May 3, 2025 | Trading Desk Notes for May 3, 2025

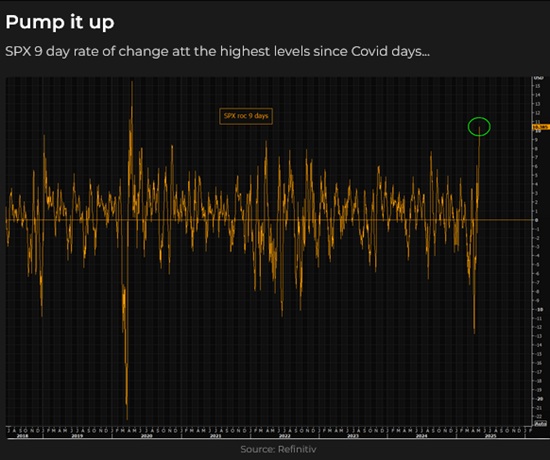

The 180-degree turn in market sentiment from bearish to bullish has been sustained, powering the S&P higher for nine consecutive days

The S&P was down ~22% at the April 7 lows (blue ellipse) following “Liberation Day” and subsequent tariff escalations. Two days later, Trump “paused” many of the tariffs to allow for “trade deals” to be negotiated, triggering a spectacular rally. However, over the next several days, sentiment turned negative again, and the S&P gave back nearly half of the huge one-day gains.

However, sentiment turned bullish last Tuesday, and the S&P has traded higher for nine consecutive days. At Friday’s close, the index had recovered about two-thirds of the decline from February’s highs to April’s lows. The “mood swing” to more positive sentiment was fuelled by expectations that tariffs may not be as severe as announced and that “trade deals” would be reached with key countries, including Japan, India, and China.

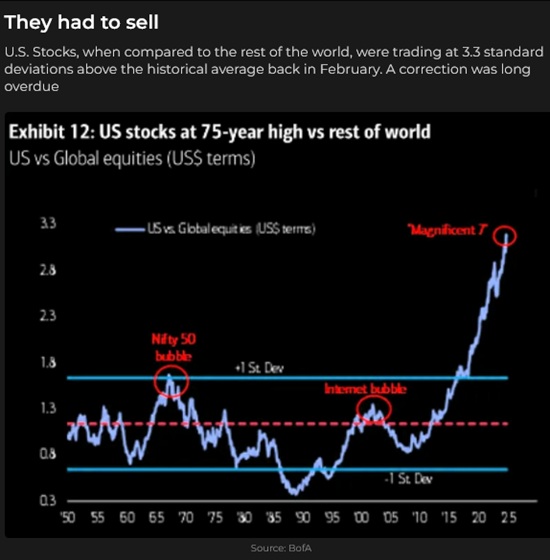

The US stock market, especially big-cap tech, was “richly valued” at the highs and “overdue” for a correction. Some “hot money” accounts appear to have aggressively shorted “overvalued” American equities as they fell, and those accounts may have been aggressively short-covering their positions recently.

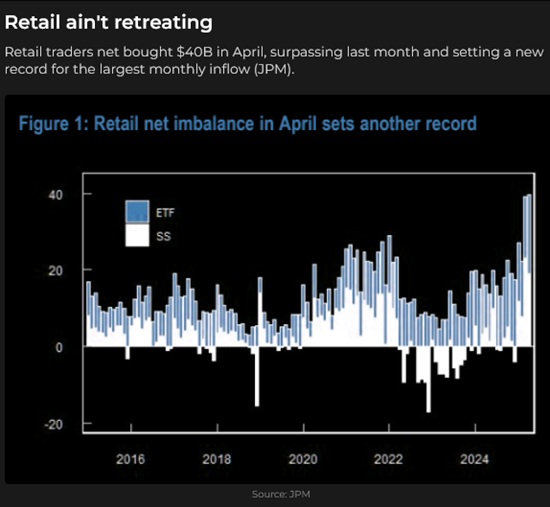

Retail never lost faith.

The NAZ is up ~22% from the April 7 lows, recovering about two-thirds of the February to April decline.

MSFT’s strong quarterly report extended the rally in the leading American indices this week.

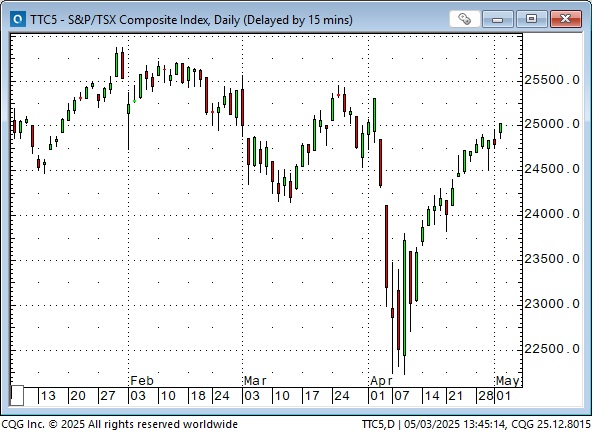

The TSE composite Index has rallied ~12% from the April lows, and is now down ~3% from January’s all-time highs.

Volatility spiked across asset classes in early April but has fallen sharply as equity markets have rallied. (That spike in early August 2024 was tied to a spike in the Yen and the “forced” unwinding of Yen carry trades.)

Gold

Comex gold prices hit all-time highs nine days ago at ~$3,510, basis June, then fell ~$300 (9%) to this week’s lows as the S&P rallied ~12% over the same nine days.

Here’s a lightly edited note I sent to an old friend this week:

I think the gold price has been “discovered” in Shanghai recently. That’s where the “demand” is—prices in NY and London tag along.

If the gold price were being “discovered” in NY, open interest and speculative net long positioning would rise, not fall, as the price increases. It looks like NY traders have been liquidating (taking profits) on their long positions and covering (taking losses) on their short positions.

Physical gold is moving from West to East. Shanghai spot gold frequently trades at a (sometimes substantial) premium to NY and London.

A risk for gold bulls is that Chinese speculators “pile on” to a rising market, taking prices too high too quickly, and then they sell “en masse” if/when prices fall.

Currencies

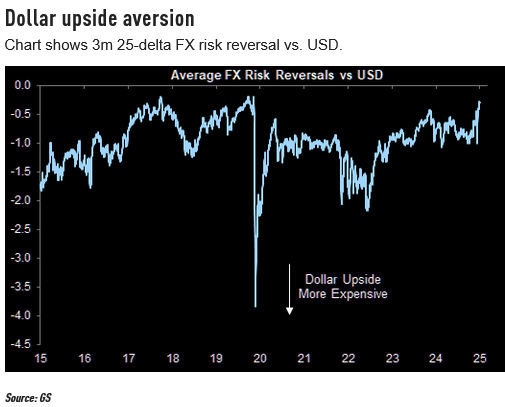

The US Dollar fell to a 3-year low on April 22 (blue ellipse), down ~11% from January’s highs. It then turned higher and has rallied for the last nine days, as gold has declined and US equity indices have rallied.

The Japanese Yen hit six-month highs on April 22 (blue ellipse), up ~12% from January’s lows, and has trended lower for the last nine days. COT data as of April 29 shows that speculative accounts hold their largest-ever net long position in the Yen. (They had their largest ever net short position early last July before official intervention ignited a short squeeze that took the Yen ~14% higher in five weeks.) The BoJ was “more dovish than expected” at their meeting this week, igniting a sharp Yen breakdown on Thursday.

The “offshore” RMB briefly fell to record lows on April 8 on tit-for-tat tariff increases between the US and China. However, it rose sharply (after rallying for the last nine days) on Friday, as it appears the US and China may begin trade negotiations.

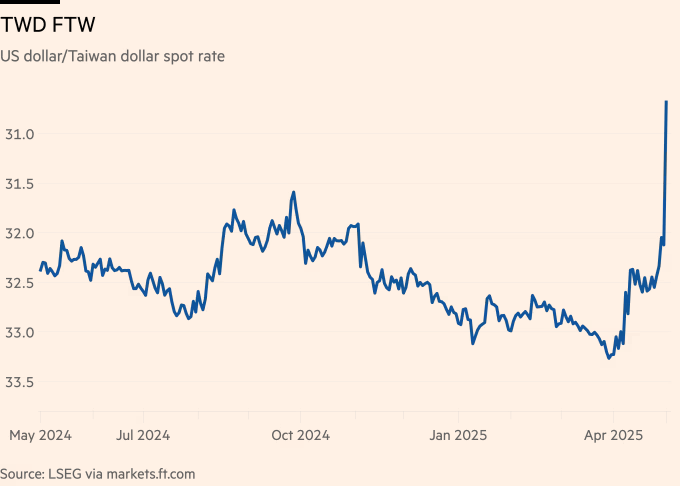

The Taiwan dollar soared late this week. (This chart is from Friday’s FT.)

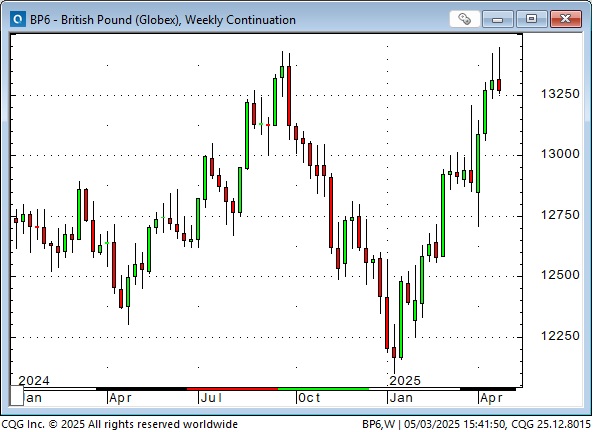

The British Pound rallied ~11% from January lows to 3-year highs at the end of April, as virtually all currencies, regardless of their individual “issues,” have rallied against the USD YTD. (I’m considering a short position against the Pound at these levels, given the daft UK energy policies that have produced some of the highest electricity prices anywhere.)

The Canadian Dollar tumbled to multi-year lows below 68 cents (blue ellipse) on February 3, when Trump imposed 25% tariffs on Canada and Mexico. That same day, after Trump “paused” the tariffs, the CAD had its largest one-day rally in years. The Loonie closed up ~5 cents (7%) this week from the February lows.

The Canadian Federal election this week resulted in a Liberal minority government. Prime Minister Carney had a “very constructive” telephone conversation with President Trump this week and will meet the President at the White House on Tuesday. King Charles will officially open Parliament on May 27. (They’re pulling out all the stops. They know Trump loves the British Monarchy.) The last time the head of state opened the Canadian Parliament was Queen Elizabeth in 1977.

About one year ago, speculators began building a net short position on the CME against the CAD. They have remained net short ever since. At the end of 2024, with the CAD down about 6 cents from the beginning of the year, it was the largest net short CAD position ever. The speculators began reducing their short position in January, and as of April 29, COT data shows it was down >60% from its maximum size.

Over the last nine days, the CAD has gone sideways while the S&P has rallied, and the Eurozone currencies, gold, WTI, and commodity indices have fallen. Interest rate premiums still favour the USD over the CAD. The CAD has not been closely correlated with any of its “usual suspects” recently, so if Carney and Trump “hit it off,” the CAD could rally independently of its usual correlation partners. If they say nasty things about each other, the CAD could tumble.

Crude oil

This week’s front-month Nymex WTI futures close was the lowest in over four years at $58.38. Prices are down ~28% from the early January highs. OPEC+ plans to increase production, and the market fears that a global economic slowdown may reduce demand. Trump’s threats of severe sanctions against anyone who buys Iranian oil didn’t boost prices. (Sanctions don’t limit production but create lower prices because buyers need compensation for the risks of buying “forbidden” products.)

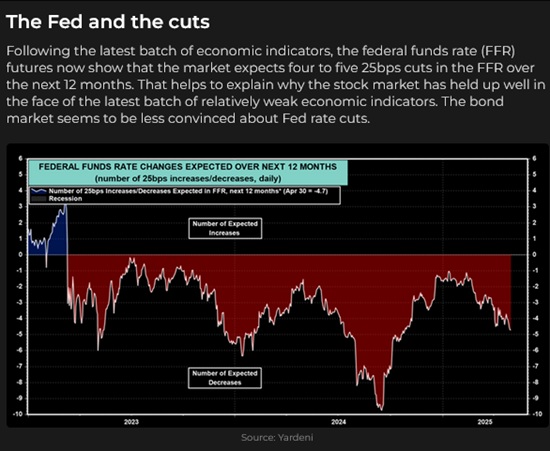

Interest rates

My short-term trading

I started this week with a short Yen position I established last week. I covered the trade for a slight profit on Monday to go flat ahead of a scheduled surgery on Tuesday. I didn’t know how I would be after the surgery, and getting flat seemed like the right thing to do. It went very well, but I felt a little “out of touch” on Wednesday and Thursday, and with the employment report coming on Friday, I stayed flat. I got short the Yen again on Friday and held that into the weekend.

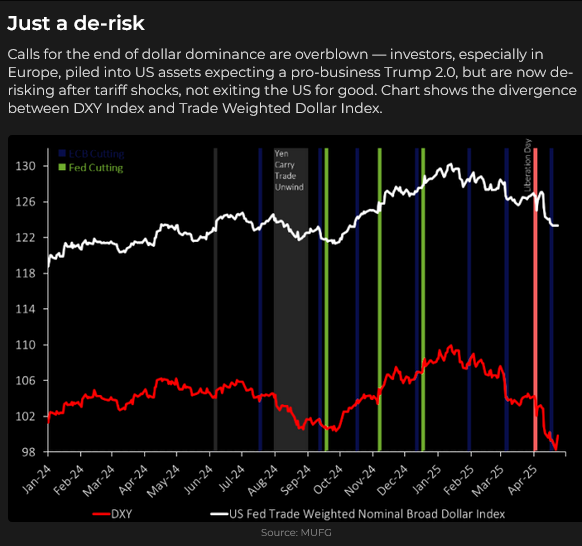

Nobody likes the USD.

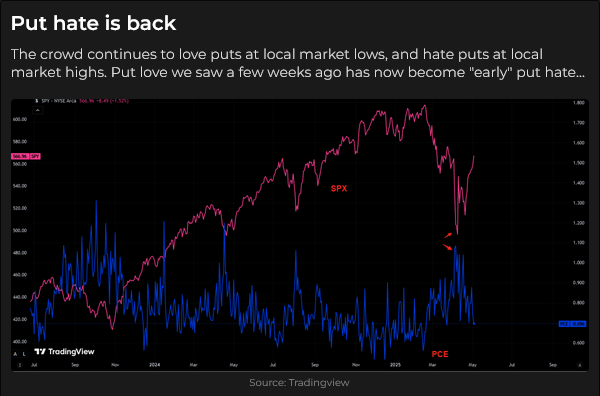

The nine consecutive days higher in the S&P (and the sharp decline in VOL) mean “nobody” wants to buy S&P puts, and they are much cheaper than they were two weeks ago.

Thoughts on trading

The surgery was a good opportunity to practice patience and realize that I didn’t have to trade this week because, more than likely, the markets will be open again next week. (h/t to my old friend, Peter Appleby!)

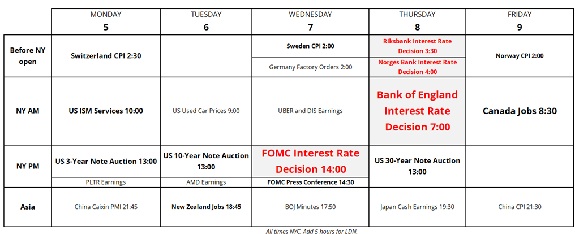

Brent Donnelly’s calendar for next week

The Barney report

I didn’t know if I could walk Barney in the days immediately after my surgery, but fortunately, two of my neighbours volunteered to do that if I couldn’t. (Everybody around here loves Barney!) It turned out that I had no problem walking him, and since the doctor told me no golf, cycling, squash, gym, or swimming, walking Barney will be my main exercise for the next few weeks! Here he is yesterday on one of our favourite forest trails.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the continuation of the 180-degree swing from bearish to bullish sentiment across markets. You can listen to the entire show here. My spot with Mike starts around the 1-hour 13-minute mark. Don’t miss Doomberg and Mike beginning around the 7-minute mark. Years ago, I followed Doomberg on the Grant Williams show and became a subscriber as soon as he started his Substack blog.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 3rd, 2025

Posted In: Victor Adair Blog