June 11, 2025 | Why Platinum Is In Our Portfolio

For most of the past couple of years, our gold, silver, and copper ETFs have done pretty well. But the lone platinum ETF in our Portfolio just sat there, hardly moving at all.

Then, seemingly out of the blue, platinum’s price spiked, taking our ETF along for the ride:

What Happened?

Several things combined to convert platinum from laggard to leader in the precious metals space. Among them:

Gold’s massive bull market has begun to price it out of the jewelry market, with platinum filling the gap:

Gold is so expensive that some jewellers are turning to another precious metal — and it’s not silver

(Business Insider) – Not everything that glitters has to be gold.

Prices of platinum, a white precious metal, have rallied over 30% this year to date, with spot prices currently around $1,200 per ounce. Spot gold prices are around 27% higher over the same period.

Platinum’s dizzying rally doesn’t just echo the stunning rise of gold prices. It also reflects a more fundamental issue of supply deficit, Bank of America analysts wrote in a note on Friday. Platinum prices are supported by solid fundamentals, wrote the BofA analysts, highlighting demand for the white metal in the jewelry industry.

“After years of declining demand, there is anecdotal evidence that interest in platinum jewellery is now bouncing back in China,” they wrote. China is one of the world’s top gold consumers.

“Rising gold prices are incentivising jewellers to diversify, in what represents a change to historical patterns,” the BofA analysts added.

China imported 11.5 metric tons of platinum in April, its highest monthly intake in a year — a sign that jewelers are pivoting as gold becomes increasingly expensive.

The BofA analysts wrote that even a 1% switch in gold to platinum jewelry could help double the white metal’s supply deficit to 1.6 million ounces.

EVs Lose Some Luster

Platinum’s main industrial use is in catalytic converters for internal combustion cars. If those cars are made obsolete by electric vehicles, demand for platinum evaporates.

But that’s looking less likely:

US Electric Vehicle Adoption Plummets

(Oil Price) – Just 16% of American drivers say they are likely to buy an electric vehicle (EV) as their next car—the lowest share recorded in AAA’s annual surveys since 2019.

High battery maintenance costs, high purchase prices, and concerns about range continue to be major deterrents for U.S. consumers to consider buying an EV, according to AAA’s latest survey released earlier this month.

These key barriers have remained more or less the same in recent years.

But this year three other factors have also played a role to result in the smallest share of American drivers considering an EV purchase—lower gasoline prices, the increasingly uncertain future of EV incentives such as tax credits and rebates, and politics.

Only 16% of U.S. adults reported in AAA’s 2025 survey that they are “very likely” or “likely” to purchase a fully EV as their next car. This compares to 25% in 2022, when gasoline prices of $5 per gallon incentivized more buyers to consider an EV purchase.

This year, the percentage of consumers indicating they would be “unlikely” or “very unlikely” to purchase an EV rose to 63%, up from 51% last year.

Consumers cited high battery repair costs and purchase prices as key barriers to go fully electric, at 62% and 59%, respectively. Other top concerns identified in this year’s survey were the perceived unsuitability of EVs for long-distance travel (57%), a lack of convenient public charging stations (56%), and fear of running out of charge while driving (55%).

Other barriers cited by the Americans unlikely to buy an EV include safety concerns cited by 31%, challenges installing charging stations at their residences for 27%, and 12% who are concerned that the tax credits and rebates will be reduced or eliminated.

Meanwhile, gasoline prices this spring hit their lowest level ahead of Memorial Day weekend in four years. A large part of the strong demand over Memorial Day weekend was due to the fact that the typical seasonal spike in the spring didn’t materialize, because oil prices – the single-biggest driver of gasoline prices—have lingered in the low $60s per barrel for weeks.

Constrained Supply

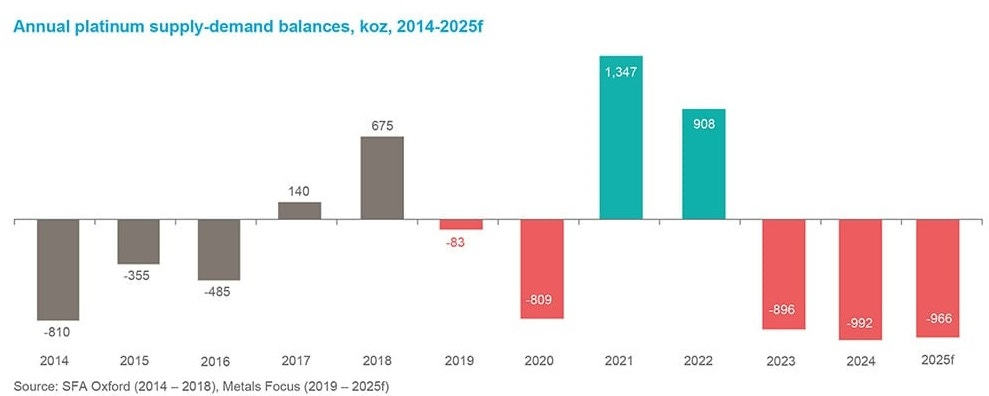

Platinum, like silver, is facing serious supply issues, with a large and persistent deficit:

Platinum jumps 3.7% on supply jitters

(Breaking the News) – Spot platinum prices continued to rise on Monday, following last week’s trend as growing concerns over a global supply shortage of the metal mounted after the World Platinum Investment Council, in its latest Platinum Quarterly report, projected a third consecutive annual market deficit, with demand expected to outstrip supply by nearly one million troy ounces.

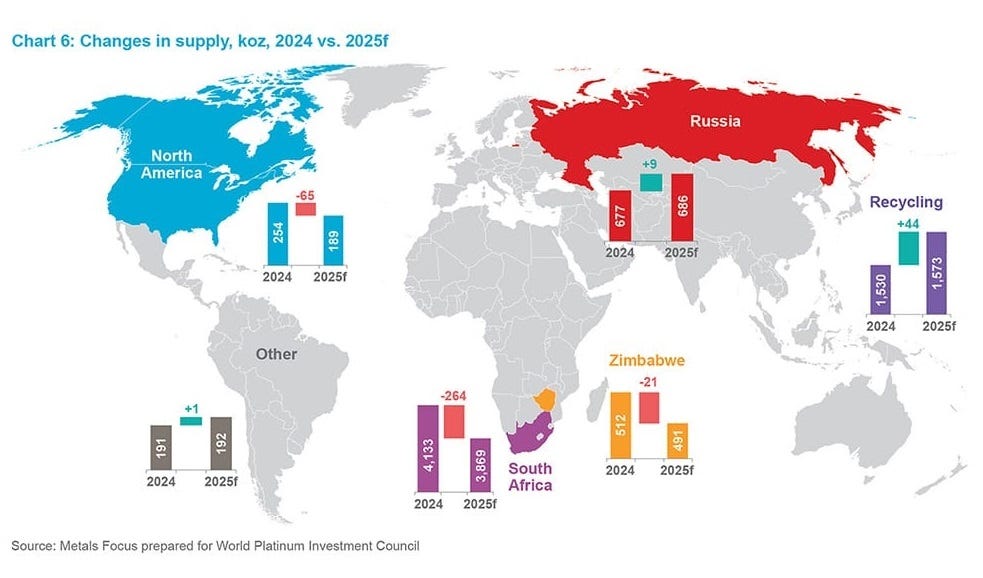

And those sources are unreliable, with Russia and South Africa dominating the mine supply chain:

Deficit Begets Shortage Begets…Panic Buying?

Add it all up, and platinum’s story looks a lot like silver’s, with insufficient supply bumping up against rising industrial and investment demand. The result? A long-term bull market featuring some spectacular spikes. Which makes this year just the beginning.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 11th, 2025

Posted In: John Rubino Substack