May 5, 2025 | Affordability Cometh

Happy Monday Morning!

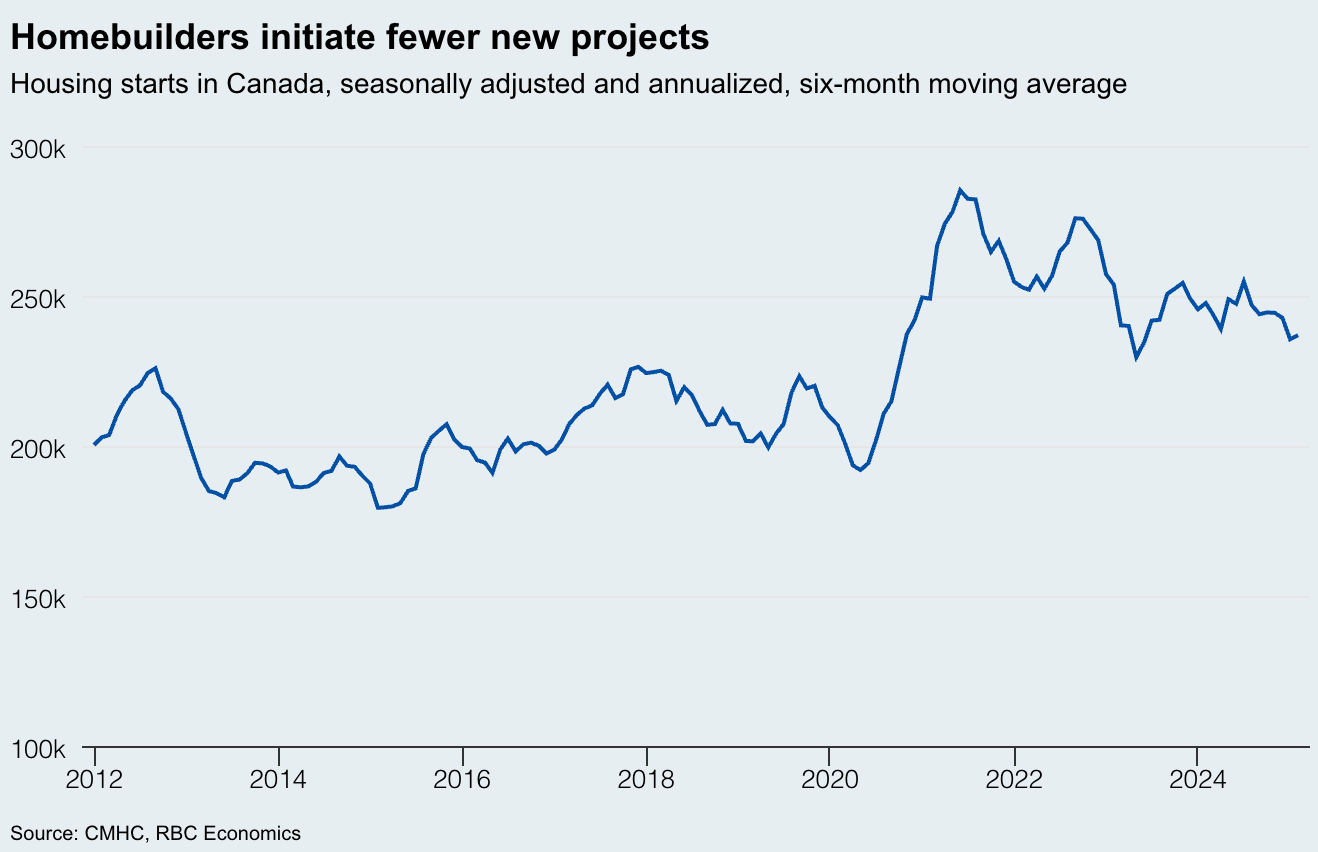

Mark Carney is in. The Liberal government was granted a fourth term in power and will have their work cut out for them as the economy circles the drain. Housing, in particular, is in a rather precarious spot. As we’ve highlighted at length in this newsletter, housing starts are crumbling.

Remember the Carney government has promised to build 500,000 homes per year. Given the current dynamics in the construction sector, it will be a miracle if they can achieve half of that.

One way to turn the tides will be through their proposed reintroduction of the MURB housing program. The Multiple Unit Residential Building (MURB) program was a Canadian federal tax incentive introduced in the 1970s to stimulate the construction of rental housing.

It allowed investors to deduct capital cost allowances and certain soft costs (like interest and legal fees) from their overall income, not just rental income. The program led to the construction of nearly 195,000 rental units before being phased out in 1981. While it successfully increased rental supply, critics argued it disproportionately benefited high-income investors, making it a lucrative tax shelter rather than a housing-focused initiative. Properties were often overvalued due to the tax advantages, encouraging speculation and inflating prices without corresponding value or affordability.

Nonetheless, the pros will almost certainly outweigh the cons given the current dynamics, and it might be the only way to revive the construction sector.

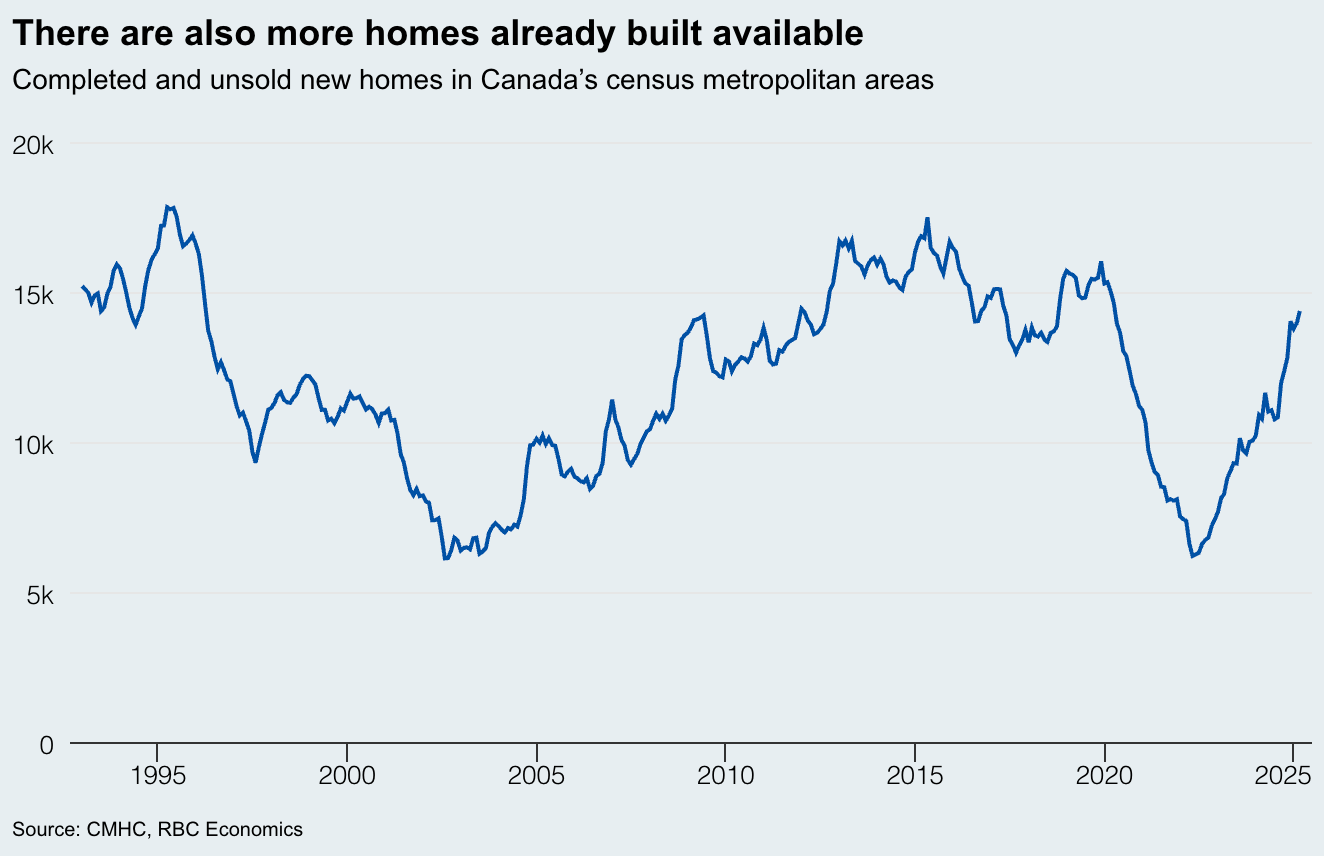

Developers will continue to focus on rentals given the abysmal state of the pre-sale market. Developers are sitting on a lot of unsold homes.

Furthermore, it’s not much better in the resale market. According to CREA, On a non-seasonally adjusted basis, the overall Canadian sales total for March 2025 fell 9.3% year-over-year and was the lowest for that month since 2009.

“Up until this point, declining home sales have mostly been about tariff uncertainty. Going forward, the Canadian housing space will also have to contend with the actual economic fallout. In short order we’ve gone from a slam dunk rebound year to treading water at best,” noted Shaun Cathcart, CREA’s Senior Economist.

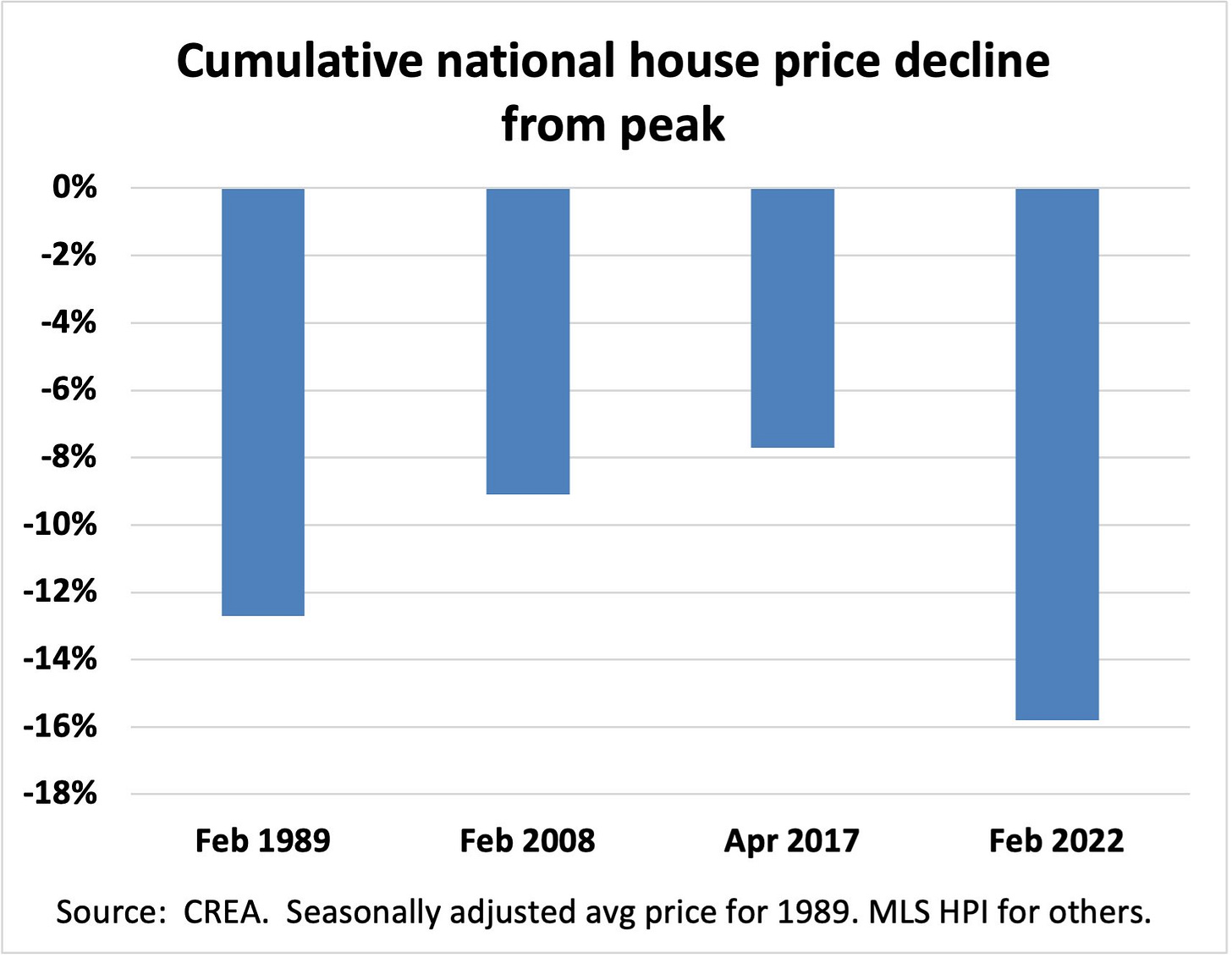

Not only have home sales slowed to a halt, but we are now enduring the steepest home price correction in over thirty years.

The pain, of course, is largely concentrated in Ontario and BC where home prices have surged at an eye watering pace over the past two decades.

Affordability is coming back, slowly.

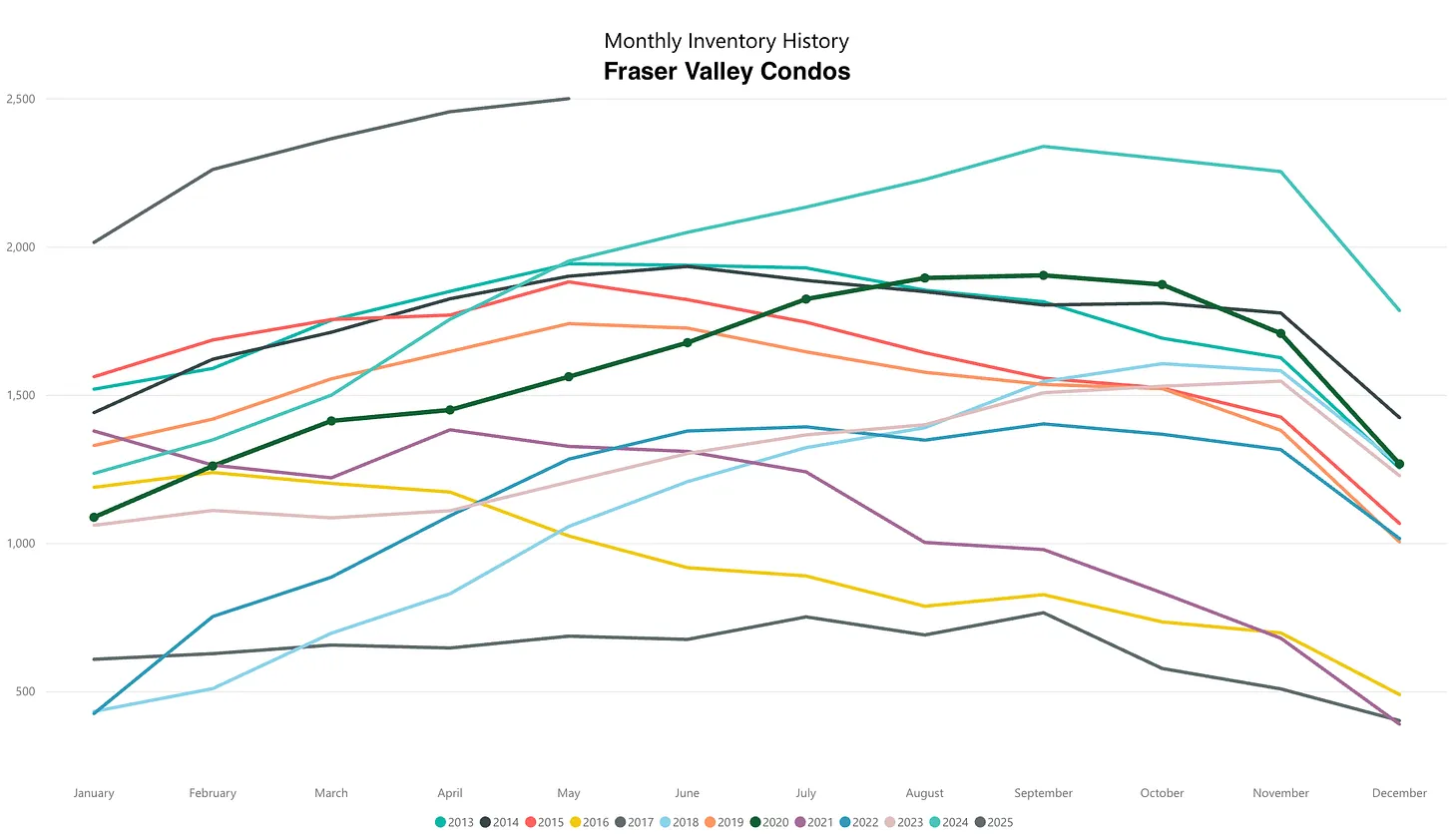

The markets that went up the quickest are now correcting the hardest. Take a look at the Fraser Valley, where condo inventory sits at record highs.

Every month more sellers are hitting the market, outpacing the number of buyers. Inventory is climbing, now at a whopping 7 months. Prices are down 8% from the peak, and there’s no indication that we’ve hit the bottom.

Some might be panicking, which is rather ironic considering prices literally doubled in the preceding five years. Perspective, my friends.

If it’s affordability you seek, prices need to fall or incomes need to rise. Maybe both.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky May 5th, 2025

Posted In: Steve Saretsky Blog