada’s housing crisis. It’s already off to a rough start.

When asked by a reporter if home prices need to go down, he had a freudian slip. “No, I think that we need to deliver more supply, make sure the market is stable.”

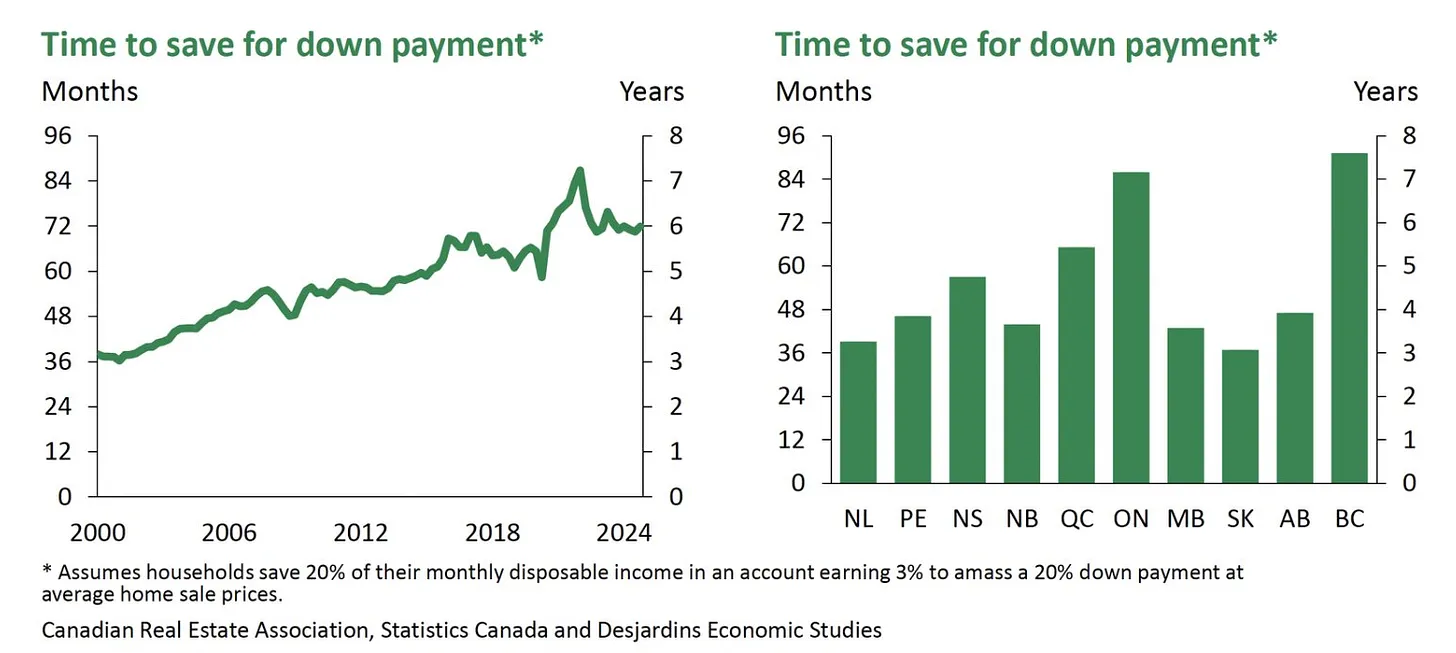

The comments sparked outrage across the media, particularly amongst the younger generation that has seemingly been priced out of housing. According to Desjardins, it now takes an average of 6 years to save for a downpayment on a typical home in Canada, that’s up from just 3 years in the early 2000’s. That’s undoubtedly much higher in cities like Vancouver & Toronto.

Robertson then made the mistake of doubling down in an interview with CBC. Suggesting, “We’ve got to create some incentives and opportunities for people to get into the market, we got to make sure that peoples assets are obviously protected, and that’s the market housing. But a big focus now on affordable housing.”

In other words, Canada’s housing minister is attempting to ride two horses with one ass, trying to maintain current home values while simultaneously flooding the market with new supply.

The idea of creating housing affordability without suffering a decline in home values is a fairytale as old as time. A convenient lie told by policy makers from all sides. This is not new. In fact, former PM Trudeau told as much last year. Saying “Housing needs to retain its value,” Trudeau told The Globe and Mail’s City Space podcast last year. “It’s a huge part of people’s potential for retirement and future nest egg.”

In other words, everyone wants affordable housing but nobody wants their house to become affordable.

It’s no secret policy makers in Canada have an implicit put on the market. Every time housing wobbles they aren’t far away, either through policy changes or simply turning a blind eye to questionable lending practices.

- Global Financial Crisis, drop rates to zero and introduce the IMPP (insured mortgage purchase program) to keep credit churning.

- Global Pandemic, drop rates to zero and allow anyone and everyone to defer their mortgage. A whopping 18% of all mortgages went into deferral.

- Interest rates surge starting in 2022, variable rate mortgages become negative amortizing with amortizations blowing out to 50, 60, 70+ years. Some banks even allow customers to defer outstanding interest and tack it onto their mortgage balance.

- Blanket appraisals on pre-sale condos. Some banks are financing underwater new construction condos at 100% LTV to prevent defaults, often tied to their construction financing book.

We say we want affordable housing, but do we really?

Policy makers are about to face another test. Home price declines are mounting, now down 18% (nationally) from the peak, and 29% in real terms. Sentiment has collapsed and further price declines seem like a foregone conclusion. How long will policy makers let this go on before flinching?

Minister Robertson says “we need to deliver more supply, make sure the market is stable” yet right now we have neither. Not only is the market not stable, but new supply is crashing. GTA pre-sales are at 30 year lows, bringing developers to their knees and bringing the rest of the industry down with it. Some would call it a much needed purge, others would call it a crisis.

Let’s see who flinches first.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky May 19th, 2025

Posted In: Steve Saretsky Blog