August 25, 2025 | The Renewal Wall is Here

Happy Monday Morning!

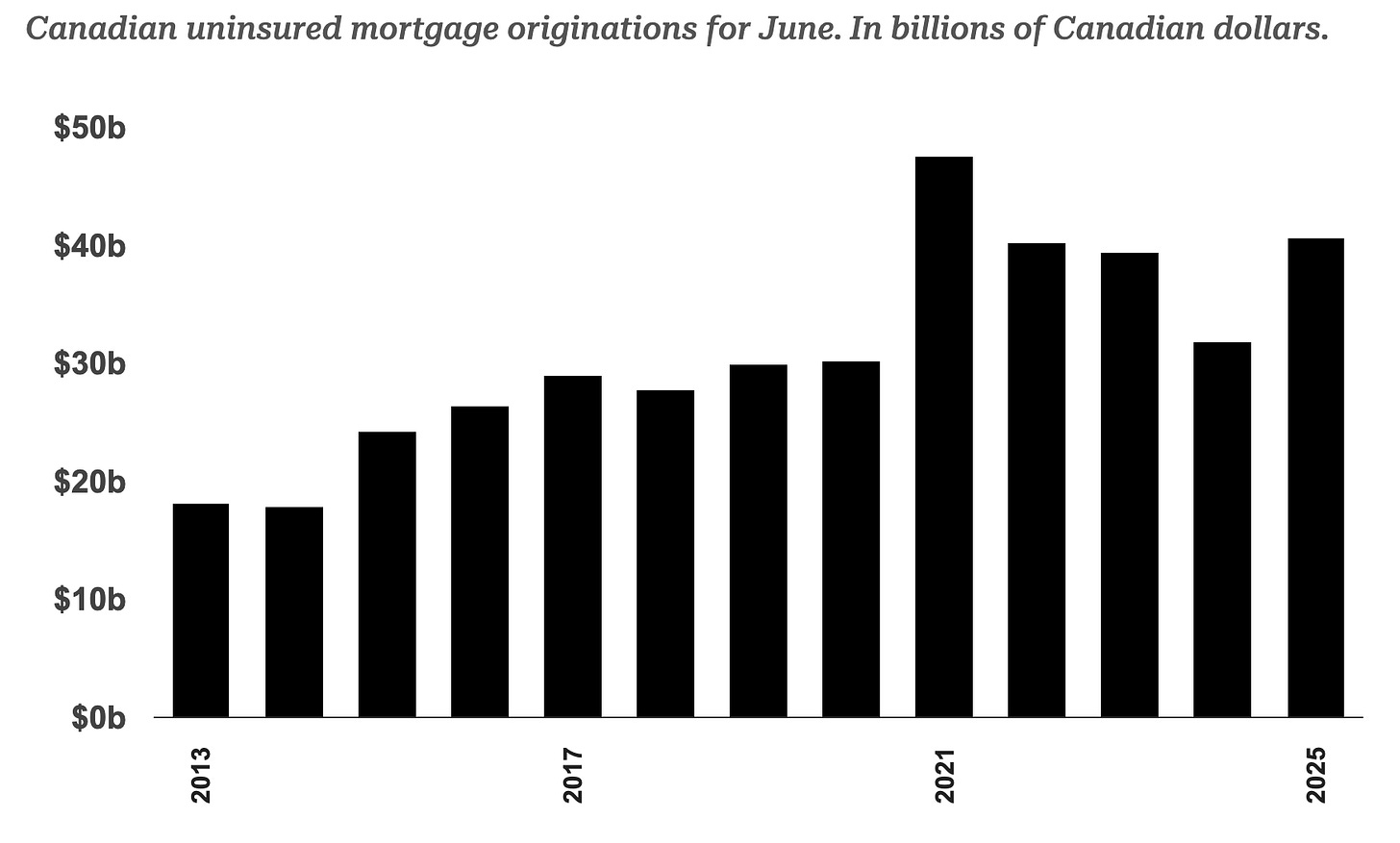

The housing market might be struggling but lenders are keeping busy. Data from the Bank of Canada shows uninsured mortgage originations surged in June, rising 27.5% year-over-year, the second busiest June on record. The only busier June for mortgage originations was back in 2021 when mortgage rates were hovering near 1.5%.

So the housing market sucks but originations are surging. What gives?

It’s a combination of increasing sales activity, a flood of pre-sale condos completing, and a giant mortgage renewal wall all colliding at the same time.

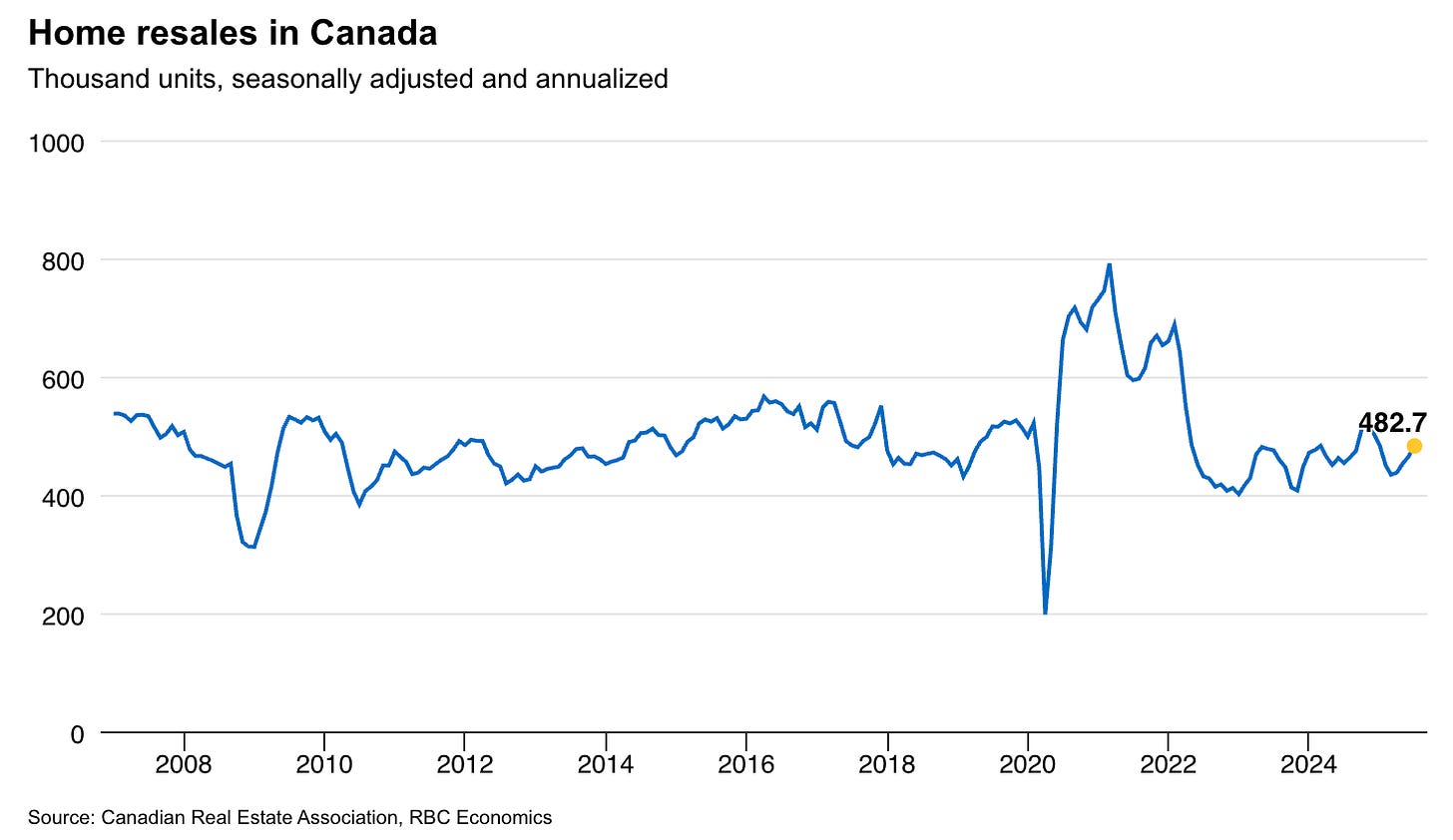

Home sales, although still running below long term averages, have bounced higher for four consecutive months. Since the spring, sales have rebounded more than 11%.

New condo completions are running near record highs. Investors that bought a pre-sale during the speculative boom of 2021 and 2022 are now seeing those units completing and need a mortgage to close.

Then there’s the mortgage renewal wall. According to the Bank of Canada, 60% of all mortgages are up for renewal in 2025 and 2026.

Furthermore, updated research from the BoC shows about 60% of those mortgage holders renewing in 2025 and 2026 are expected to see a payment increase. Most of these borrowers hold a five-year, fixed-rate mortgage, and they’ll endure the brunt of the pain. Mortgage holders with a five-year, fixed rate contract renewing in 2025 or 2026 should face an average payment increase of around 15%–20%.

There’s more pain coming for variable rate and variable payment mortgages as well.

About 10% of borrowers renewing in 2026 will see an increase of more than 40%!!

Nearly 5% of all borrowers who originated or last renewed a variable-rate, fixed-payment mortgage before 2022 had a higher principal balance in February 2025 than at origination or the previous renewal. Yes, their balances have been growing because they are effectively deferring interest payments and allowing the amortizations to blow out.

Some people would call that a non-performing loan but the big banks prefer not to talk about that, so let’s move on and look on the bright side.

The remaining 40% of mortgages up for renewal should see modest payment declines. These are the borrowers who took out 2 or 3 year fixed rate mortgages when rates were hovering between 5-6%, or have paid down the principal on their variable mortgage.

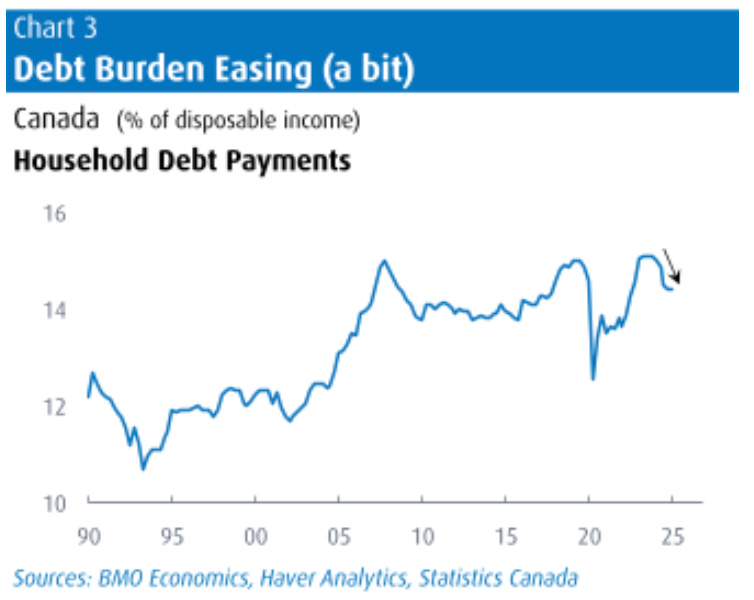

Thankfully, we’ve also seen wage inflation and this will help with the debt burdens. Household debt payments as a percentage of disposable income is improving.

The mortgage renewal wall is here. Some will manage just fine, others will hit it like a fly on a windshield.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky August 25th, 2025

Posted In: Steve Saretsky Blog