September 14, 2025 | Recession Watch: Brutal Job Market

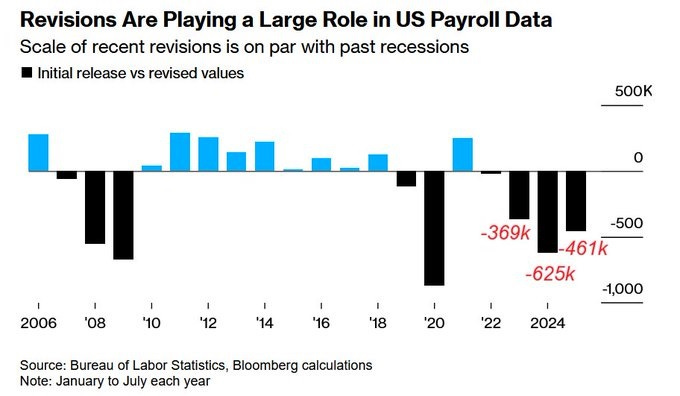

It seems that (surprise!) the US government has been systematically overstating job growth and then (when no one was looking) revising the numbers down to much lower, more ominous levels. The following chart shows the size and consistency of those revisions, resulting in over a million fewer jobs than initially reported.

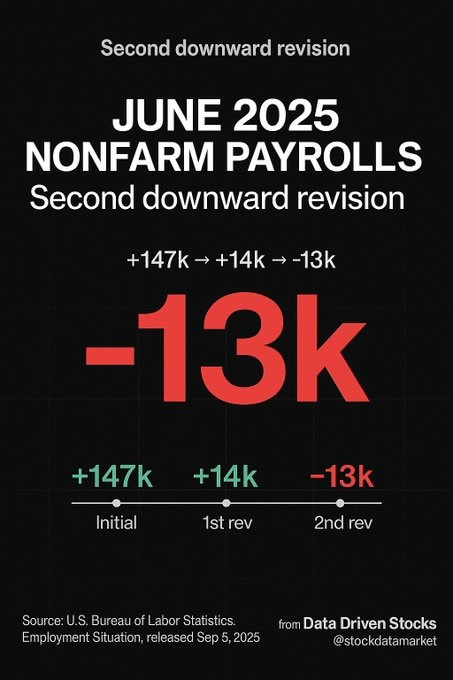

And it’s still happening. In June of this year, the initial jobs report was a pretty good 147,000 gain. But after two revisions, it’s now showing a net loss.

YouTube has a growing subgenre of videos showing how tough the job market has become, especially in tech where AI is making its initial inroads:

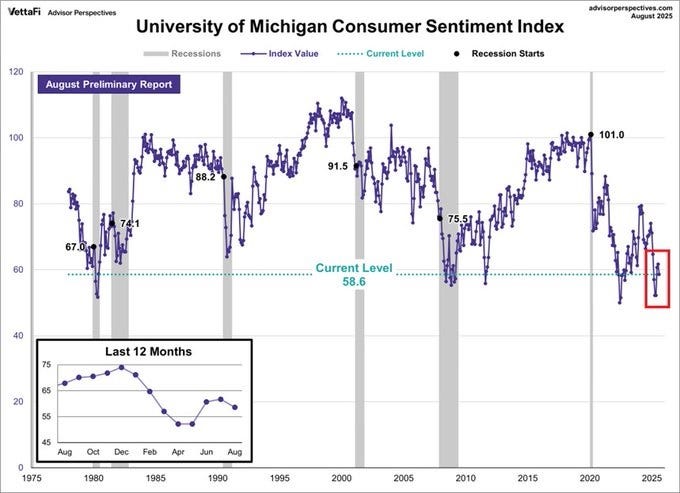

Spooked Consumers

When jobs are scarce and insecure, consumers get nervous…

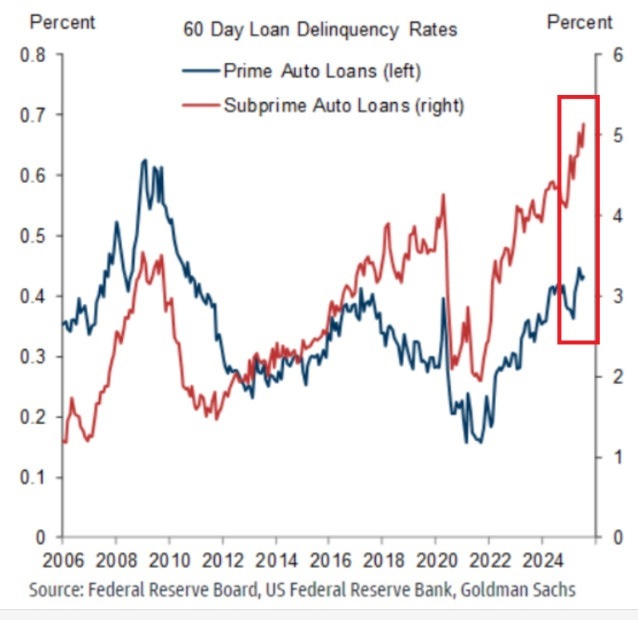

…subprime borrowers stop making their loan payments…

…and other borrowers get desperate. Absolutely ridiculous “buy now, pay later” loans have become shockingly popular — and even those loans are going bad:

New LegalShield Research Warns of ‘Buy Now Pay Later’ Credit Crunch: 3 in 4 Americans Use It, Half Miss Payments

– BNPL shifts from luxury to necessity: 47% use for groceries, 35% for medical bills

– Credit score surprise: 38% don’t know FICO changes coming this fall

– Legal exposure rises: missed BNPL payments put millions at risk, 45% face legal disputes and need a lawyer to help

(September 9, 2025) – A new study from LegalShield exposes a brewing debt challenge: 76% of Americans rely on Buy Now, Pay Later (BNPL) services while half (49%) have missed payments. The survey of 2,018 Americans reveals that the majority (67%) of BNPL users juggle multiple BNLP loans at once, often for everyday needs, creating both a simmering credit crunch and new legal exposure for millions of consumers who could benefit from legal assistance as FICO prepares to factor BNPL loans into credit scores this fall.

BNPL Becomes Essential for Basic Needs

Two-thirds of BNPL users manage multiple BNPL loans at once, and the majority (62%) of those users have more than five open loans simultaneously. BNPL has evolved beyond discretionary spending into a tool for essential expenses: 47% use it for groceries and 35% for medical bills. Yet luxury purchases remain popular too, with 54% buying items like designer handbags and jewelry.

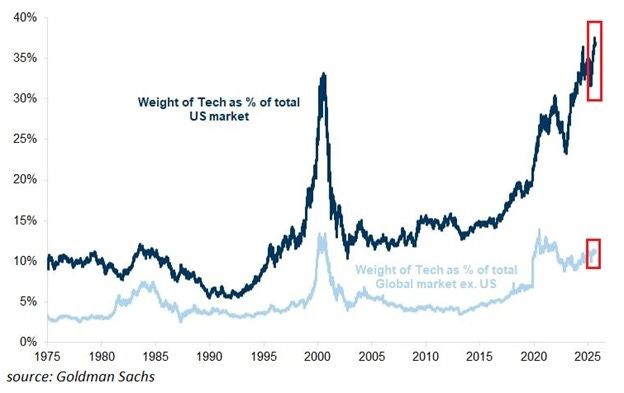

Overvalued Stocks

While tech companies are shedding workers, their aggregate market value as a % of the broader stock indexes exceeds dot-com bubble highs:

Wild Times Coming

The US labor market isn’t turning ugly. It’s been ugly for at least a year, and statistical sleight of hand can no longer hide that fact. Expect the Fed to enter panic-cutting mode shortly.

The trillion-dollar question is: Will the stock and bond markets love the new liquidity or hate the new turmoil? Wild times are coming either way.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino September 14th, 2025

Posted In: John Rubino Substack

Next: Interview with Daniel Estulin »