November 14, 2025 | Quantum Computing: The “Next AI” For Investors?

Quantum computing is back in the spotlight this week, with earnings from pure‑play companies and new breakthroughs from IBM. But can it truly capture the same investment excitement as artificial intelligence, or will volatility and technical hurdles slow its rise?

Artificial intelligence has dominated markets in recent years, moving rapidly from research labs into everyday business applications. The question now is whether quantum computing could follow a similar trajectory.

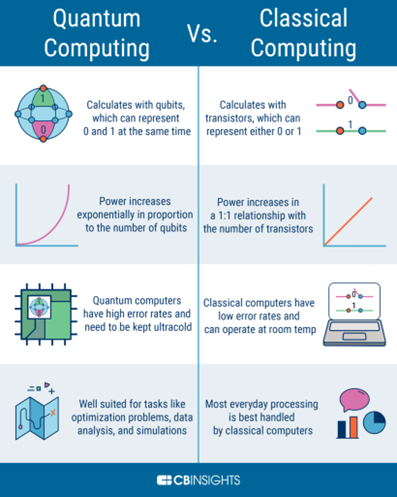

Quantum computing differs fundamentally from classical computing. Instead of bits that are either 0 or 1, quantum computers use qubits, which can exist in multiple states at once. This opens up a richer space for problem‑solving, enabling machines to tackle tasks that would take classical computers thousands of years. Potential applications include drug discovery, logistics, and cryptography. Yet qubits are fragile, prone to errors, and correcting those errors remains the central challenge.

Interest surged this week after earnings from pure‑play quantum companies. Yet excitement was tempered by a sharp pullback in their stocks. Benchmark analyst David Williams trimmed his price target on Rigetti Computing, citing “a broader slowing of share momentum across the quantum technology landscape.” While he maintained a buy rating, Williams noted that volatility across emerging tech and AI sectors has cooled near‑term investor enthusiasm.

Rigetti, which specializes in superconducting qubit‑based architecture, saw its shares soar to record highs in mid‑October before retreating sharply. The stock fell more than 5% this week, while peers D‑Wave Quantum and IonQ also declined. Williams called the pullback “healthy,” pointing out that Rigetti remains up nearly 100% this year, and suggested investors could be opportunistic buyers as new catalysts emerge.

IonQ also made headlines. At a conference this week, Chris Ballance, the company’s president of quantum computing, highlighted a milestone achievement of 99.99% two‑qubit gate fidelity. Fidelity measures how accurately quantum gates perform, with 100% meaning perfect execution. While the result was shared in a non‑peer‑reviewed paper and awaits replication in larger machines, it signals progress toward practical quantum solutions. IonQ’s shares, however, remain volatile, trading largely on hype and headlines.

IBM continues to be a central player. On Wednesday, the company unveiled Quantum Nighthawk, its most advanced processor yet, promising more complex problem‑solving with lower error rates. IBM also announced progress on its experimental Loon chip, which for the first time demonstrated all the components needed for fault‑tolerant quantum computing or, systems that can continue operating even in the presence of errors. IBM has set its sights on releasing the world’s first fault‑tolerant quantum supercomputer by 2029, a bold target.

For investors, the narrative is compelling. Quantum computing could eventually unlock entirely new industries, much as AI has done. Yet commercial quantum advantage has not been proven, and the hurdles—error correction, scalability, and manufacturing complexity—are formidable. Unlike AI, which quickly found profitable applications, quantum computing may take years, perhaps decades, before delivering widespread utility.

In the end, quantum computing may well become the “next AI” in terms of transformative impact. The challenge is that it is still in its infancy, and the road ahead is long.

Fraser Betkowski

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth November 14th, 2025

Posted In: Hilliard's Weekend Notebook