October 4, 2025 | The Trading Desk Notes for October 4, 2025

Leading global stock indices surge to record highs

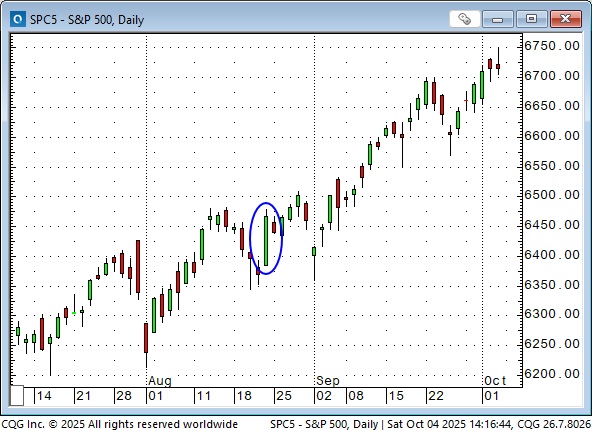

The S&P has rallied ~40% from its April lows, up ~13.5% YTD.

The S&P is up ~5.5% since the FOMC cut rates on August 22 (blue ellipse), and signalled more cuts to come over the next few months.

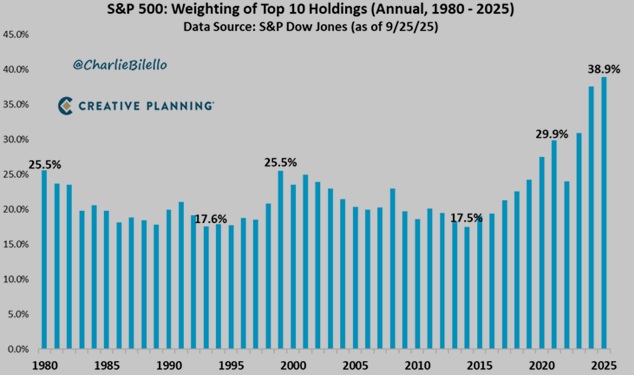

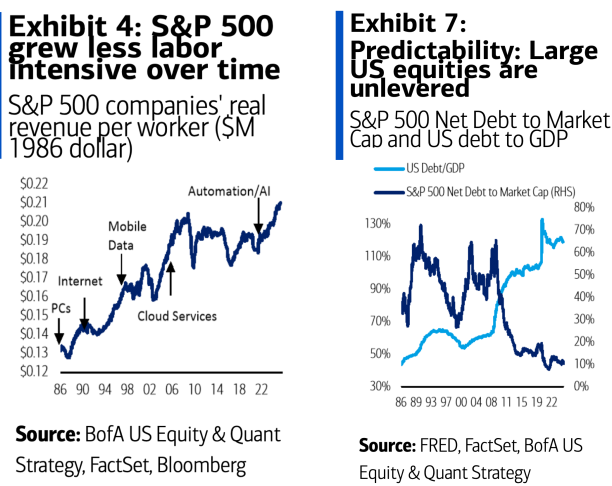

Big Cap Tech/AI continues to power the rally in US stocks, with concentration intensifying.

Quote of the week: “We’re in the hype phase of a new technological epoch.” The Heisenberg Report

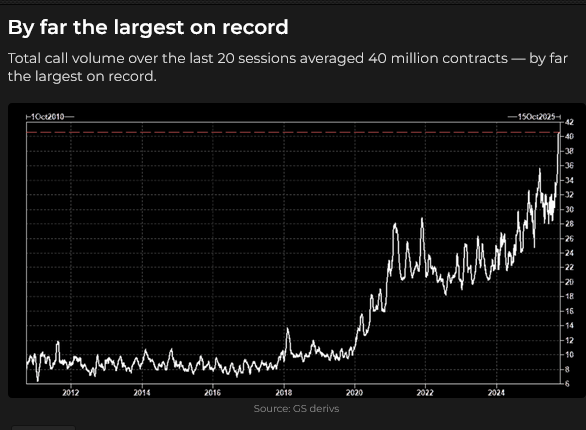

Speculation is also intensifying. Nearly two-thirds of SPX option volume is now ODTE (Zero Days To Expiration – in other words, the option’s life is one day).

Intensifying speculation is not only in American markets.

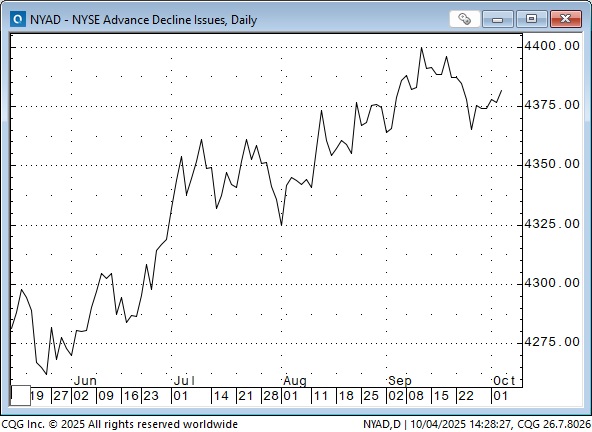

Speculation is not the only thing driving stocks higher.

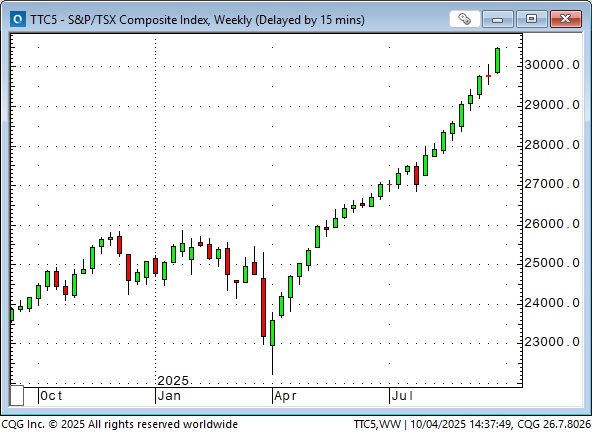

The “most impressive global stock index” award goes to the Toronto Composite, which has traded higher for 26 consecutive weeks since the April lows, rising ~36%.

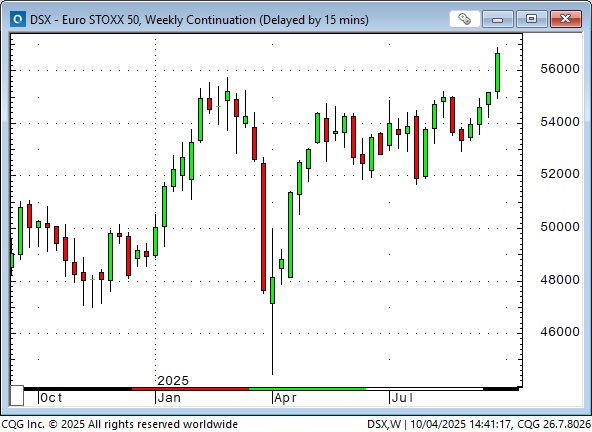

The Euro STOXX 50 index rallied to a new all-time high this week, up ~28% from its April lows.

The Shanghai Index rallied to a 4-year high this week, up ~30% from its April lows.

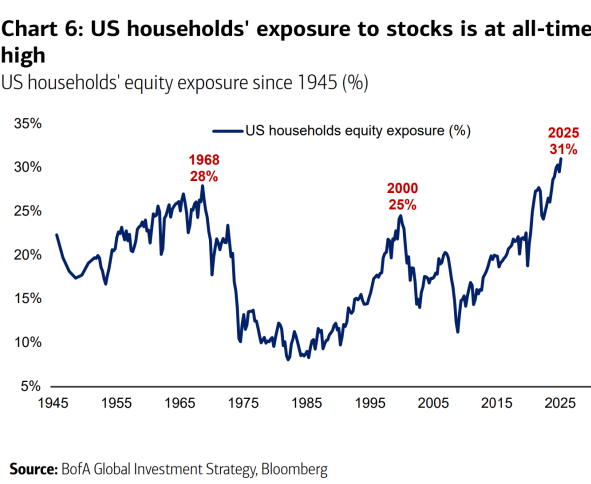

Foreigners now own ~30% of all US stocks (valued at ~$20 trillion), the highest percentage ownership in 80 years, as capital continues to come to America for safety and opportunity. The idea that “American exceptionalism” is a thing of the past is losing traction.

In previous Notes, I’ve written that foreigners have mostly not hedged their currency risk on these investments, which gave them a “double win” when stocks and the USD both rose. However, the DXY US Dollar Index fell by ~12% in H1 2025, and some of that weakness may have been due to “some” FX hedging by foreign investors. If the USD were to continue weakening, foreigners may have “ample reasons” to hedge more of their FX risks, or sell US equities and repatriate the capital.

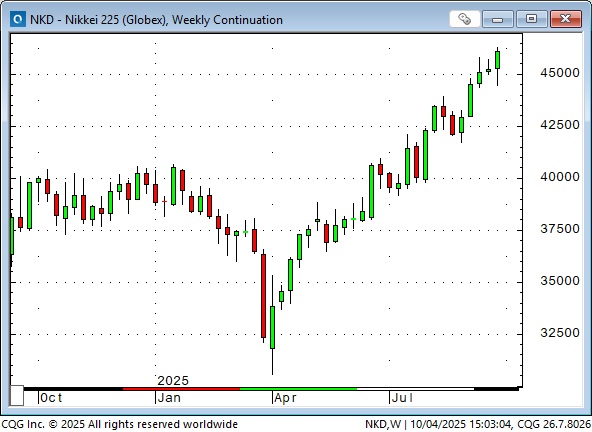

The Japanese Nikkei Index also rallied to a record high this week, up ~52% from its April lows.

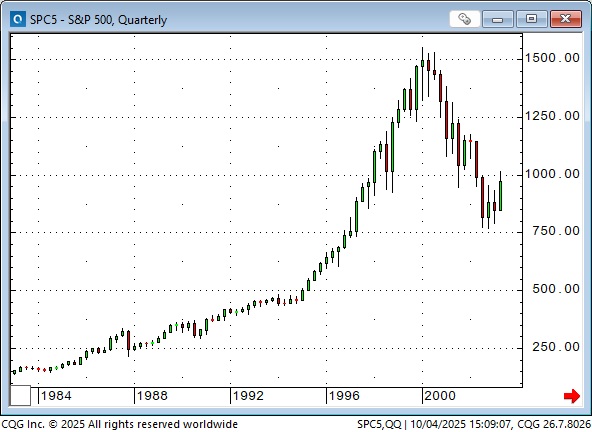

In last week’s Notes, I mentioned that the current stock market feels like 1999, followed by this chart.

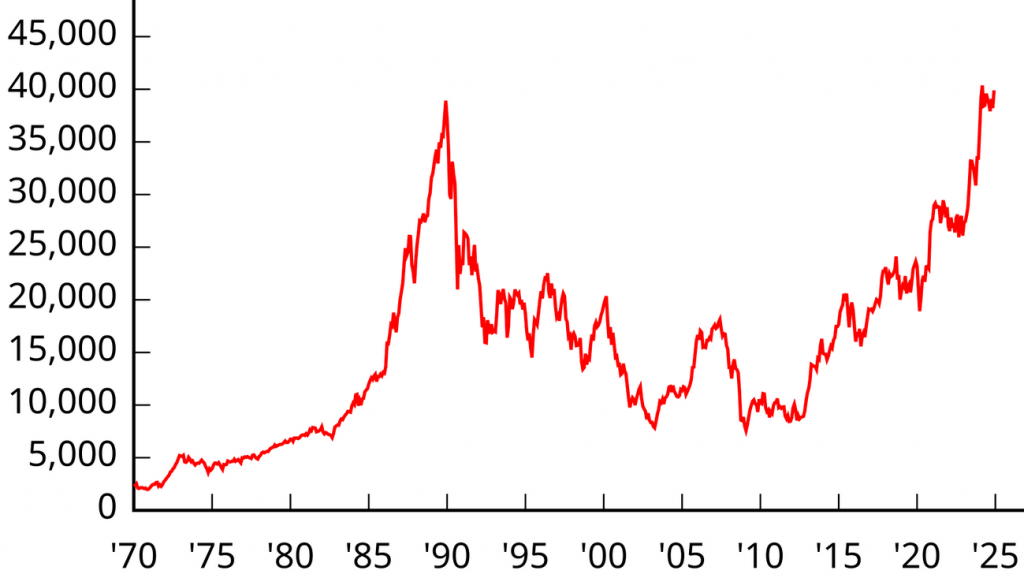

I’ve been thinking about Japan a lot this week, and I could easily have said that the current stock market environment feels a lot like the Nikkei in 1989.

The Nikkei quadrupled from 1985 to the end of 1989, and then fell by ~50% in the first nine months of 1990. In 1989, the Japanese stock market accounted for ~45% of total global stock market capitalization. (It now accounts for ~5%.) The USA was in 2nd place with ~30%. The Nikkei was trading at a P/E ratio of ~60 at the highs, and 15 of the world’s 20 most valuable companies were Japanese. Nine of the ten biggest banks in the world were Japanese.

Japanese real estate prices soared even more than share prices in the late 1980s, and I remember seeing a report that claimed the total value of all Japanese real estate was worth more than four times the value of all American real estate.

I also recall being in the business section of a bookstore at Chicago’s O’Hare Airport in late 1989, searching for a book to read on my flight home. Virtually ALL of the featured books were about Japan, and how they were going to “take over the world.”

Perhaps the “defining moment” came in early 1990, when a Japanese businessman paid a reported $850 million for the iconic Pebble Beach golf course in California, only to sell it two years later at a loss in excess of $200 million.

The Japanese Yen doubled in value against the USD from 1985 to 1987 (blue ellipse).

However, the Yen was not the only currency rising against the USD in 1985 to 1987 – all currencies were rising against the USD after it had soared from 1980 to 1985.

Japan

I’ve been thinking about Japan a lot this week because I’ve been wondering if it’s time to get long the Yen against the USD and the Euro. In previous Notes, I’ve written about the Yen being near all-time lows against the Euro and the USD, after trending lower from the 2012 all-time highs following the application of Abe’s “three arrows” mercantilist policies.

The Yen fell by ~50% against the USD from 2012 to 2024.

For “background” on my thinking about buying the Yen against the USD and the Euro, here’s a comment I made yesterday on a Substack essay written by Stephen Innes (a Canadian who is a veteran financial markets trader, currently living in Thailand. Readers can access his Substack comments free of charge here.)

Great piece, Stephen. Thank you. I’m very interested in the China-slowdown/over-capacity story (the balance sheet recession) and what that may mean for China and markets outside of China. (For instance, is China exporting deflation?)

My basic view is that all of Asian FX is “too low” in line with mercantilist trade policies, and also because they have to compete with one another for export market share. Exports help China offset domestic deflation, to some degree, and with exports to the USA down, exports to other countries are up. What does China do if exports to “other countries” decline? Is China a reprise of the Japanese boom/bust pattern?

I also wonder if the Trump administration will demand FX revaluation across Asia, perhaps with different targets for different countries. I limit my trading to exchange-traded futures, so I’m buying Yen against USD and looking to buy Yen against the Euro, given the Euro’s record highs against the Yen.

Early this morning, the LDP party in Japan elected Sanae Takaichi as their President. As the LDP and its coalition partners currently have a majority in the Diet, she is likely to become Japan’s first-ever female Prime Minister. She is a veteran politician, and apparently sees herself as a Japanese version of Margaret Thatcher. She supported Abe’s Three Arrows policies and may implement similar policies once she becomes the Prime Minister (which may mean that the BoJ will be less likely to raise interest rates at their late October meeting). President Trump is scheduled to visit Tokyo from October 27 to 29 to meet the new Prime Minister of Japan.

Canada

The CAD fell to a 22-year low of ~68 cents in February when Trump was threatening massive tariffs on Canada. It rallied back to ~74 cents at the end of June (when the USD bottomed out against most of the actively traded currencies). It is now below 72 cents, with signs that the Canadian economy is weakening (unemployment is above 7%). I expect further pressure on the CAD as the BoC continues to lower interest rates, the Prime Minister discusses shifting our trading focus towards Europe, and as the market realizes that Canada is vulnerable to additional tariffs from Trump.

Gold

December Comex gold has closed higher for seven consecutive weeks, rising ~$575 (~17%). It appears to me that FOMO buying is making gold more of a “risk asset” than a “hedge.”

Gold shares have spectacularly outperformed bullion this year, with the GDX ETF up ~120% YTD. Gold mining companies are aggressively selling shares into this rally.

Silver lagged behind gold during the first five months of this year, but then the afterburners kicked in and silver soared.

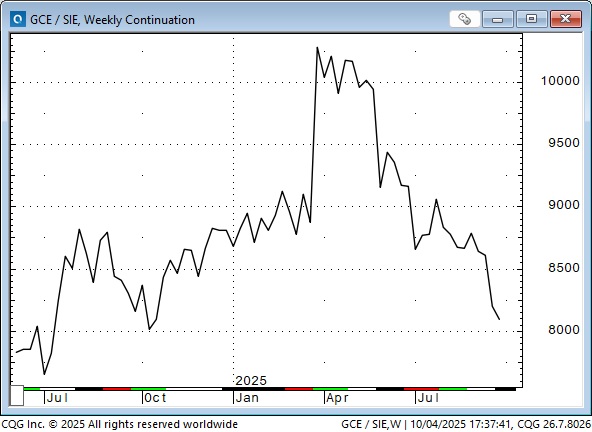

The gold/silver ratio peaked around 103 at the end of March (it took 103 ounces of silver to buy one ounce of gold), and has fallen sharply since then as silver rallied faster than gold.

The January contract of Nymex WTI briefly traded below $60 this week as crude oil is pressured by supply/demand issues. Technology (especially fracking) has been a weight on the crude oil price.

Looking ahead

The Supreme Court meets on November 5 to start deciding whether the Trump tariffs under IEEPA are legal or not. Two lower courts have agreed that Trump did not have the authority, without Congressional support, to institute the tariffs.

I’ve been puzzled by Trump’s apparent ability to “govern” by executive order. If he can do that, what’s the point of having a Senate and a House of Representatives?

My short-term trading

I started the week with a small short position on the S&P. I covered that mid-week for a slight loss. I bought a small Yen position early in the week and held it into the weekend. I may get stopped Sunday afternoon if the market sours on the Yen after the LDP election.

The Barney report

Barney has got to be one of the happiest dogs in the world, and nothing makes him happier than running with a good stick – the bigger the better! Here he is galloping along the old railroad tracks in the forest near our house.

The Josef Schachter Annual Energy Conference – Calgary, October 18, 2025

I look forward to attending Josef’s annual energy conference again this year. I’ve attended every one over the past several years, and I’m not only continually amazed at the quality and diversity of the presenters, but I also learn more every year about the energy business and the incredible technological advances the industry is undergoing. For more information about the conference and to buy a ticket, click here. Check out Josef’s weekly “Eye On Energy” letter on Substack.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the soaring stock markets around the world. It seems that “everything” is surging to all-time highs. You can listen to the entire show here. My spot with Mike starts around the 57-minute mark. Be sure to listen to my friend Paul Beattie’s explanation for the 40% rally his fund has had YTD.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair October 4th, 2025

Posted In: Victor Adair Blog