June 7, 2025 | Trading Desk Notes for June 7, 2025

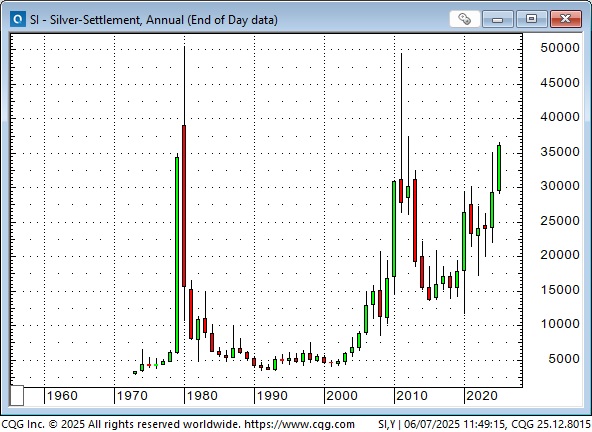

Silver surges to a 13-year high

Comex July silver futures reached a 13-year high of ~$36.50 this week, up ~10% for the week and ~30% from the April 7 lows. Some analysts suggested that Chinese speculative buying of silver (now that gold is “too expensive”) fuelled the rally.

Silver rallied to ~$50 in 2011, at the peak of the 2008-2011 commodity bull run. Its highest-ever Comex futures price was ~$50.25 in January 1980 (when gold hit $850.) In inflation-adjusted terms, $50 in silver in 1980 would be ~$200 today.

Platinum soared to 3-year highs, rising ~$300 (30%) from the April 7 lows.

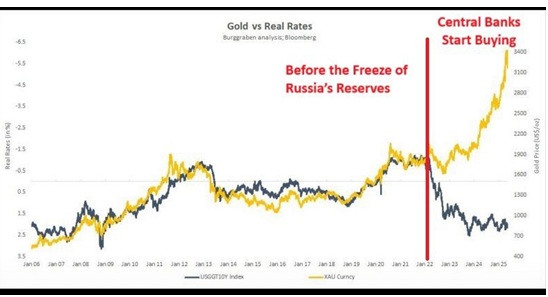

Comex June gold futures reached an all-time high of ~$3,510 on April 22 and have since traded mostly between $3,200 and $3,400, closing this week at ~$3,308, up ~11% from the April 7 lows.

The Comex gold/silver ratio (the number of ounces of silver needed to buy one ounce of gold) hit a modern era low of ~15 in January 1980, and a record high of ~122 in March 2020 (during the covid crisis). The trend over the past 50 years has been for gold to become increasingly more expensive than silver.

Comex copper futures reached an all-time high on March 26 at ~$5.25 (blue ellipse). The red metal was bid higher from Monday through Thursday this week, tracking the gains in silver and platinum, but couldn’t sustain the rally and dropped ~25 cents from Thursday’s high to Friday’s close.

Global stock indices have rallied sharply from the early April lows

The Nasdaq-100 has been the strongest American index, up ~33% from the April 7 lows. (No wonder retail loves to buy the dip!)

The German DAX has soared to an all-time high, up ~29% from its low on April 7. The German government has amended the constitution to allow deficit spending for rearmament and infrastructure projects.

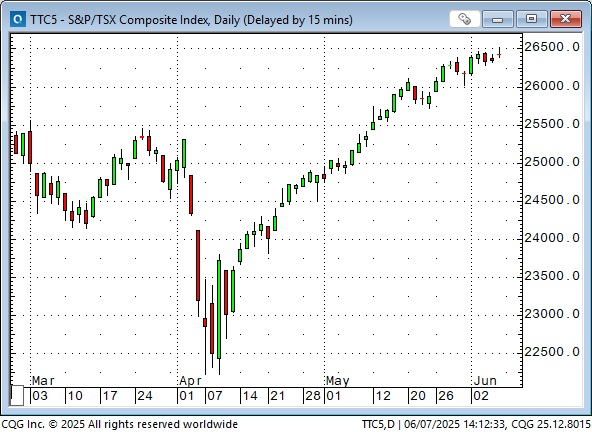

Canada

The TSE Composite Index reached new all-time highs (~26,500) this week, up ~19% from the April 7 lows.

The CAD reached an 8-month high this week at ~7350, up ~5 cents (7%) from the 22-year lows (~6775) reached on February 3, when Trump imposed 25% tariffs on Canada and Mexico (and then “paused” them a few hours later.)

The rise in the CAD since February was more a function of USD weakness against nearly all currencies rather than CAD strength. The Euro rose ~12% since early February, the British Pound rose ~10%, the Yen rose ~7%, and the Australian Dollar rose ~7%.

I’ve frequently noted that changes in the CADUSD price are often a function of events/issues “outside” of Canada rather than “Canada-specific” events/issues. For instance, if the USD is rising against the Euro, the Pound and the Yen, it is likely also rising against the CAD.

I’ve seen the CAD highly correlated with the S&P from time to time, and sometimes changes in the crude oil price will impact the CAD. On a multi-year time frame, the CAD has a strong correlation to changes in the commodity indices.

The fact that the CAD has rallied ~5 cents from the early February lows, while Canadian short-term interest rates have been below US short-term rates (currently ~135 bps below at the 2-year tenor), reinforces the idea that the CAD rally has been (mostly) a function of USD weakness, not CAD strength.

Since the CAD rallied above 72 cents in mid-April, speculators in the currency futures markets have increased their net short position by ~50%. Perhaps they see the rally off the February lows as only a correction in a longer-term downtrend.

Mark Carney, the new Prime Minister of Canada, may be a “Canada-specific” issue that will have an impact on the CAD. Two years ago, I opined that the Liberals would dump Trudeau before the next election, knowing that they couldn’t win with him as their leader. I also thought Mark Carney would be “too smart” to accept the Liberal leadership role because, after all, “who wants to be the leader of the opposition?”

Mark Carney is virtually the polar opposite of Justin Trudeau, despite critics painting him as a WEF groupie and an environmental crusader. He is Canada’s Prime Minister in the Trump era, and his priorities will be better for Canada than Trudeau’s. I wish him well (even if I didn’t vote for him), and I hope he Makes Canada Great Again.

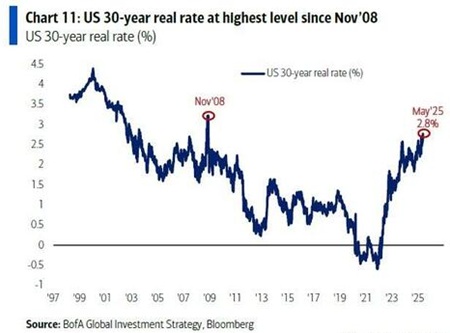

Interest rates

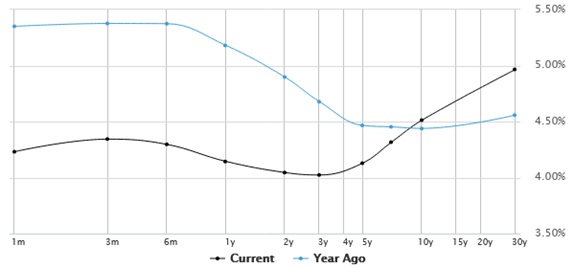

US interest rates rose across the curve late this week on signs that the US economy is not slowing as much as some analysts expected, and as the prospect of never-ending and growing fiscal deficits weighs on the long end.

The short-term interest rate futures market is now pricing ~43 bps of Fed cuts this year, with a ~70% chance of the first cut occurring in September. (At the height of the post-Liberation Day crisis in early April, the market was pricing more than five cuts from the Fed this year.)

The yield curve has steepened dramatically since early April. The market is pricing out Fed cuts even as Trump (on June 6) demanded that the Fed immediately slash short-term rates by 100 bps (if the Fed did so, yields on the long end would soar. But Powell’s term is up in 11 months, and Trump will nominate a new Fed Chair. Yikes!)

(Chart from www.marketwatch.com)

Why has the US Dollar index fallen ~10% since January?

1) The US Dollar Index was at (effectively) 23-year highs (all-time highs on the trade-weighted dollar) in January, and it began an overdue correction when the Trump-envisioned “golden era” marked the peak of the “American exceptionalism” narrative.

2) Markets thought Trump wanted a lower USD, a “Mar-a-lago Accord”, to rebalance trade deficits.

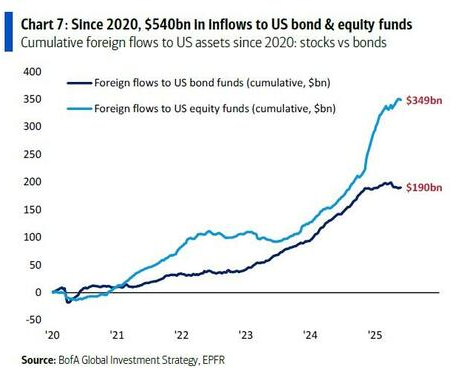

3) Stepped-up currency hedging by foreigners holding US assets.

4) The outright sale of USD financial assets (and repatriation of capital) by foreigners taking profits after a fantastic multi-year rally.

5) Capital leaving the USA due to “Trump fatigue,” which would include things like the “Section 899” of the Big Beautiful Budget, which is seen as a “revenge tax” on “discriminatory foreigners’” holdings of US financial assets. (If you have Trump fatigue, imagine how Elon Musk feels!)

6) Stepped-up selling of US assets as international capital “loses faith”, to some degree, in “America.”

7) Capital flows are “arbitraging” the spread between international “bargains” and “richly priced” US assets.

7) Outright short sales by speculators.

If geopolitical stress ramps up, for instance, if the Russian military moves aggressively deeper into Ukraine, the USD should rally on a “flight to safety bid.” The test will be whether the rally is sustained.

What are we trading?

I remember when copper was surging during the 2008 to 2011 commodity bull market, I posed the question, “What are we trading when we buy or sell copper? Are we trading pallets of red metal or some over-hypothecated Chinese financial instrument?“

When people buy or sell TSLA, do you think they care about Tesla’s EBITA? If not, what motivates them to engage in trading? “What” are they trading?

In the early 1980s, my business card announced that I was a specialist in currencies and interest rates. I was comfortable with the notion that currency trends were primarily driven by “sentiment,” and I observed that trends often seemed to run far longer than I could imagine, and then they turned on a dime and went the other way. There didn’t seem to be the “restraints” on price trends in the FX markets like there were in other markets. For instance, in grains, high prices were the best cure for high prices (substitution, increased plantings), but that didn’t seem to apply to currencies.

Now it seems as though “gambling nation” is effectively trading sentiment. I’m not saying that’s right or wrong, but if you’re hoping to catch a move in prices, you’ve got to wonder why prices move.

My short-term trading

I’ve done relatively little trading the past two weeks. I felt “out of sync” with price action, so I didn’t engage. I’ve taken a few minor losses shorting the S&P, as I thought it looked toppy around 6,000. I’m short the S&P and the CAD going into the weekend.

A recommendation

Maggie Lake continues to post great 30-minute interviews with market experts.

The Barney report

Barney and I saw a black bear today on our walk along the abandoned railroad tracks that run through the forest near our house. The bear also saw us and ran away, which was a good thing!

Listen to Mike Campbell and me discuss markets

On today’s Moneytalks show, Mike and I discussed the soaring silver market, the Canadian dollar and how interest rate markets are reacting to the prospects of never-ending government deficits. You can listen to the entire show here. My spot with Mike starts around the 52-minute mark. Peter Grandich was Mike’s featured guest this week, discussing precious metals and junior miners.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 7th, 2025

Posted In: Victor Adair Blog