China’s War on “Involution”

China is cracking down on “blind and disorderly competition,” also called involution. Factories keep building too much — solar, batteries, EVs — and prices collapse. That deflation spills abroad.

How low can China push prices — and who gets crushed next?

Western firms know the rule: compete with China and prices only go one way — down. No wonder the U.S., Europe, and Canada keep slapping tariffs on Chinese imports.

We’ve seen this movie before. When excess cash poured into Chinese real estate, a bubble formed — then burst. Remember China Evergrande? World’s most valuable property developer in 2018. Bankrupt rubble by 2021.

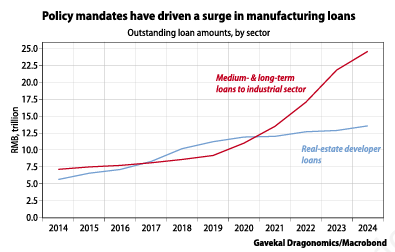

So, banks and local governments searched for an alternative to keep growth alive and the firehose of new money turned to factories and infrastructure. From 2021 on investment was growing at 10–20% a year. This push showed up in loans:

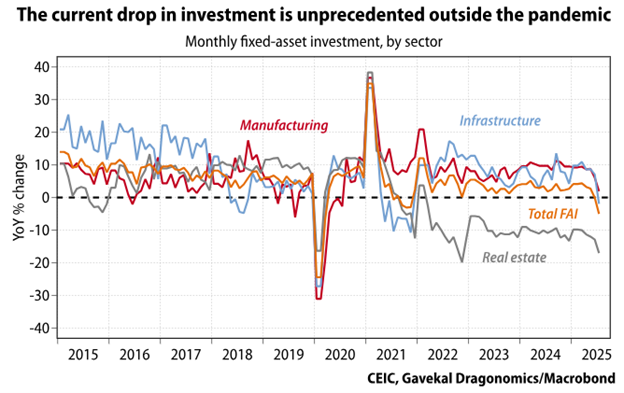

But in July, Xi blasted “disorderly low-price competition” at a special meeting of the Central Commission on Financial and Economic Affairs. Soon after a slump in investment started to show up in the monthly numbers:

But history shows that local governments don’t always listen to Beijing. They will find it hard to stop handing out subsidies to hit growth targets and keep people employed. As the saying goes: the mountains are high, and the emperor lives far away.

China’s growth model now thrives on business and infrastructure capital spending. Banks lend to businesses and local governments instead of real estate developers. Will Beijing stick to its anti-involution guns if GDP growth stumbles and borrowers start to default on bank loans?

One obvious fix would be higher consumer spending. But Chinese households save too much and are still dealing with fallout from the bursting of the real estate bubble.

If Beijing clamps down on over-investment with too much zeal, the outcome won’t be stability.

It could be a deflationary bust in China that spreads worldwide.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.