January 12, 2026 | Rob Smallbone: This Commodities Boom Goes Way Beyond Gold and Silver

Contrarian Capitalist’s Rob Smallbone just posted a deep dive into commodities and the developing shortages that make the sector a once-in-a-generation opportunity. Here’s an excerpt:

The Commodity Shortage Nobody Is Priced For

Why structural supply constraints are forming across silver, copper, and the materials that underpin the global economy

Beneath the surface, a growing number of strategically important commodities are facing structural imbalances.

These are not short-term disruptions driven by weather or isolated geopolitical events; they are long-developing supply constraints created by years of underinvestment, declining ore grades, regulatory paralysis, and overly optimistic assumptions about how quickly new supply can be brought online

Mining timelines have stretched from years into decades. Capital expenditure has fallen in real terms. Permitting has become politically complex and increasingly uncertain. Recycling cannot scale fast enough to close the gap. At the same time, electrification, energy security, and industrial demand are no longer optional trends. They are policy mandates.

This is how structural deficits form. Slowly at first. Then all at once.

Using recent data from industry bodies and energy agencies, this piece identifies where deficits already exist, where they are likely to emerge, and why markets remain far more complacent than the underlying numbers suggest.

Lock in lifetime access to conviction-driven research, weekly commodity and market wraps, and high-conviction investment insights at 50% off.

This 50% discount applies to all annual subscriptions taken before Saturday 17th January 2026, and once subscribed, your rate remains fixed for as long as you wish to remain a Contrarian Capitalist!

Legend

🟢Supply Surplus

🔴 Supply Deficit

Data Sources

- Nickel, Lithium, Cobalt, Copper: International Energy Agency, May 21st, 2025

- Platinum: World Platinum Investment Council, November 19th, 2025

- Palladium & Rhodium: Johnson Matthey PGM Market Report, May 2025

- Silver: World Silver Survey 2025 & Mining Visuals

- Aluminium: The World Bureau of Metal Statistics September 2025

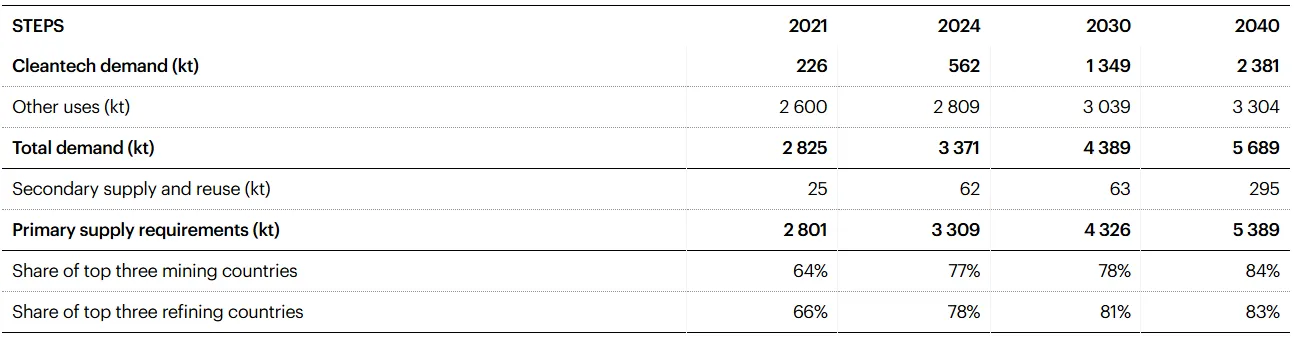

Nickel 🔴

Nickel is often presented as a market with ample supply, largely due to rapid production growth in Indonesia. However, this headline growth masks a structurally fragile balance.

Global nickel demand reached approximately 3.371 million tonnes in 2024. By 2030, total demand is projected to exceed 4.389 million tonnes, driven primarily by electric vehicles and energy storage.

While supply is expected to grow, over 50 percent of incremental production through 2030 is projected to come from Indonesia, creating significant geographic and processing concentration. Outside Indonesia, project pipelines remain thin, costs are rising, and permitting timelines continue to lengthen.

The result is a market that appears balanced on paper today, but is structurally exposed to geopolitical risk, ESG constraints, and demand surprises.

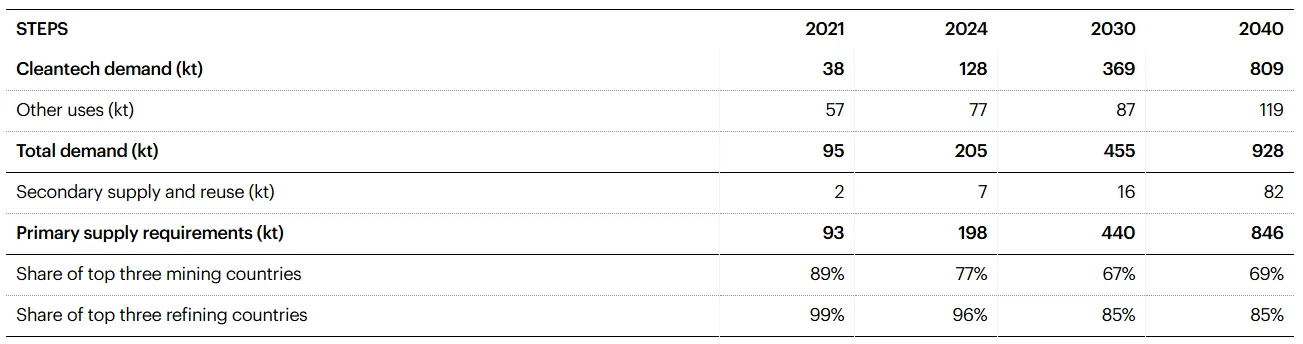

Lithium 🔴

The IEA’s latest analysis shows demand growth driven by energy storage and electric vehicles continues to strengthen, even as prices have softened. While near-term balances may fluctuate, the longer-term outlook remains highly sensitive to project delays, cost inflation, and slower-than-expected ramp-ups.

Energy storage boom strengthens demand outlook for beaten-down lithium

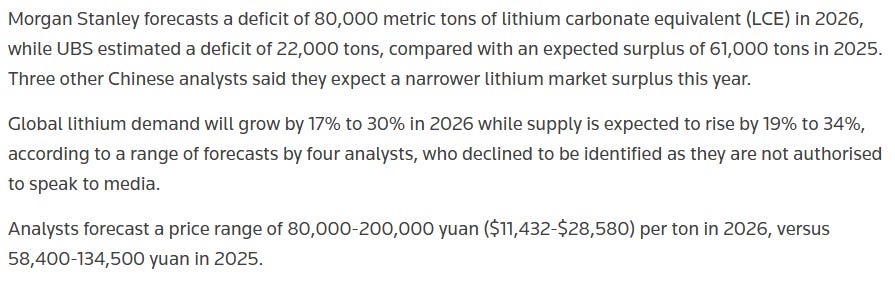

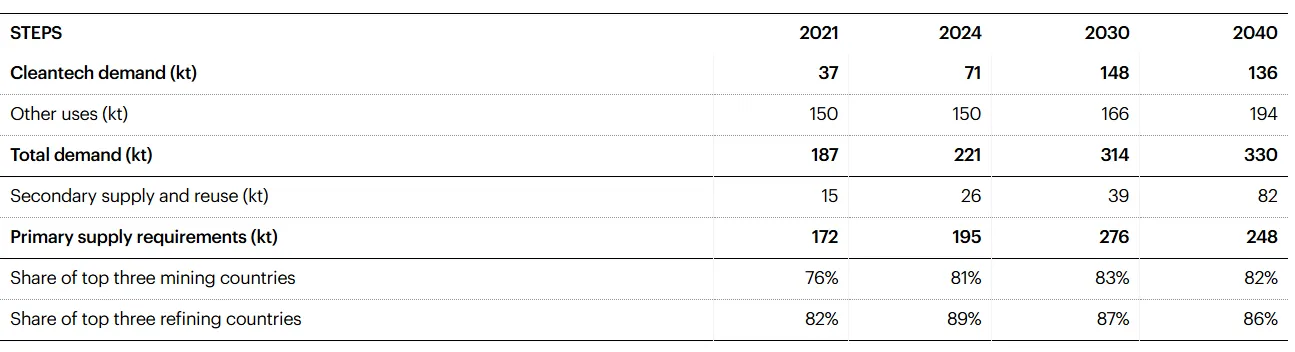

Cobalt 🔴

Cobalt faces a projected 38,000 metric tonne deficit by 2030, widening to 82,000 tonnes by 2040, according to the IEA.

Supply remains heavily concentrated in the Democratic Republic of Congo, while demand growth is driven by batteries, defence, and aerospace applications.

Recycling helps but does not offset the structural concentration and geopolitical risk embedded in the supply chain.

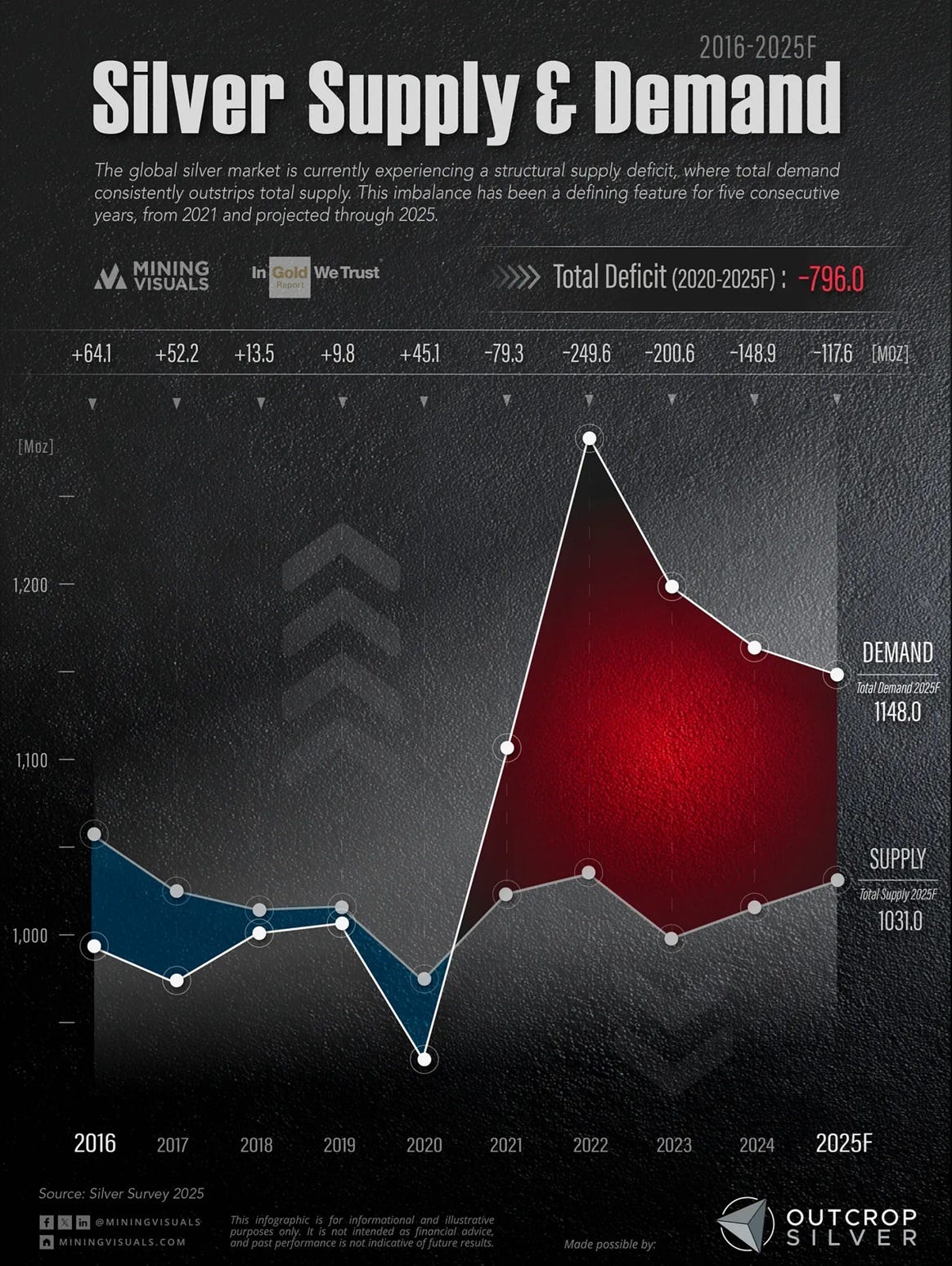

Silver 🔴

Silver is one of the clearest examples of a sustained structural deficit.

According to the World Silver Survey 2025, global silver demand has exceeded supply for multiple consecutive years. Industrial demand, particularly from solar and electronics, continues to rise, while mine supply remains constrained and recycling cannot close the gap.

MiningVisuals’ Outcrop Silver-sponsored chart of silver supply and demand from 2016–2025 illustrates this shift clearly, showing a persistent deficit emerging after years of relative balance.

Silver is being consumed faster than it can be mined or recycled.

There’s much more. Read the rest here.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino January 12th, 2026

Posted In: John Rubino Substack