February 9, 2026 | Pre-Sale Flip Flop

Happy Monday Morning!

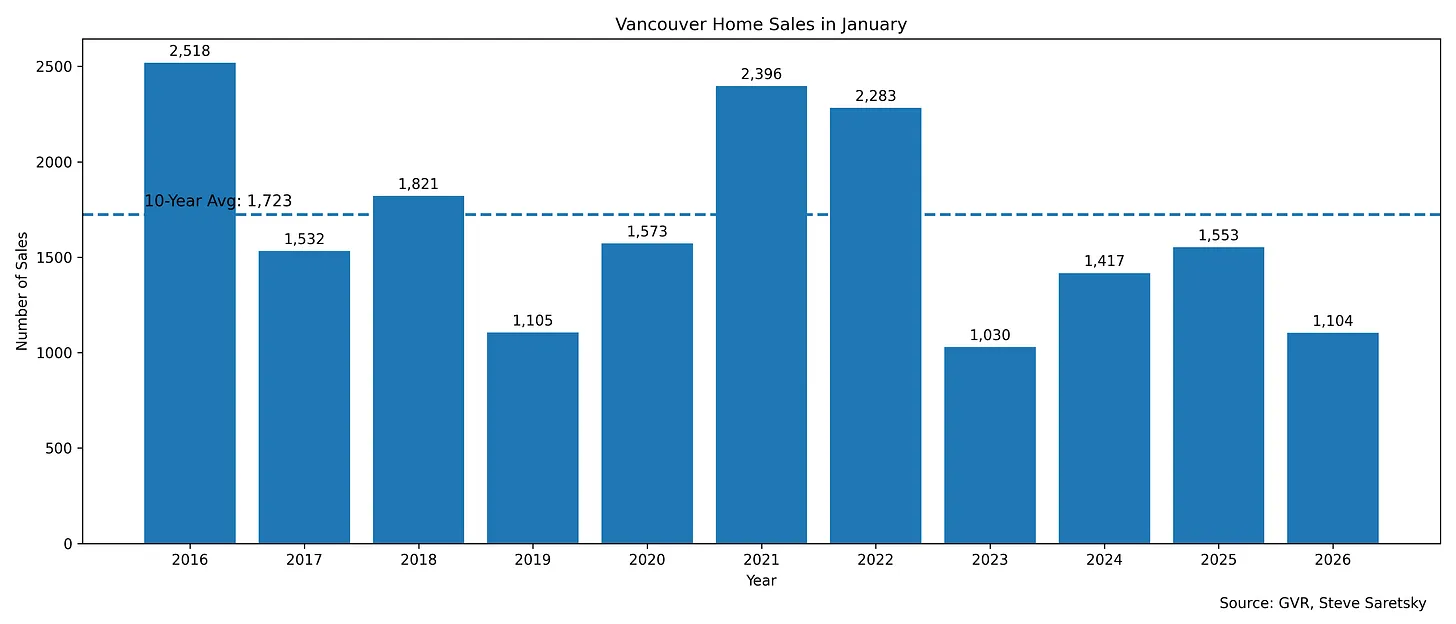

As we noted last week, Greater Vancouver home sales continued their slump into 2026. January home sales fell 29% year-over-year in January, and were a whopping 35% below the 10 year average.

The sales to actives ratio was just 9%, the lowest reading since September 2012. In other words, only 9% of homes available for sale during the month are actually selling, which ultimately means more price reductions are coming.

Sounds bad, because it is.

However, things are getting really spicy in the new condo, pre-sale/ assignment space.

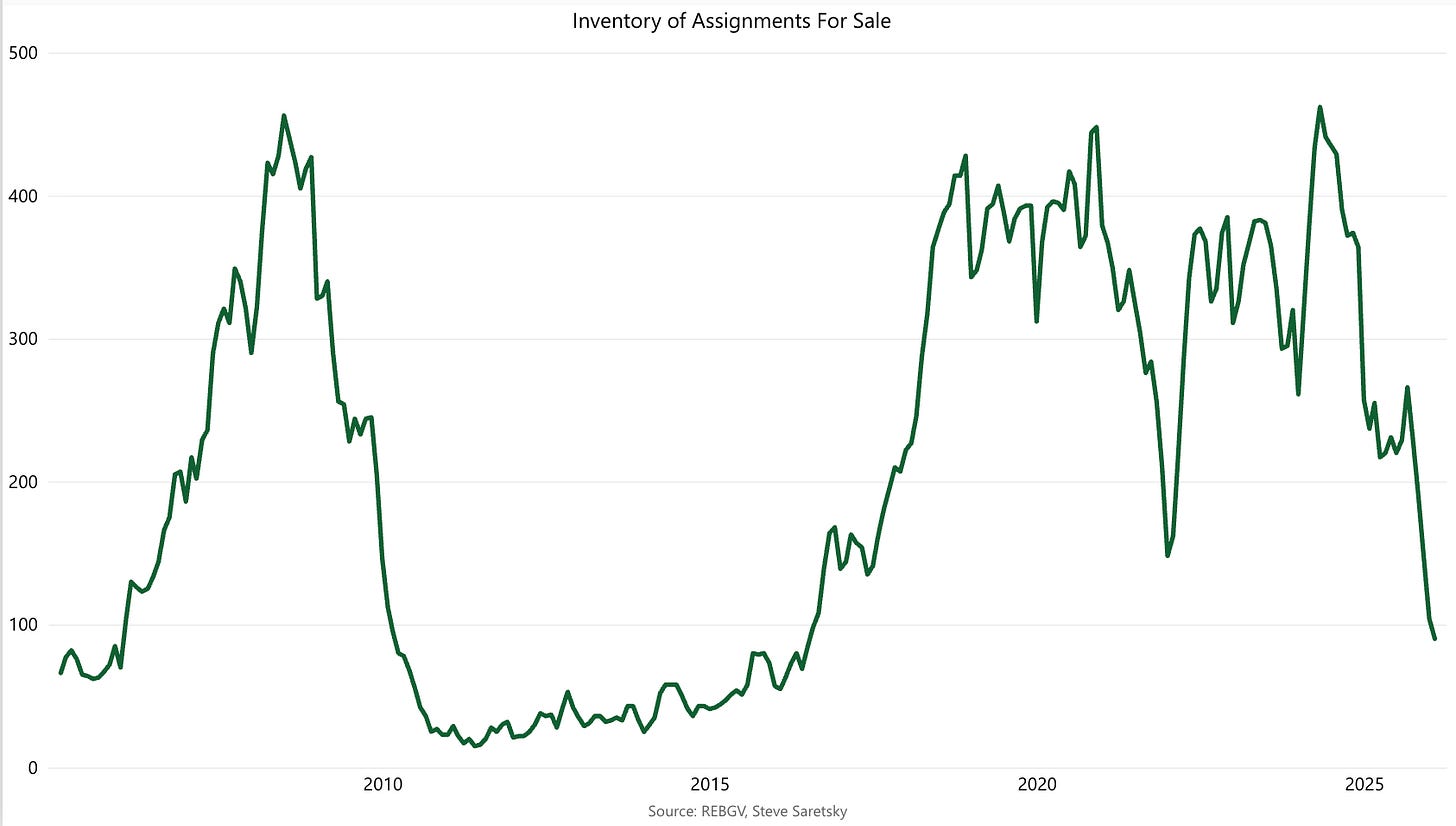

Assignments have become completely illiquid. Pre-sale buyers attempting to assign their pre-sales have been told not to bother. There’s zero liquidity in the assignment market to the point where Realtors aren’t even taking those listings anymore. This is showing up in the data too. Assignment listings on the MLS are plunging.

The number of assignments listed for sale (Greater Vancouver & Fraser Valley) have plunged from 462 listings on the MLS in April 2024 to just 90 by the end of January 2026.

If anything this number should be growing when you consider how many of these units are under water. The challenges around appraisal values are significant. One of my lenders (he works at a big 5 bank) says he’s seeing pre-sales that are completing soon typically appraising anywhere from 10%-30% lower than the original purchase price.

Blanket appraisals at TD and RBC are still around, but not everyone can get those. They’re also coming under increasing scrutiny.

The moral of the story, if you want to flip a pre-sale contract be prepared to forfeit your deposit and inject additional capital to boot.

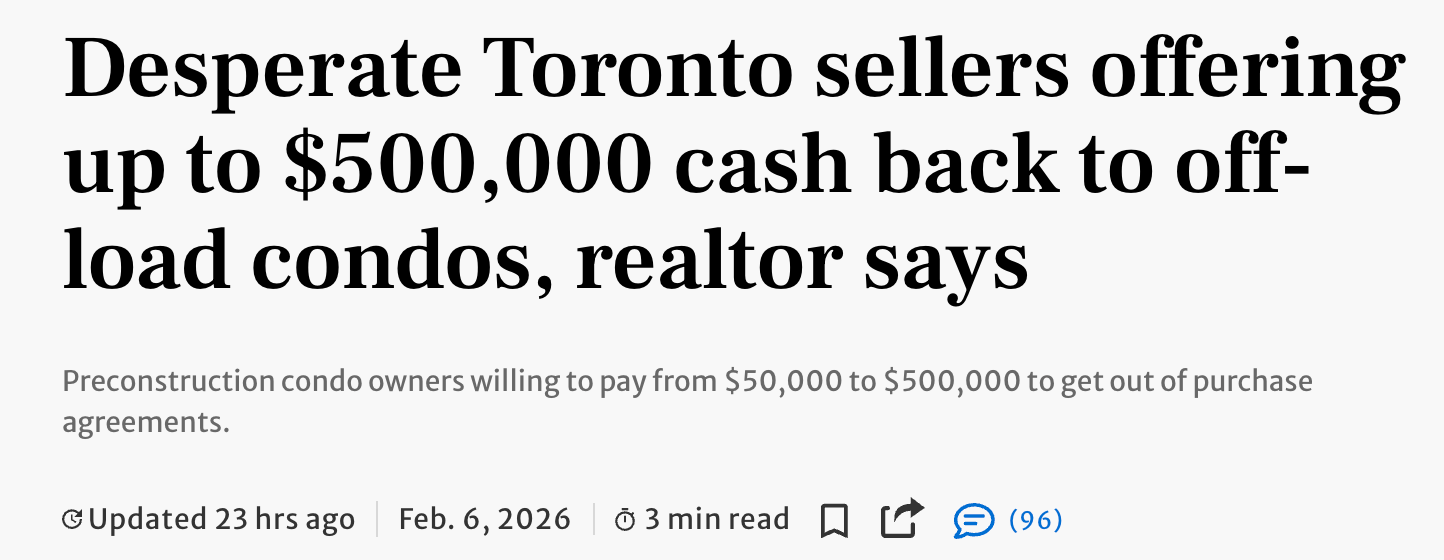

This is not just a Vancouver story. Check out this one in the Toronto Star this week.

“A lot of the assignments that we’re working with right now, the seller actually needs to pay the buyer in order to get out of the deal, because that’s what it takes to get it to a price to sell,” said Daniel Zadegan, managing partner and sales representative at the The Zadegan Group.

So they are not only forgoing their deposit, but having to fill the pricing gap for the new buyer.

“The price that they need to sell at is below what their deposit covers,” Zadegan said.

For example, if someone signed a contract on a preconstruction condo for a million dollars, made a $200,000 deposit and the price a new buyer is willing to pay for that condo has now dropped to $700,000, the deposit is only going to get the price to $900,000. The developer will still be expecting a million, so “the seller will need to pay the buyer $100K and cover that difference,” Zadegan said.

In other words, most buyers are better off to find a way to close on the unit and then flip it on completion. It’s easier to sell a completed proudct a buyer can walk through than selling a piece a paper. When you look at it through that lens it makes sense why assignment listings are plunging.

The question then becomes how big will the losses be.

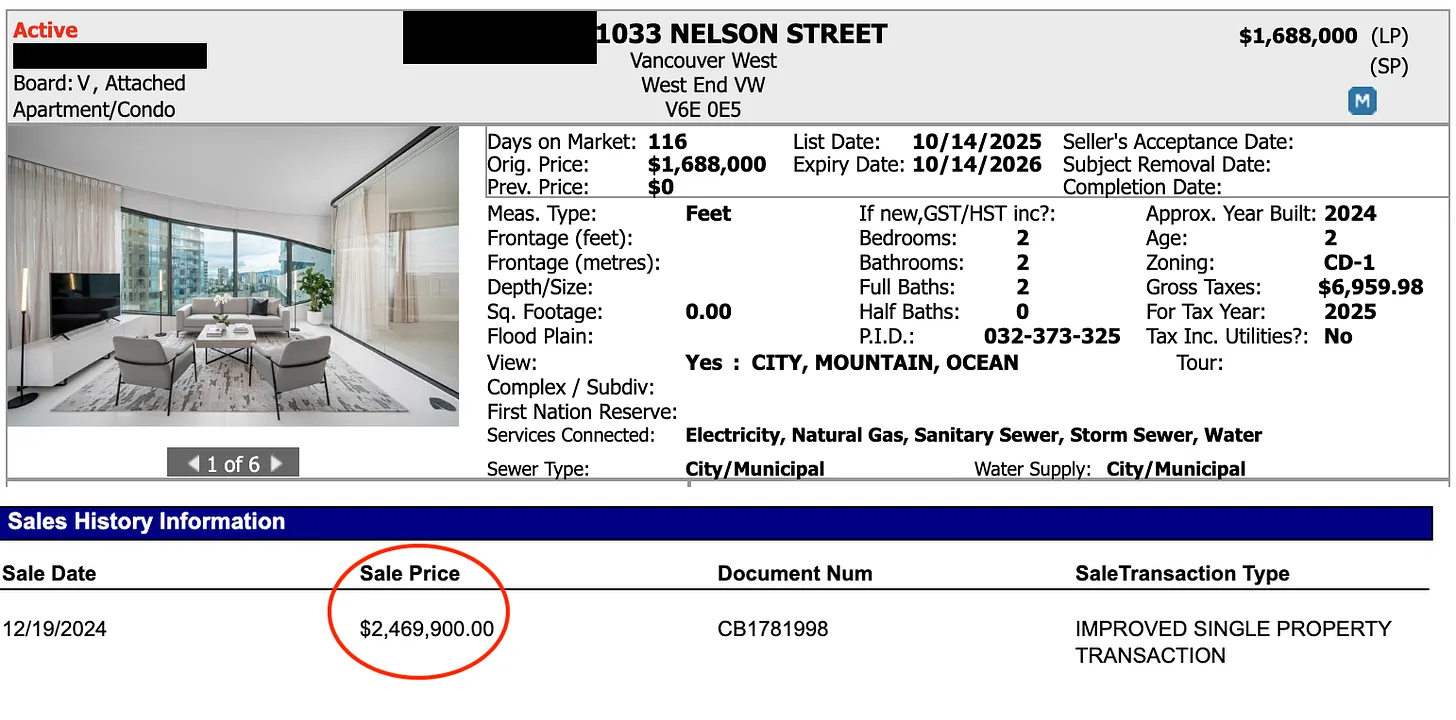

In some extreme cases, it’s nearly seven figures.

Despite some sellers willing to take million dollar losses, there hasn’t been a single MLS resale in the Butterfly building since they started closings over a year ago.

This one has been listed on the market for 116 days at $1,688,000. It closed for $2,469,900 in Decemebr 2024.

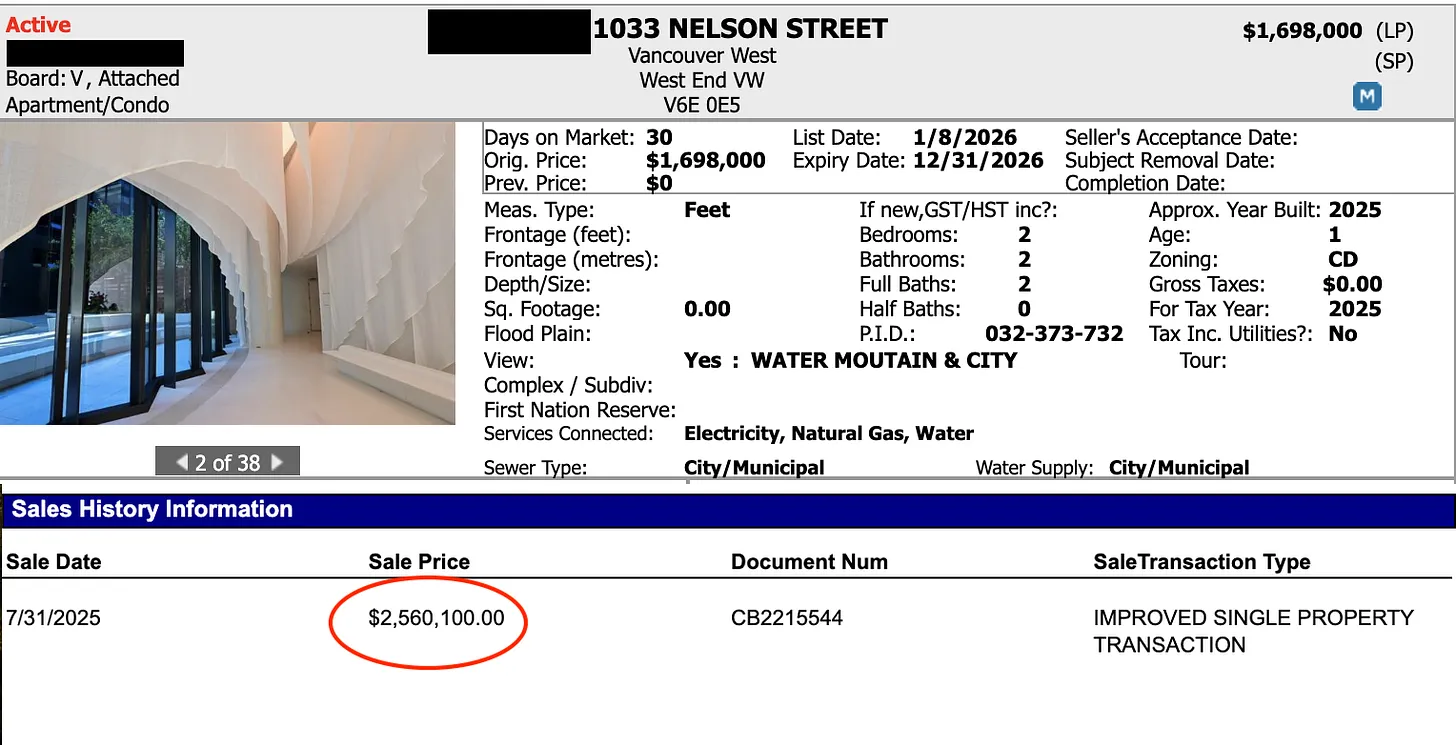

There’s another one here at $1,698,000 that originally closed for $2,560,100 in July 2025.

Keep in mind, even if you can resell it for the same price you paid there’s still a 10% hurlde rate. (5% GST, 2% Property Transfer Tax, 3% Realtor commission).

These are extreme cases, but make no mistake, what’s happening in the new construction space is absolutely wild. The losses are compounding and that’s scarring a generation of investors. Those very investors are the ones responsible for supplying all the capital required for the half a million new homes the government has promised to deliver each year.

It’s no wonder housing minister Gregor Robertson never mentions what type of housing they intend to deliver, because it certainly won’t be housing you can purchase. The data doesn’t lie, by 2030 housing completions for new condos will hover near ZERO in both Toronto and Vancouver.

Houston, we have a problem

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky February 9th, 2026

Posted In: Steve Saretsky Blog