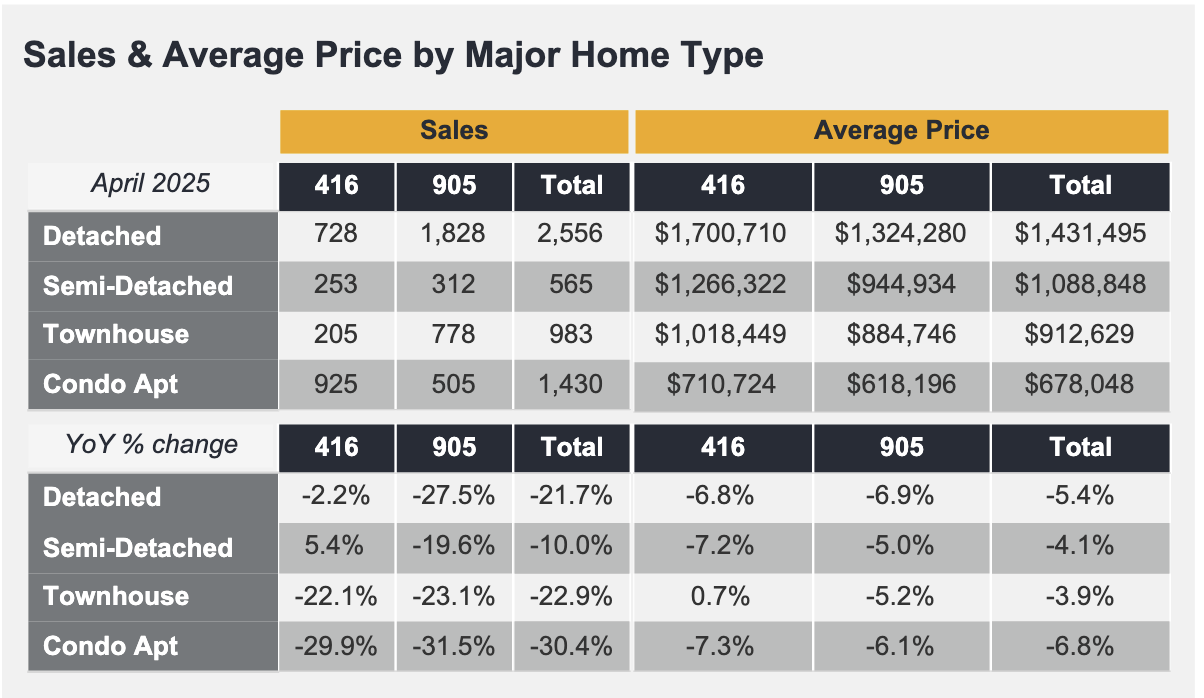

TRREB is Canada’s biggest real estate board, covering the Greater Toronto Area (area codes 416 and 905, as shown below), which has the largest population concentration in Canada. TRREB just posted April numbers (here); year over year, single-family home sales were down 22%, and condo sales were down 30%.

An hour or so in each direction of metro Toronto—places that saw the largest buying frenzy during the ultra-low rate era, 2019-2022—average sale prices are down more than 20% year over year. New listings are leaping daily, and some sellers are starting to panic.

An hour or so in each direction of metro Toronto—places that saw the largest buying frenzy during the ultra-low rate era, 2019-2022—average sale prices are down more than 20% year over year. New listings are leaping daily, and some sellers are starting to panic.

Even so, the median GTA selling price of $950k remains a ludicrous 11x the median household income of about 80k. As a reminder, the long-term affordable home price-to-income ratio, commonly called the “median multiple,” is a key indicator of housing affordability. Historically, a ratio of 3x or less has been considered affordable–meaning a median home price three times the median household income (see here). After home prices tanked in the early 1990s, the Canadian national median price hovered around 3 to 4 times the median household income for about a decade.

Many people erroneously believed that home prices only went up and did not realize that housing bubbles typically end with significant price declines that do not recover for many years. Unfortunately, many ill-informed decisions were made as the financially blind led the financially blind and unaware.

Real estate is the most widely owned and leveraged asset, so housing downturns have historically led to the most painful economic contractions. This is a huge macro theme with reverberations yet to unfold.

What do we make of this? What happens next? Ron is one of the few who has actually gone through this disaster before, in 1990. Here is a direct video link.