David Rosenberg, founder and president of Rosenberg Research, believes recession odds are higher than 2022 despite nobody expecting one, pointing to Fed staff forecasting 50% recession probability and the most downbeat Beige Book since 1980. Rosenberg criticizes Powell for calling the economy “solid” while real GDP has been negative sequentially in 2 of the past 3 months and survey data suggests 1% contraction. He highlights a major market dichotomy with stocks up 24% while the dollar is in an 11% bear market, suggesting something is fundamentally wrong. The housing market faces a negative wealth effect as supply-demand gaps widen and prices start cracking. Here is a direct video link.

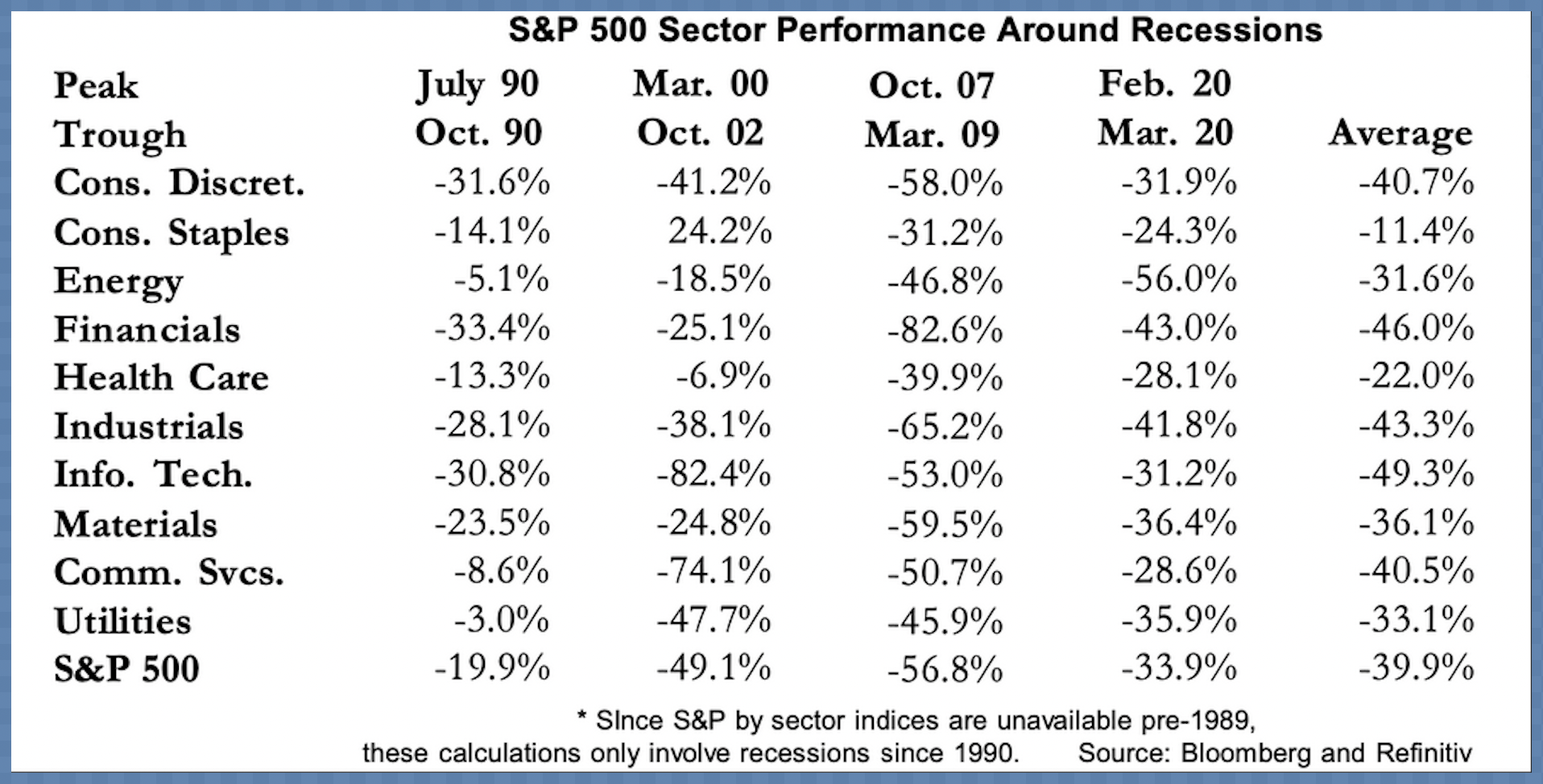

Further to the comment regarding defensive equity allocations, it is worth noting that they also typically decline significantly during bear markets and recessions. The chart below, courtesy of A., Gary Shilling, offers some historical perspective. Eyes wide open.