May 2, 2025 | Household Struggles Weigh on Real Estate and Spending

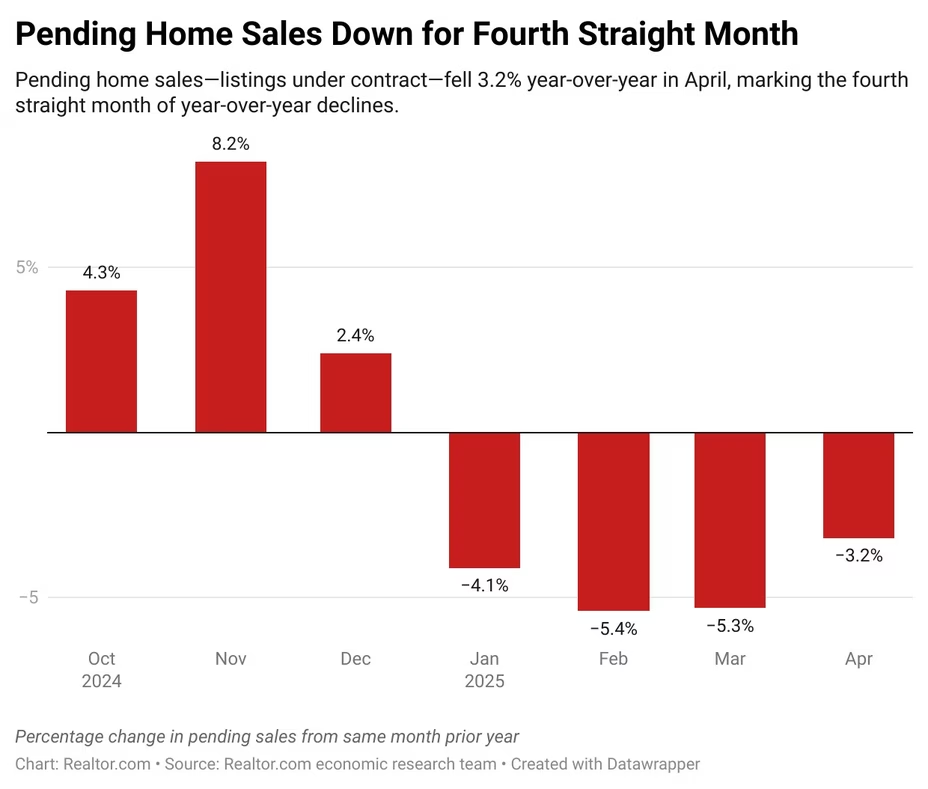

A surge in active listing supply and an increase in price reductions failed to lure more homebuyers off the sidelines in April, as US pending home sales dropped for the fourth consecutive month (chart below via Realtor.com®).

The new monthly housing trends report estimates that a household now needs to earn $114,000 annually to afford a median-priced home. That’s up 70% from $67,000 just five years ago.

The sharp increase in income requirements has been fueled by both rising home prices and higher mortgage rates.

Median list prices in April were up 37% from five years ago, while 30-year mortgage rates averaged 6.73% last month, compared with 4.14% in April 2019.

The trouble is that as of March 2025, the median household income in the United States was approximately $82,675 USD, some 31k short of what is needed to qualify for a median-priced home.

Meanwhile, a Lending Tree Survey found that 25% of buy now, pay later (BNPL) users were funding grocery purchases with the loans, up from 14% in 2024. Forty-one percent of respondents to the survey said they made late payments on their BNPL loans, compared with 34% in the prior year. BNPL loans charge late fees and interest rates up to 35%. See: More Americans are financing groceries with buy now, pay later loans.

At the same time, consumer bellwether McDonald’s reported that U.S. same-store sales shrank 3.6% in the first quarter—the worst home market drop since the 8.7% plunge during the second quarter of 2020 during COVID lockdowns.

Starbucks reported that its global same-store sales fell 1% in the second quarter, fueled by a 2% transaction decline. U.S. locations saw transactions fall 4%, dragging same-store sales down 2%—the fifth consecutive negative quarter. China’s same-store sales were flat for the quarter, as a lower average ticket offset transaction growth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park May 2nd, 2025

Posted In: Juggling Dynamite

Next: Markets Rallying Into Resistance »