The spreading downturn in real estate is the typical and foreseeable mean reversion of the speculative mania that prevailed through the years of near-zero interest rates.

The condo market in two of Canada’s big cities has taken a major downturn. CBC’s Nisha Patel breaks down three reasons why condos aren’t selling in the middle of a housing crisis. Here is a direct video link.

Not just in Canada, and not just condos; home prices are falling in many US markets, too.

Housing supply is skyrocketing across Southwest states like Arizona, Nevada, Utah, and Colorado, suggesting that the 2025 housing market is amid a correction in these states. Here is a direct video link.

Builders now have more completed but unsold homes on lots than at any time since 2009. See, First-Time Home Buyers Are Struggling. That’s Bad News For Builders:

People buying their first homes in the existing market are about a decade older than historical norms, at 38 years of age, according to Jessica Lautz, deputy chief economist at the National Association of Realtors.

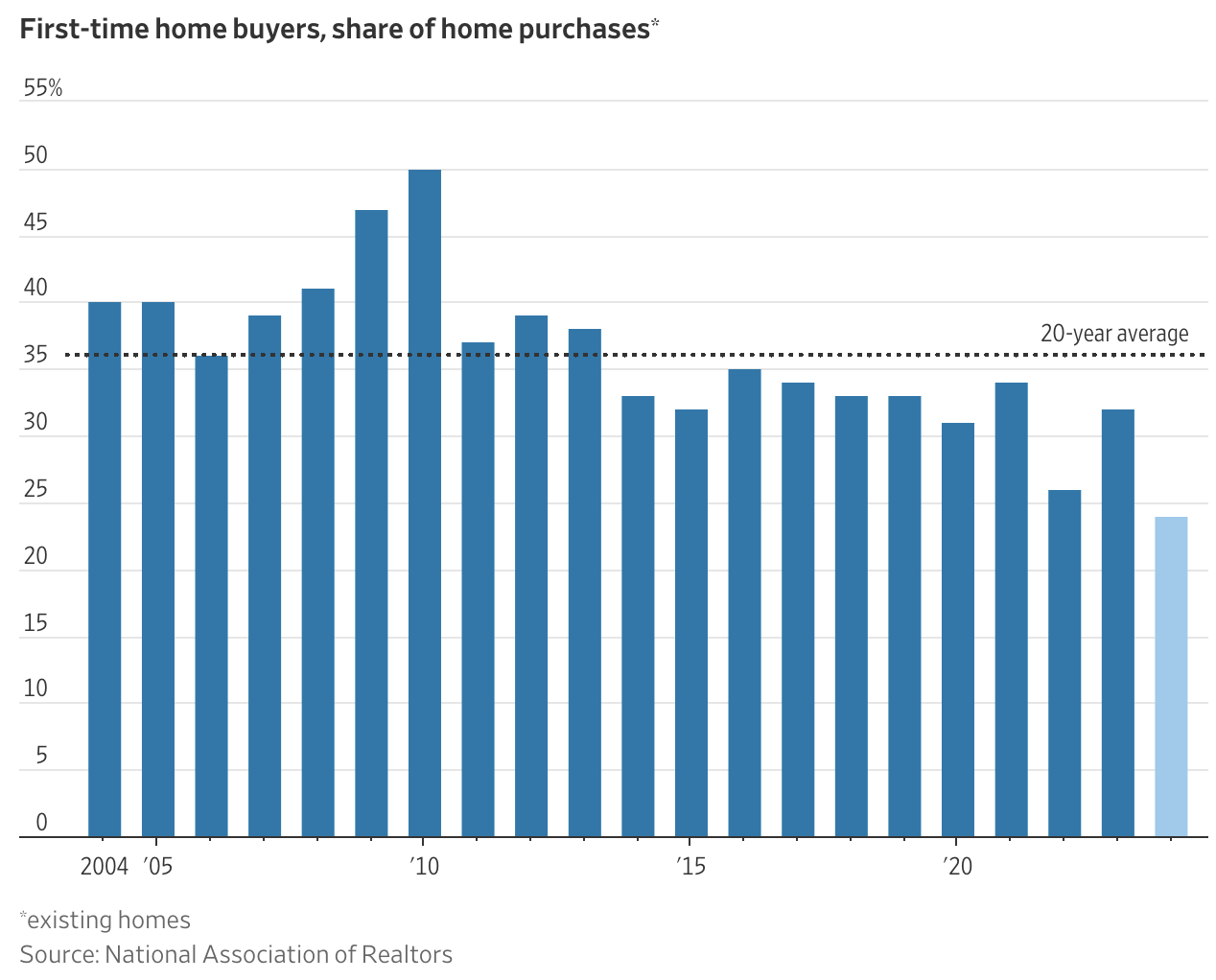

Their median household income has shot up to $97,000, and last year they had a 9% down payment on average. These buyers had to wait until they were older and had higher incomes for homeownership to be affordable. The share of first-time buyers in the existing-homes market is at a record low (shown below).

As bubbles burst, real estate “corrections” tend to last 4 to 6 years, with prices not recovering prior highs for years after that. Traditionally, housing has led the harshest economic contractions.

Then, we have a tariff shock hitting the highly leveraged economy on a scale not seen since the 1930s (the present US weighted average tariff rate is estimated at 14% vs. 2.5% at the start of 2025, shown below via Barclays and The Daily Shot).

These increased costs are expected to be evident in the price of goods this summer–some food for thought and personal risk assessment.

The United States and China to drastically roll back tariffs on each other’s goods for an initial 90-day period, in a surprise breakthrough that has de-escalated a punishing trade war and buoyed global markets. The announcement, which was made in a joint statement, comes after a weekend of marathon trade negotiations in Geneva, Switzerland by officials from the world’s two largest economies, during which both sides touted “substantial progress.” Here is a direct video link.