July 19, 2025 | Trading Desk Notes for July 19, 2025

The Trend Is Your Friend – summerweight edition!

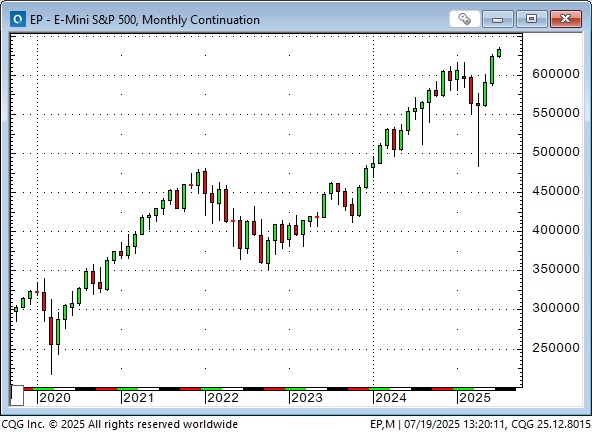

The S&P has rallied nearly 10X in the last 16 years.

It is up ~3X from the covid lows five years ago.

It’s up ~30% from the April 2025 “Liberation Day” lows.

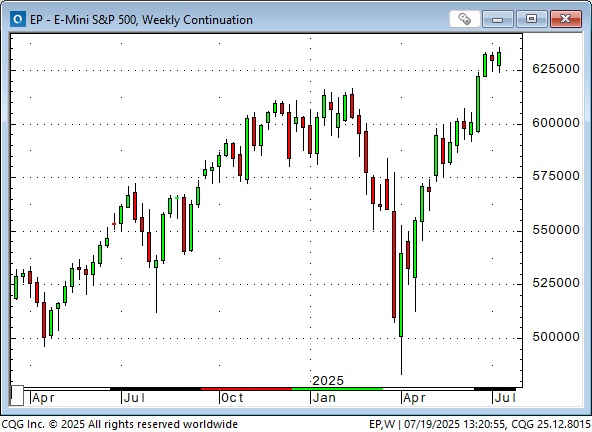

And this week, when the S&P fell ~100 points on “fresh news” that Trump was planning to fire Powell (this time for real), it was just another opportunity to BTD! – The market came roaring back and made new all-time highs on Friday.

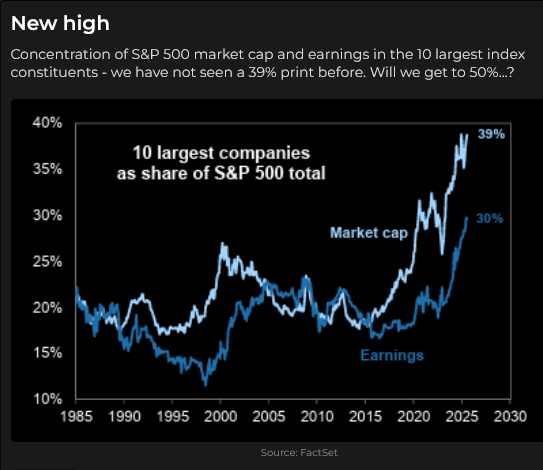

Big-cap tech is on fire (especially NVDA, up over 100% from the April lows) and is pulling all stock markets higher; concentration is not a concern.

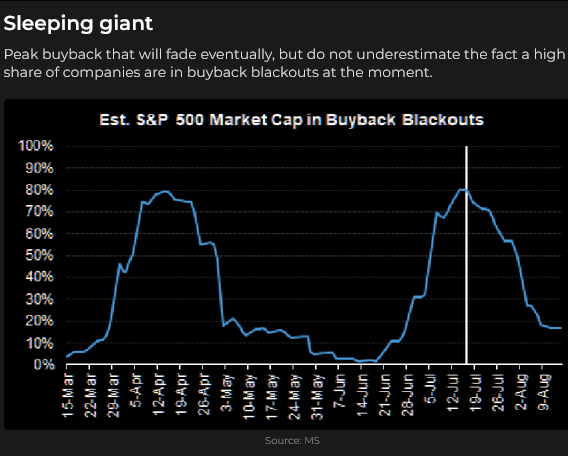

Corporate buybacks are in peak “blackout” season (companies cannot buy back their stock ahead of quarterly reports), but the blackouts will be over by early August.

Currencies

The US Dollar Index trended lower in H1, from multi-year highs, but has had a wee bounce since July 1.

Some analysts believe that foreign institutions have been hedging some of the currency risk on their (considerable) US investments, after years of being underhedged, and this has been the “driving force” behind the dollar’s decline YTD.

Net speculative short positions in the currency futures market are at multi-year highs, exacerbating the pressure on the USD.

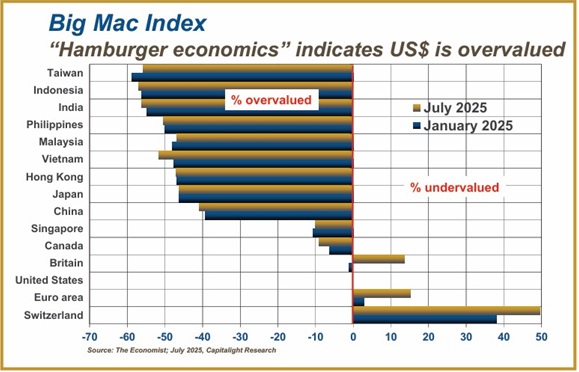

Asian currencies are especially “under-valued” relative to the USD, as those countries keep their currencies low to compete with one another to export goods to the USA. (The Big Mac Index was developed 40 years ago by The Economist Magazine as a light-hearted way of illustrating purchasing power parity. This chart, from the Gold Monitor, shows that the USD is overvalued against the leading Asian currencies. Note that the USD is significantly undervalued against the Swiss Franc, the world’s strongest fiat currency.

Interest rates

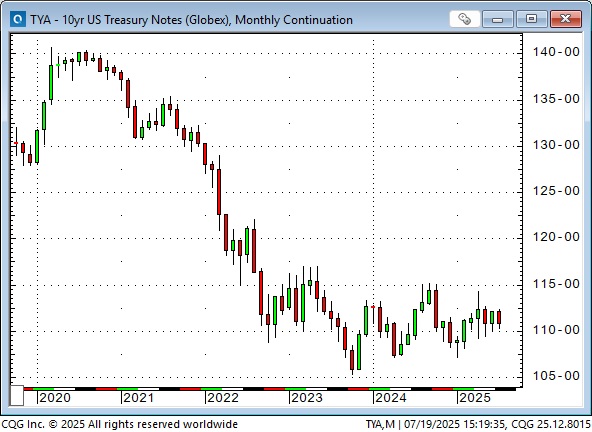

The yield on the US 10-year Note reached an all-time low of ~0.50% in August 2020 and is currently ~4.42%.

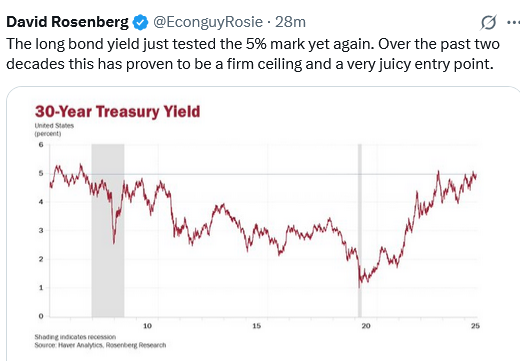

My view is that Trump wants to run the economy “HOT” with stimulative fiscal policy and stimulative monetary policy, as he believes “growth” (and tariff income) will make up for tax cuts and reduce the debt and deficits. MAGA. He claims that Powell is “costing the country hundreds of billions of dollars” by not cutting interest rates.

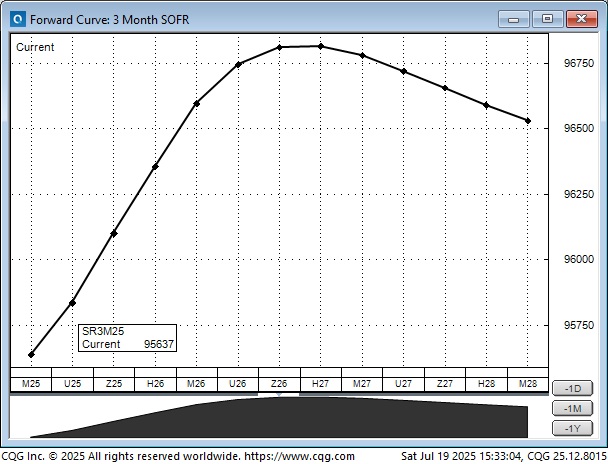

The forward curve of the SOFR (Secured Overnight Financing Rate) futures indicates that the market currently expects the 3-month rate to decline by ~118 basis points from current levels by December 2026.

Coming soon

There will be an upper-house election in Japan on Sunday that may precipitate a change of government. 30-year bond yields (~3.2%) are at historic highs, and inflation (especially food price inflation) is unpopular.

The Yen has been weakening against the USD and is down ~7% since mid-April. It is at an all-time low against the Euro.

Trump’s August 1 deadline is fast approaching, and very few trade “deals” have been agreed upon. Markets may be underestimating the possibility of trade “wars.”

The Bank of Canada and the FOMC will announce their interest rate policies on July 30. No change is expected from either institution. The ECB meeting is on July 24 – likely no change.

Quarterly reports for a raft of corporate heavyweights are due over the next two weeks.

My short-term trading

I started the week with a net short British Pound position (short futures, short OTM puts) and short the S&P.

I was stopped for a slight loss on the S&P short overnight Sunday when the market spiked on news that NVDA (and other companies) would be allowed to sell chips to China.

I reshorted the market and covered the position for a slight profit when the market tanked on Tuesday, when reports that Trump was close to firing Powell. My net P&L on the S&P was a wash for the week.

I was stopped for a decent profit on the short GBP futures position when the market rallied on Friday. I stayed with my short GBP puts (slightly in the money), which expire next Friday. The time value of the puts will erode quickly over the next few days, but if the Pound weakens much more, I will cover the puts.

This week’s Notes are much shorter than usual because, well, because it’s summertime and the weather is excellent and the British Open is on and Barney wants to play. I will probably write more next week.

My wife and I became grandparents last week when her daughter (my step-daughter) had beautiful twin girls.

The Barney report

Barney loves the long sunny days of summer and going for long walks in the forest with me. Life is good.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the market reaction to the news on Tuesday that Trump was “very close” to firing Powell. You can listen to the show here. My segment with Mike starts around the 55-minute mark.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair July 19th, 2025

Posted In: Victor Adair Blog

Next: Inflationary Confusion »